The cleantech sector has maintained its momentum among investors even in light of hardening financial circumstances. According to the Cleantech Group, cleantech became the single largest category of investments for the U.S. venture capital market in the second quarter of 2009, capturing 27% of total investments. With concerns about rising energy prices, national security, climate change and the potential impacts of carbon regulation, more investors are flocking to cleantech, and perhaps it's time you engage as well.

A number of investment avenues exist for the average investor to enter the cleantech space from low-risk mutual funds to publicly traded stocks. This increased focus on cleantech investment bodes well for the development of the sector, but as it stands investment and investment strategies are a bit lop-sided, favoring the large versus the small. These larger financial vehicles tend to focus on companies with mature technology and not the so-called "science experiments" and early-stage entrepreneurs. Meanwhile, real opportunity exists in these early-stage investments: Patient capital has a high-value return and seed-stage provides investors access to cutting-edge technologies and trends ahead of the masses.

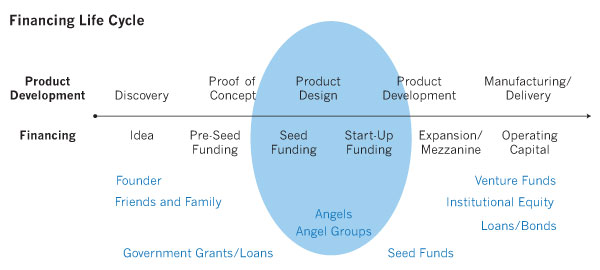

One of the main reasons why the average investor has shied away from these early-stage investments is because of the relative lack of established financial vehicles and deep industry intelligence. In addition, because few investors choose to back early-stage entrepreneurs, potential game-changing technologies often struggle to make it past the initial "friends and family" financing round. Without support for early stage entrepreneurs, we risk creating a critical gap in the lifecycle of cleantech development, where the market (and society) will not benefit from the positive impacts of technology which may lower carbon emissions from power plants, increase the energy efficiency of buildings or economically produce biofuels from algae-only a few of worthy cleantech goals.

Fortunately, we're beginning to see the emergence of a new investment model created to bridge this funding gap-the seed-stage venture fund. The CalCEF Clean Energy Angel Fund is one such example taking on a hybrid approach, combining the deal flow and diligence of a traditional venture capital firm with the culture and transparency of an individual angel investor experience. Other variations of this early-stage investment vehicle include Vinod Khosla's $250 million fund announced in the summer of 2009, publicly traded Greenangel Energy Corp. based in Vancouver, and Clean Energy Venture Group investing in companies in the North Eastern United States.

Setting The Stage For Seed-Stage Success

In a market with no shortage of spectacular innovation, how do these seed-stage funds sort the potential winners from the losers? When assessing new cleantech ventures, the default trio of evaluation criteria still applies: team, technology, and market. But how do the indicators for success differ when vetting young cleantech companies; what are the other factors that smart investors must consider? And what is the fourth criteria, unique to cleantech investment?

I. Team

VCs are often quoted saying that people are the secret ingredient: while technology and market are variable to change and disruption, a committed, experienced executive team is a primary key to success.

The executive team members are the individuals who will be managing and directing the use of invested funds. They need to be smart, passionate, dedicated leaders. It's not just about having the magic mix of skills to succeed, past records are also important indicators: Have they established long-lasting partnerships? Have they been successful in bringing other new technologies to market? Do they have experience navigating a highly regulated market? What about a relatively nascent one where the path to success has yet to be clearly defined and demonstrated at great scale?

For early-stage cleantech, team presents unique variables.As with any emerging industry, the lack of management track-record in the specific market makes it more difficult to analyze applicable skill sets. With an industry as compelling and front-and-center as cleantech, many scientists are viewing themselves as debut inventors and would-be entrepreneurs. In addition, we are seeing experienced entrepreneurs from other technology-related industries crossing over to cleantech, bringing company growth experience but no unique market or technical knowledge and little regulatory experience.

As an investor in seed-stage cleantech, it's important to set realistic expectations about the team. Come to the table with the understanding that the team you see today may not be the team in front of you six months down the line. This isn't a bad thing, as team development and management expertise is a critical area in which experienced investors add value beyond capital support.

II. Market

Cleantech-focused angel funds look for capital-efficient companies in existing markets poised for strong growth. Market validation, including prospective customers and marketing channels, must be well established and assessable. For example, a cautious early-stage investor would be amiss to focus financing on an arena such as solar in space, one with a highly unlikely chance of near-term market breakthrough. This may seem obvious, but unlike other industries such as information technology, an early-stage cleantech investor does not have the capital to create new markets and the necessary verticals and infrastructure.

With a new software or Internet product, the physical product, manufacturing capacity, and distribution needs are minimal. A beta version is developed, perfected, and a liquidity event can be achieved within as little as two years. In cleantech, and especially in the case of large-scale renewables, we're looking at much longer lead-times and several hundreds of million dollars in funding. These capital-intensive companies are being built for IPOs, and, unfortunately, our current financial climate is not supportive of an IPO market.

However, not all technologies require such grand lift-offs. Every investor has its own definition of capital efficiency. The CalCEF Angel Fund's definition is companies that require no more than $25 million for a liquidity event. Small market caps mean less equity dilution for investors and a more profitable return with an M&A.

Some may be surprised to know that there are no shortages of interesting and investable capital-efficient cleantech companies. One of the significant areas is energy efficiency, such as efficient lighting, energy management and aspect of the smart grid. Many other opportunities abound for technologies, which enhance the efficiency and performance of renewable energies, distributed energy production, and even aspects of biofuels.

III. Technology And Product

Not surprisingly, in cleantech we look for companies with strongly defensible intellectual property. How is one technology competitively superior to another in its sector, and can the intellectual property be owned uniquely by that particular company? What are the competitive barriers to entry?

In early stage cleantech, technology is strongly linked to market. What is the market need being met by the technology? What is the customer ROI and IRR? Are regulations driving adoption through Renewable Portfolio Standards (RPS) or other mandates?

Right now energy management is a hot market. This includes software for identifying and correcting high energy consumption patterns as well as smart grid companies for utilities and monitoring software and management systems that lower energy usage for homes and businesses. In 2009, nearly $20 billion in stimulus money was invested in energy efficiency and some states' give credits for energy saved via efficiency programs in addition to renewable energy generation.

Many more investable areas abound for large and small investors. Consider the results of the McKinsey Study on greenhouse gas abatement (see graph), which emphasizes two key factors in cleantech: there is no silver bullet answer to climate change and cleantech is ripe for innovation and financial support of these solutions. For the early-stage investor, many of these abatement-focus areas represent capital efficient industries and market drivers for rapid customer ROI, particularly for those technologies below the abatement potential axis. Not surprising, many of these areas include energy efficiency.

IV. Public Policy Considerations

Regulation doesn't drive where people put their inventive nature, it drives where investors put their money. Every industry experiences a share of regulation, but clean technology, with its focus on energy, is a uniquely highly regulated sector. The fate of many cleantech portfolios rests on public policy mechanisms to drive demand. Therefore for investors, an ear towards policy is an essential fourth criteria in this market.

The small wind market, which is experiencing an increase in investor interest, is an example of policy's role in driving market. This growth can be understood as largely influenced by the federal Investment Tax Credit (ITC) extended in 2009 that provides an eight-year, uncapped 30% tax credit to consumers that purchase small wind systems.

Pending climate legislation has many industries holding their breath-clean energy companies are awaiting the additional boost while energy intensive industries are seeking survival tools. The implementation of a cap-and-trade system will certainly drive growth in a number of sectors that enable heavy carbon emitters to adapt cost-effective solutions to reduce greenhouse gas emissions, and a national RPS will serve as a major catalyst in quick adoption of new renewable energy generation assets.

For a seed-stage investment vehicle to be successful, it must be deeply attuned to the regulatory system, able to assess often complicated technologies and able to read market trends.

The cleantech seed-stage investment is a new category, but this newness need not imply risk. Through a smart approach that marries the established investment criteria with a lens to the unique forces of the cleantech industry, investors and entrepreneurs are both positioned for success. It's important that investors focus on financing early-stage innovators and deploy these best practices in order to avoid the gaps in cleantech lifecycle development.

Susan Preston is the general partner of the CalCEF Clean Energy Angel Fund based in San Francisco and the author of "Angel Financing for Entrepreneurs." CalCEF, the California Clean Energy Fund, an evergreen venture fund and nonprofit think tank led by a prominent team of policy-makers, scientists, entrepreneurs and financial professionals, is a founding partner of the CalCEF Angel Fund.