A critical intellectual pillar of portfolio management is the study of the efficient frontier. By optimizing portfolios, advisors can deliver levels of return that are commensurate with investors’ risk tolerance. That, in turn, may help advisors address two of investors’ worst fears about retirement. But remember, the above allocations refer to theoretical models.

No 1. Losing Retirement Savings

When it comes to balancing risk and return for retirement savings, Americans tip toward the cautious end of the spectrum. During 2014, 64% of all investors participating in a national survey indicated they would prefer a secure investment even if potential for growth were low. A separate survey found that the vast majority of investors have become less comfortable with investment risk during the past 10 years. About 55% are uncomfortable with the idea of putting any of their savings at risk, and less than one-fourth indicated they could tolerate the loss of 5% of their savings.

No. 2 Outliving Retirement Savings

Not too long ago, Social Security benefits, pension plan income and personal savings provided steady income that retirees could rely on receiving throughout retirement. Today, pension plans are rapidly disappearing, and worries about inflation, high health-care costs, inadequate savings and other issues have many investors worried they will outlive their savings during retirement. In fact, the possibility of outliving their retirement savings frightens them more than the prospect of dying.

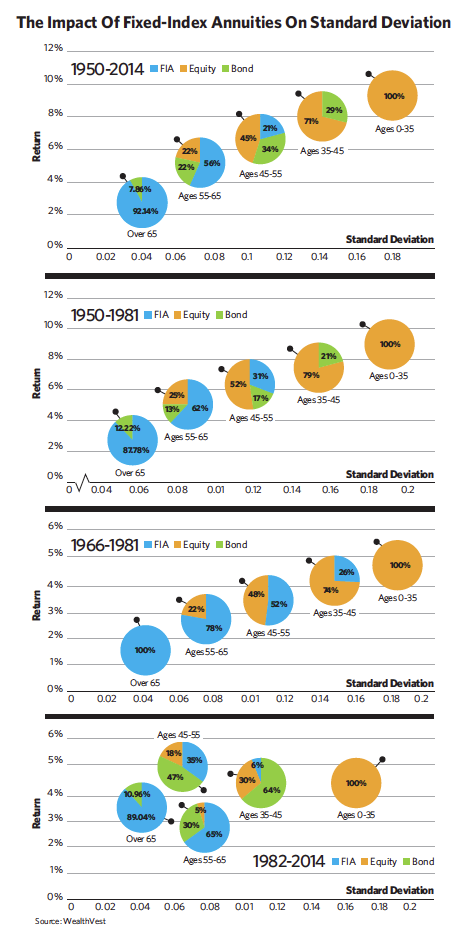

The best solution, then, is for them to optimize their portfolios so they receive the greatest potential return for the level of risk they are willing to incur. Fixed index annuities may help with this optimization.

Still, efficient frontier modeling does not take into account a product’s liquidity or other issues important to investors. Like structured notes, fixed index annuities are dependent on the underlying credit quality of the issuer or insurer. Investors should also consider the overall suitability of the annuity, such as the ability to meet liquidity needs in light of surrender charges and other restrictions, limitations and risks.

Wade Dokken is co-founder and co-president of WealthVest Marketing and the author of New Century, New Deal, a public policy analysis of the challenges facing Social Security in the coming decades.

Jack Marrion is president of a research consultancy that publishes the Index Compendium newsletter, the consumer education materials of Safe Money Places, and the Advantage Compendium research studies. He has an MBA from the University of Missouri and has conducted doctoral studies in the area of cognitive bias in decision-making.