Luxury residences in Greenwich, the Connecticut town that’s home to hedge funds and Wall Street executives, sold at a quicker pace in the fourth quarter as owners became more amenable to negotiating on price.

Homes that sold in the top 10 percent of the Greenwich market -- those priced $3.79 million or higher -- spent an average of 164 days seeking a buyer, down from 281 days a year earlier, according to a report Thursday by appraiser Miller Samuel Inc. and brokerage Douglas Elliman Real Estate.

Greenwich, with a population of about 60,000, has yet to see home values fully recover from the financial crisis, with prices last quarter down 26 percent from the peak reached in early 2006. In September, Starwood Capital Group Chairman Barry Sternlicht labeled his former hometown as possibly the country’s worst housing market, saying, “You can’t give away a house in Greenwich.”

Buyers in the town are tending to favor smaller properties, leaving many larger, lavish estates lingering on the market -- and leading to price cuts. The 16 luxury homes that traded hands in the fourth quarter did so at an average discount of 6.4 percent off their last asking price, compared with an average 5.5 percent reduction a year earlier.

“The big challenge in Greenwich at the high end is that the sellers remained disconnected from the market,” Jonathan Miller, president of Miller Samuel, said in an interview. The fact that the highest-priced homes sold faster is a “positive change,” he said.

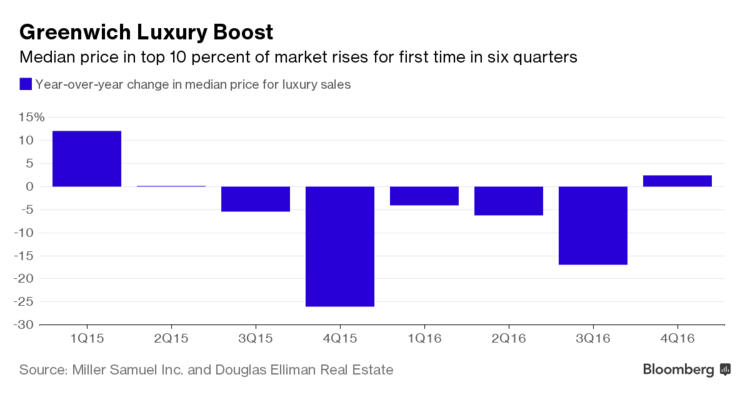

There was another positive change for sellers: the median price of luxury homes that sold in Greenwich rose for the first time in six quarters, climbing 2.4 percent to $4.56 million.

There are currently 13 listings in Greenwich priced at or above $15 million, Miller said. In the fourth quarter, only one such property sold. That home, an 8,354-square-foot (776-square-meter) home at 7 Cobb Island Drive, was listed for sale in May at $16.5 million, and sold in December for $15.3 million, the result of negotiation rather than an official price reduction, Miller said.

“The fact that the highest-priced sale in the quarter didn’t require a price cut, that tells me it was priced properly to begin with,” he said.

The second-priciest transaction was the sale of 14 Rockwood Lane, which was listed in January for $7.9 million, had its price reduced a few months later and ultimately sold in October for $7.1 million, Miller said.

The number of luxury homes on the market in Greenwich fell by 4.2 percent from a year earlier to 204 at the end of the fourth quarter.