“A lost election can have the jolt of a drop through the gallows door, leading to a dark night of the soul in which the future presses down like a cloud that will never lift.”

– James Wolcott

“Recession is when a neighbor loses his job. Depression is when you lose yours.”

– Ronald Reagan

We who inhabit the northern hemisphere will soon enter summer. Many would say summer is already with us – most schools are closed, and a general laziness is beginning to set in – especially for those in the “protected” class. For many of them, summer is a verb. They “summer” in the Hamptons, or Lake Tahoe, or somewhere in the tropics.

Summer isn’t lazy for the “unprotected.” Working parents often dread it because they have to find – and worse, pay for – child care for their out-of-school children. Vacations to the tropics or anywhere else are just a dream.

As I wrote last month, the protected/unprotected schism increasingly drives both politics and economics. Maybe it has always driven them, and we’re just now recognizing it. In either case, we find ourselves in increasingly weird circumstances. I certainly see parallels with the 1930s. And a number of those circumstances will collide with one another over the next few months.

My intention this week had been to revisit some of the powerful ideas that were discussed at my Strategic Investment Conference two weeks ago. But events are looming in Europe that absolutely demand our attention. The powerful macroeconomic and investing ideas will still be there next week – and at the end of today’s letter I will discuss an informal poll I’ve conducted on the timing of the next recession.

We may be in for a very hot summer. Where to begin?

ECB Spreads the Cash

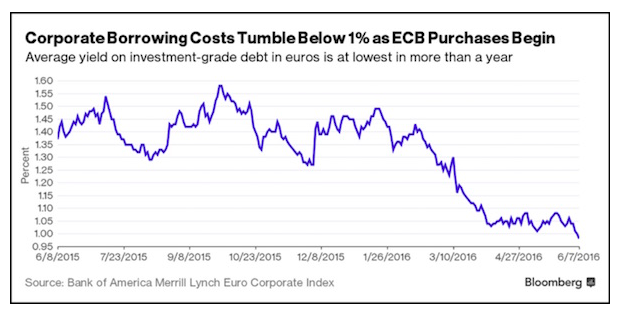

This week the European Central Bank launched a new stimulus tactic: outright purchases of corporate bonds. This buy will be in addition to the 800+ billion euros of government bonds it has bought since March 2015.

The ECB wants to create inflation by making borrowers an offer they can’t refuse. European public companies have been issuing new debt at a record pace this year. I can see why, too: interest rates were at record lows. The ECB intends to drive them even lower and possibly negative.

If you are the board of a Eurozone company and your central bank offers you free or better-than-free cash, of course you take it. Japan already proved that this can work back in January, when it first bought corporate bonds at a below-zero interest rate. And this new tactic of the ECB is going to affect more than just corporate bonds in Europe. US multinationals with European subsidiaries (and most have them) are going to be lining up to take advantage of a central bank that will buy up to 70% of anything the corporations issue, at rates that can’t be matched in the US. At least for now. You think that’s not going to bring European-style central banking to the United States?

If you’re a corporation in Europe, the harder question is what to do with your free cash. The ECB wants you to buy stuff and drive up prices. That would leave you owning stuff, which isn’t rational if you think deflation will continue. So the ECB has a chicken-egg problem. They can’t have inflation unless businesses and individuals spend their cash, but everyone will hoard their cash until they’re convinced inflation is back.

Liquidity is another problem. Bloomberg calculates that the universe of corporate debt eligible for ECB purchase totals about €620 billion. To produce the desired effect, the ECB will have to own a significant chunk of that market. At some point it then stops being a “market” by any normal definition.

Japan is already dealing with that problem and worse, since it buys equity ETFs as well as bonds. The Japanese government bond (JGB) market is becoming a monopsony – the opposite of a monopoly. Instead of one seller, JGBs have only one buyer. It is very possible that other markets will soon operate similarly. How can the center hold in such an economy?

Where does the distortion of markets end? I don’t know. More to the point, Draghi and Kuroda don’t know, either. Draghi is buying private assets because in his view there are no better options. Even at the “relatively” small amounts it is buying now, the ECB is already distorting the credit markets.

The ECB won’t officially confirm what it bought until sometime next month, but word quickly leaked out that the purchases included Anheuser-Busch, InBev, Siemens, and other well-known names. Do you think some bond traders might have used that information before it appeared in the press? You know the answer to that one.

Regardless, Draghi will keep buying assets. He could buy most of the Eurozone and still not have any inflation.

German Banks Hoarding Cash

Speaking of cash-hoarding behavior – which is one side effect of negative rates – one of Germany’s largest banks is seriously considering it. Sources within Commerzbank have told Reuters they are “examining the possibility” of hoarding physical euros by the billions in secure vaults. This would let them avoid the -0.4% NIRP penalty for parking cash with the ECB.

This is truly bizarre. Under normal conditions, holding cash is anathema to commercial bankers. They keep as little as possible on hand and certainly don’t go out of their way to hold more. Yet here we see a major bank considering doing just that. The only way that tactic makes sense is if the bank can’t profitably lend the cash to its customers, which, given the rules for lending in Europe, actually happens to be the case.

Nonbank financial institutions are also storing cash. Munich Re said back in March it would store both physical cash and gold to avoid paying negative interest rates. Management framed the move as a minor test at the time. It may well have been – but you don’t conduct such a test unless you see some chance that you will need to hold cash on a larger scale.

Perhaps not coincidentally, the ECB thrilled conspiracy buffs last month by announcing it would cease issuing 500-euro notes after 2018. The ostensible reason is that the large notes could “facilitate illicit activities.” Few believed the deterrence of crime was the bank’s main objective. The presence of large amounts of physical cash in an economy is inconvenient for any central bank that wants to push interest rates negative, as the ECB does.

Now the ECB’s move makes more sense. Draghi isn’t worried about German and French citizens stuffing their mattresses with euros. The real threat would be banks doing so on a much larger scale.

Here’s my guess. The ECB’s promise to continue issuing 500-euro notes until 2018 is probably honest – but they made no promises about how many they will issue. I bet the number slows to a trickle very soon. The big bills will be hard to find, especially if your name is Commerzbank or Munich Re.

Meanwhile, Deutsche Bank is also sparring with the ECB. Chief Economist David Folkerts-Landau issued a note (in less polite circles we would call it a smackdown) last week, blasting Draghi’s stimulus plans. He was unusually blunt (if you could call launching an economic nuclear weapon blunt), especially for someone whose bank is not exactly on the firmest footing right now. The entire piece is worth reading to gain an appreciation of the intensity with which Folkerts-Landau addresses the ECB. (Emphasis below is mine.)

Already it is clear that lower and lower interest rates and ever larger purchases are confronting the law of decreasing returns. What is more, the ECB has lost credibility within markets and more worryingly among the public.

But the ECB’s response is to push policy to further extremes. This causes misallocations in the real economy that become increasingly hard to reverse without even greater pain. Savers lose, while stock and apartment owners rejoice.

Worse, by appointing itself the eurozone’s “whatever it takes” saviour of last resort, the ECB has allowed politicians to sit on their hands with regard to growth-enhancing reforms and necessary fiscal consolidation.

Thereby ECB policy is threatening the European project as a whole for the sake of short-term financial stability. The longer policy prevents the necessary catharsis, the more it contributes to the growth of populist or extremist politics.

Our models suggest that in its fight against the spectres of deflation and unanchored inflation expectations, the ECB’s monetary policy has already become too loose.

Hence, we believe the ECB should start to prepare a reversal of its policy stance. The expected increase in headline inflation to above one per cent in the first quarter of 2017 should provide the opportunity for signaling a change.