Fidelity spokesman Vincent Loporchio said Fidelity executives declined to grant interviews for this story. In a written statement, Fidelity said it follows the law relating to potential conflicts of interest between its mutual funds and the venture capital arm.

"We strictly adhere to all legal and regulatory requirements that apply to our management of our mutual funds and other client accounts and our proprietary venture capital investments," Fidelity said. "Where there is the potential for such investments to overlap, we apply internal guidelines designed to ensure that our mutual funds comply with relevant legal and regulatory restrictions on their ability to acquire securities issued by companies in which Fidelity has a pre-existing proprietary investment."

Fidelity declined to comment on whether its mutual funds were interested in making the same pre-IPO bets as F-Prime Capital.

Over the past three years, however, the mutual funds have been among the nation's biggest investors in pre-IPO companies, U.S. regulatory filings show. The pressure on Fidelity to produce market-breaking returns has never been higher. Since the end of 2008, investors have pulled nearly $100 billion from Fidelity's actively managed mutual funds, while net deposits into Vanguard Group's index funds approached $700 billion, according to Morningstar Inc data.

Fidelity's two top rivals, BlackRock and Vanguard, said they do not operate separate investment arms that might compete with their mutual funds. Vanguard Chairman and CEO William McNabb goes a step further, investing almost all of his personal financial assets in Vanguard funds, because he wants to ensure his interests are aligned with those of his customers, said company spokesman John Woerth.

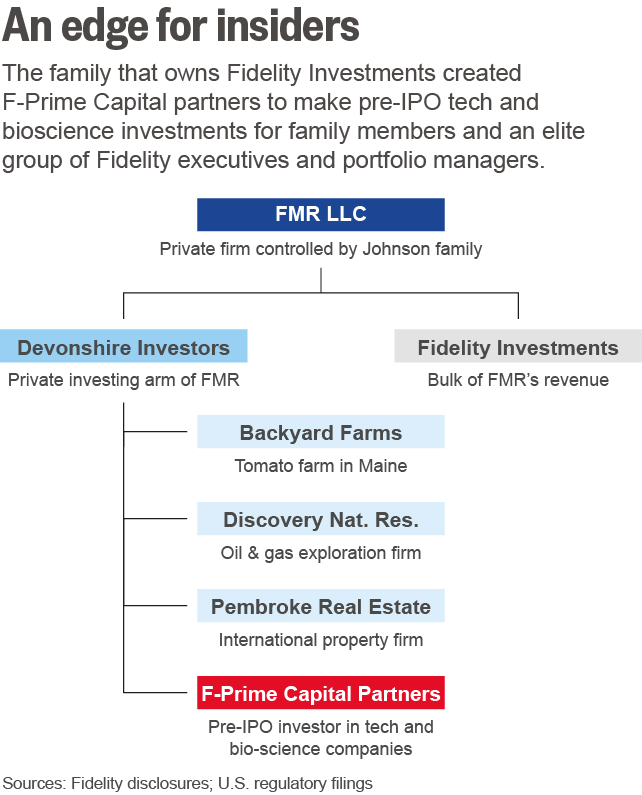

Fidelity Investments is owned by privately held FMR LLC, which is controlled by the Johnson family. The family, along with a small group of FMR employees and shareholders, are also investors in F-Prime Capital, the private venture capital arm.

Johnson family members and Fidelity insiders also own Impresa Management, which runs partnerships and investments on F-Prime's behalf, overseeing about $2.6 billion in assets, according to SEC disclosures. Impresa's strategy is to bet on promising bioscience and tech start-ups.

If F-Prime controls 5 percent or more of a private company's voting stock, then that ownership prevents the Fidelity mutual funds from buying the same security before or during an IPO, according to the Investment Company Act of 1940. Fidelity told Reuters that it concurs with that reading of the law, which is enforced by the Securities and Exchange Commission.

SEC rules aim to ensure that the interests of mutual funds are on at least equal footing with the interests of affiliates, said Joseph Franco, a law professor at Suffolk University Law School in Boston. The rules seek to prohibit a situation where, for instance, a mutual fund might invest in a pre-IPO company at an above-market price with the intent of boosting the value of an earlier, lower-priced investment by an affiliated entity.

The rules also seek to ensure that mutual fund managers are not influenced by the interests of an affiliated entity, such as Fidelity's in-house venture operation, Franco said.