So I traveled to Orlando last week to see Orlando, in this case it wasn’t Orlando the city, but Phil Orlando the esteemed portfolio manager for Federated Funds. I have known Phil for years and have always found his insights to be net-worth changing. In fact, a few weeks ago I spent an hour with Phil and his boss Stephen Auth, arguably the smartest guy on Wall Street, but I digress. In front of a standing room only crowd Phil began his presentation by stating there is a strong correlation between politics and Wall Street. “This presidential election,” he suggested, “Is likely the most impactful election ever because it is a three ring circus.” First, it determines who controls the House of Representatives. Second, it will decide who controls the Senate. And third, it likely sets the direction of the Supreme Court for a generation considering three of the justices are 77 years of age, or older.

Phil thinks “anger is the new hope” and reflected on the award winning movie Network (1976) where Howard Beale, news anchor of Union Broadcasting Network, tells listeners, “I want you to get up right now. Go to your windows. Open them and stick your head out and yell – I’m mad as hell and I’m not gonna take this anymore!” (Mad). Clearly, that was the sentiment driving the recent Brexit vote and is probably what is behind the sentiment in our country to “throw all of the career politicians out!” Phil noted that ~70% of voters think the country is headed in the wrong direction and that the two most important concerns are: 1) are we safe; and 2) we need the economy to grow (job creation). He opined the majority of voters are more concerned with those two points, implying the Republicans may have the upper hand since those are the pillars of their campaign.

Speaking about the Federal Reserve, he believes Janet Yellen is a one-term chairwoman and she has already begun to manage her legacy. She has ended the “taper,” raised interest rates, will start to work off the Fed’s $4.5 trillion balance sheet, and has avoided a double-dip recession. Interestingly, since World War II there have been 11 recessions with seven of them beginning in the first term of a newly elected President. Also speaking of the Fed, Phil recently met with Bill Dudley (ex-head of the New York Fed) where Dudley stated he would: 1) not have raised taxes; 2) not have instituted sequester; and 3) curtailed Obamacare. If those three steps were taken he believes we would have seen a normal economic recovery (+3% GDP growth) rather than the struggling economic recovery we have (+1.2%).

Last Friday our chief economist (Scott J. Brown, Ph.D.) addressed the weaker-than-expected real GDP report by writing:

Real GDP rose much less than expected in the advance estimate for 2Q16, due largely to a sharper drag from inventories. Recall that inventories are a stock ($) and GDP is a flow ($/time). The change in inventories ($/time) contributes to the level of GDP, and the change in the change in inventories contributes to GDP growth. Slower inventory growth subtracts from GDP growth. However, inventories didn’t just slow in 2Q16, they contracted (for the first time since 3Q11) – farm inventories fell, while nonfarm inventories were about flat. Lean inventories normally pave the way for production gains in the months ahead. Consumer spending (70% of GDP) rose sharply, following a soft 1Q16 (averaging a 2.6% annual rate in the first half of the year). Foreign trade (a decrease in imports and a pickup in exports) made a positive contribution, but just about everything else subtracted. This is a very mixed picture, but consumer spending is pulling us through for now. Bear in mind that these figures will be revised (and revised again), but the story may not change much.

Phil concluded the metrics of the voting population have changed noticeably. In 2008 Democrats comprised 49% of the total. Now that ratio is 29%. However, it is not the Republicans that have gained ground. It is the independents that have surged to 42% because “everybody is mad as hell and we’re not going to take it anymore!” Independents, he stated, will be key as to who wins the election. While the race is extremely close, he thinks the odds favor a Hillary win with the Senate “flipping” to Democratic control and Republicans continuing to control the House. However, there could be a number of wildcards between now and November 8th. There could be more bombshells from Julian Assange’s WikiLeaks. Or, Donald Trump could state he is only a one-term president and he is going to employ the kind of people to fix things in four years because he has to get back to his real job. In such a revelation he could also broach the topic of “term limits” to kill the wrong-footed tradition of career politicians.

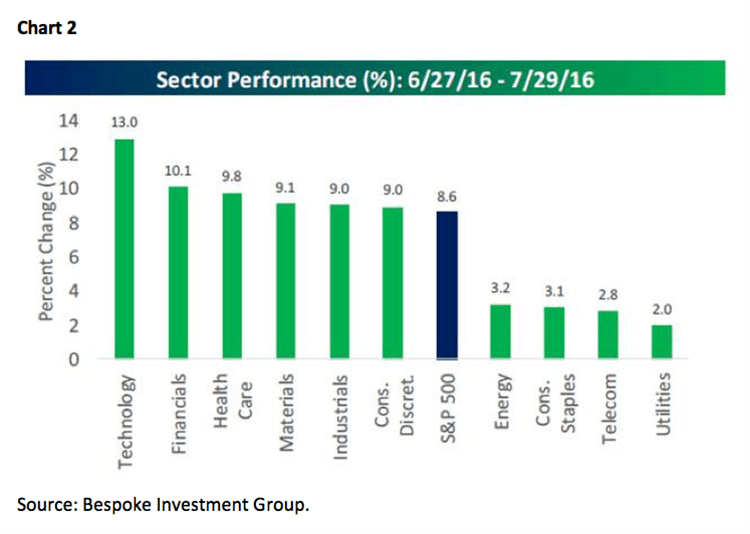

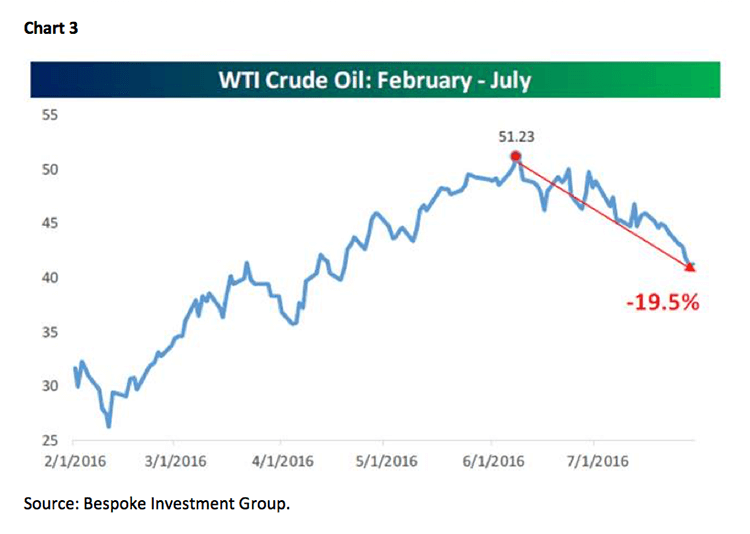

Turning to the markets, what can I say? The S&P 500 (SPX/2173.60), after breaking out to the upside of a reverse head-and-shoulders bottoming formation (Chart 1), has traded to new all-time highs. In the process it has traced out a bullish “flag” formation in the charts. Counting the number of sessions in said flag, it tallies to 12 sessions within less than a 1% trading range. Ladies and gents, that hasn’t happened in 45 years and it is bullish. Not to be outdone, the NASDAQ 100 (NDX/4730.23) bettered its 2000 all-time closing high of 4719.05 last week. For the month of July the tech-heavy NDX was up 7.15%, while the SPX was better by 3.65%. Sector performance, as we surmised, was led by technology (Chart 2) with many of the tech companies reporting “blow out” earnings. On the earnings front, hereto as surmised, earnings are coming in better than the “lowered bar” expectations. Indeed, with more than 1000 companies reporting, 67% have beaten their consensus estimates and 58.3% have exceeded revenue expectations. Meanwhile, crude oil is down ~19.5% from its early June high and is resting slightly above its 200-day moving average (Chart 3), while the U.S. Dollar Index took a header last week. So what do we do now?

Well, the NYSE McClellan Oscillator has worked off its overbought condition and by my way of measuring the stock market internal energy, the energy level has recovered to a full charge. So while many will try to argue with the message of the market, the message is clearly bullish. As one emailer wrote last week, “In this case [the market’s direction] is up with a target for the S&P 500 between 2335 and 2672.” As for stocks for your consideration, every earnings season we screen for companies that beat both earnings and revenue estimates, and raised forward guidance. Such names from the Raymond James research universe, which have favorable ratings from our fundamental analysts, and screen favorable on our proprietary algorithm, include: Apple (AAPL/$104.21/Outperform), Essex Property (ESS/$233.88/Outperform), Garmin (GRMN/$54.33/Outperform), GrubHub (GRUB/$37.92/Outperform), MarineMax (HZO/$20.20/Strong Buy), LKQ (LKQ/$34.39/Outperform), ServiceNow (NOW/$74.92/Strong Buy), Quintiles (Q/$77.64/Strong Buy), Teligent (TLGT/$8.12/Strong Buy), and Wix.com (WIX/$35.60/Outperform).The call for this week: Years ago award-winning strategist Stan Salvigsen (of C.J. Lawrence, then Merrill Lynch, and finally Comstock Partners) wrote some of the best strategy reports ever penned on the Street of Dreams. One of them in 1982 was titled “Surf’s Up” where he showed a picture of hundreds of surfers standing on the beach in Hawaii watching 40 foot waves roll in, yet only a few were brave enough to surf them. Stan’s tag line was, “If you want to catch a wave you need to grab a board and get in the water!” The analogy was that although you are afraid, you need to buy stocks. At the time investors could get a 20% return in a money market fund, so there was little interest is equities. Verily, the stock market had decoupled from the fundamentals with the SPX trading below book value with a dividend yield of roughly 7%, ignoring improving geopolitics, the improving economy, etc. The same thing happened in 1997 with astronomical equity valuations that stayed that way for over three years. The equity markets are doing it again here. You can either take that as “a few years from now we are going to be in a bear market,” or that the stock market is “telling” us things are going to get better. I am “long” . . .

.png)

Jeffrey D. Saut is chief investment strategist at Raymond James.