There’s also the issue of valuation. Given India’s strong performance relative to other emerging markets, especially in 2014, some observers believe that a great deal of good economic news has already been priced into its market. Asnani points out that India has historically been relatively expensive for the emerging markets for a few reasons—because of the higher quality of its corporate sector, because it doesn’t depend on commodities and because of technical factors such as its restrictions on short selling.

But even by historic standards, the Indian market seems to be hitting its upper limit. “Usually the Indian market trades at 17 to 18 times trailing earnings,” he says. “Today that figure is 20 times, or more.” And while India’s market has been less volatile than usual lately, it is typically even more volatile than other emerging markets.

That volatility works for the fund by helping Asnani buy stocks on dips. He targets companies with the financial stability, transparency and management to do well whether or not government reforms materialize or occur more slowly than expected. Other desirable characteristics among his target companies include strong market share and strong and rising expenditures on research and development as sales grow.

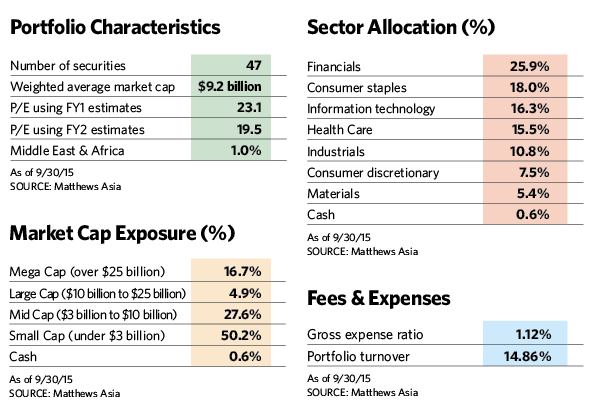

Although the fund is classified as an all-cap offering, it holds more small-cap and mid-cap names than most India indices and mutual funds. Asnani likes them because Wall Street analysts typically don’t follow them and they trade at discounts to large-cap stocks. According to the latest fact sheet, the fund has a 50% allocation to small-cap stocks with $3 billion or less in market capitalization. That’s significantly higher than the 4% for its benchmark, the S&P Bombay Stock Exchange 100 index.

Asnani is a long-term investor whose typical holding period is five to seven years. “In emerging markets such as India, managers are increasingly trading companies rather than investing in them,” he says. “We believe a five-year holding period is necessary to consistently benefit from both bottom-up and top-down drivers of returns.”

The portfolio is underweight relative to its benchmark in areas whose fortunes hinge on unpredictable and capricious government policy, including the infrastructure plays that have been so popular among both domestic and foreign investors. Asnani has avoided such companies because they face heavy competition, lack pricing power and depend on government policy and official favor. There are also incentives for corrupt corporate practices in the sector. The fund also has no presence in utilities or telecommunications and energy companies, whereas altogether these have an allocation of about 13% in the benchmark.

On the other hand, the fund is overweight in sectors that depend less on government reforms and stand to benefit from strong domestic consumption, including consumer goods, health care, technology services and select industrials. Among such holdings is specialty pharmaceutical company Ajanta Pharma. Headquartered in Mumbai, the 43-year-old company has cut costs by outsourcing much of its manufacturing and plowing the savings into research and development. The company has an extensive presence in India as well as many countries in Asia, Africa and Latin America, and it is just beginning to crack the U.S. market.

Another fund holding, Symphony Ltd., offers a wide range of air coolers and air conditioners. Founded in 1988, the company has a 50% share of the market in a country dogged by oppressive heat. The fund began buying the stock a couple of years ago, and the price has risen about sixfold since then.

Cognizant Technology Solutions is one stock representative of India’s well-known technology services arsenal. Although the company trades on the Nasdaq, 90% of its operations are based in India. The fund added the stock after a correction in 2014 brought the price down to an attractive level.

Industrial holdings include Gujarat Pipavav Port, which runs the Port Pipavav shipping facility. Ten years ago, global shipping giant AP Moller-Maersk acquired a 54% stake in the port and made significant investments in port machinery and infrastructure expansion, and in 2010 the company went public with an IPO listing on the Indian stock exchange. Asnani says the company boasts strong, transparent management, well-run facilities and a key location that serves key markets in India and offers room for expansion.