As the fund's low turnover suggests, Akre is a faithful investor who typically holds on to his picks for several years. Because companies that fit his criteria don't pop up all that often, he rarely sells them just because their valuations are high, nor does he adhere to strict pricing targets. But he might pull the trigger if management stumbles badly or if the reasons he bought the stock in the first place are no longer relevant.

Reasonably priced, well-run companies armored for downturns are familiar territory to Akre, who ran the FBR Focus Fund between 1997 and August 2009. During that period, the fund produced an annualized return of 12.3%, while the Standard & Poor's 500 index came back with 4.4%.

He left FBR largely because the firm proposed cutting the fund's investment management fee. When he decided to launch Akre Focus, the analysts who worked with him on FBR Focus stayed behind to run that fund. Akre set about building a new team.

His new fund got off to a slow start in 2009, in part because he took his time investing new inflows while the market was rising. But Akre Focus has steadily chugged past its competition since then. From its inception in August 2009 through June 30, its annualized return of 15.34% beat the S&P 500 index by more than two percentage points.

Word of mouth and some good publicity have helped Akre Focus gain more assets in three years, $1.1 billion, than his 15-year-old former charge, which has $750 million. Akre says the increasing size of the fund won't dampen his investment style, though he admits that it limits the size of positions he can take in smaller companies.

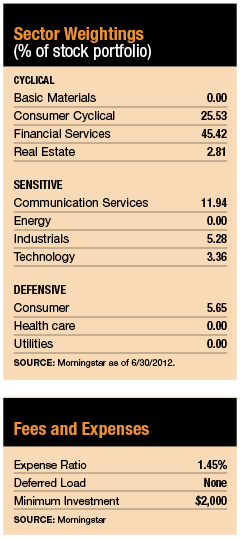

Investors can look to FBR Focus's long history to get an idea of what to expect at the newer Akre Focus. Much of the older fund's success came from losing less than its competitors in down markets, according to Morningstar analyst Russel Kinnel. Its relatively light presence in technology stocks softened the blow of the "tech wreck" in the early 2000s, he notes, though the fund sometimes lagged a bit during bullish periods.

Tech stock valuations have fallen to more reasonable levels since the newer fund emerged, and Akre has been able to pick up some at attractive prices. According to his latest fact sheet, technology companies such as Apple and Computer Services account for 19% of his assets. Financials and consumer discretionary, the two largest sectors, each account for about 30% of assets.

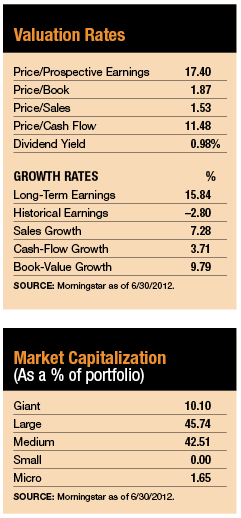

The fund invests in companies of any size, and it can own sizable stakes in just a few stocks. Its top 10 stocks recently accounted for almost 60% of assets.

From time to time, Akre loads up on cash if he can't find investment opportunities in the stock market, especially when money is coming into his fund at a rapid clip. Besides, he likes to have ample cash on hand so he can swoop in on buying opportunities when the market tumbles. At the end of March, for example, he stood at 26% cash in the fund because he had seen a combination of strong inflows and a lack of attractively priced stocks to absorb them. Much of that money was funneled into stocks during the market downturn in the spring and by the end of June, the war chest had shrunk to about 14%, where it stands now.

At 9.7% of net assets, MasterCard is the fund's largest holding. With its ability to capitalize on the growing number of international credit card transactions, the stock typifies the "compounding machine" Akre craves. He began buying the stock soon after the fund opened, and has added to the position periodically. At current levels, it sells at 16 times estimated 2013 cash flow per share, and Akre believes it can grow cash flow at a "high teens" rate over the next five years.

Another longtime holding, cell tower operator American Tower, maintains its pricing power through multiyear, non-cancellable contracts with wireless carriers that feature annual pricing escalators. The company is well ahead of its peers on the international front and has more than 40% of its towers located in countries with significant growth potential, such as India and Brazil. In the U.S., the company is enjoying growth because of the increasing demand for high-speed wireless data and thus the need for more network capacity.