Key Points

• High-yield bonds may look appealing, but they come with additional default and volatility risks.

• If you decide to invest in high-yield bonds, understand the risks and be sure your bond portfolio is diversified enough to cushion the impact of a default.

• One way to help manage high-yield bond risks is by investing through a professional manager, such as a mutual fund, exchange-traded fund or separately managed account.

Interested in a 10% yield? You’re not alone. High-yielding “hot” investments have undeniable appeal, which may explain why they pop up so often in newsletters, newspapers and on TV.

But there’s no free lunch—high yields usually come with high risks. That’s why we caution against reaching for yield without also thinking carefully about risks. This is a particular concern now that yields on individual high-yield corporate bonds have surged.

This isn’t to say such bonds should be avoided altogether. But if you’re tempted by one, make sure you understand how these types of bonds work, what the risks are and if they are appropriate given your risk tolerance.

High-yield bonds come with high risks

Despite the name, high-yield corporate bonds are defined by their credit ratings, not their yields. The label is used for bonds with ratings of Ba1 and below by Moody’s Investors Service or BB+ and below by Standard & Poor’s. High-yield bonds do often offer eye-catching yields—but that’s to help compensate for their higher risks.

These bonds—also called “sub-investment-grade” or “junk” bonds—are issued by borrowers considered to be less creditworthy than those issuing higher-rated investment-grade bonds. They are considered speculative investments of relatively low quality.

A key risk of high-yield bonds is the risk of default, or an issuer’s failure to promptly pay interest or principal when due. But that’s not the only way a bond can default. Many bonds have covenants—basically, a legal agreement spelling out what the issuer will and won’t do over the life of the bond—and a broken covenant can trigger a default, as well.

So if you’re evaluating the creditworthiness of a high-yielding security, it’s not just a question of “will the issuer have enough money to redeem this bond at its maturity date?” A lot can happen to an issuer over the life a bond. Its fundamentals and revenue-making ability may change significantly over time, and be drastically different as the maturity date nears, compared with when the bond was purchased.

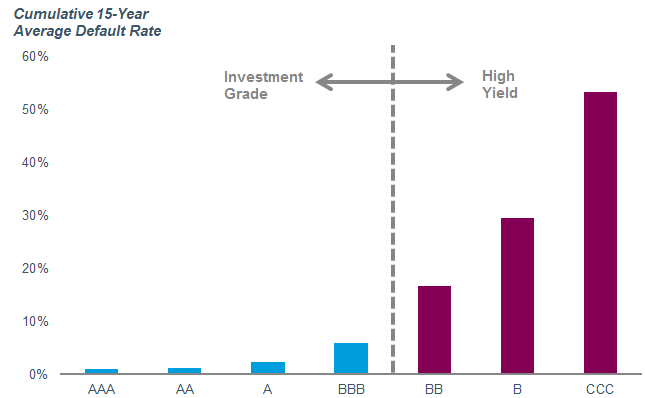

Credit ratings historically have been a pretty decent predictor of default rates. The lowest-rated bonds tend to have the highest default rates, and there’s a noticeable jump when the credit ratings dip down to junk territory.

Lower credit ratings generally mean greater default rates

Source: Schwab Center for Financial Research, with data from Standard & Poor’s 2014 Global Corporate Default Study. The study analyzed the rating and default history of 16,857 U.S. and non-U.S. companies first rated by Standard & Poor’s between 12/31/1980 and 12/31/2014. The 15-year cumulative average default rate is calculated by weight-averaging the marginal default rates in all static pools. Past performance is no indication of future results.

What’s the downside?

If you see a recommendation for an individual high-yield bond, it might quote the yield or total return if held to maturity. While that’s helpful if the bond doesn’t default, the chart above shows that defaults among the lowest-rated bonds are actually pretty common. If you’re interested in high-yielding junk bonds, it’s important to focus on the downside as well as the yield.

If a bond defaults, you won’t know the downside in advance. You won’t know how much you might recover, or how long it will take to get it. Bankruptcies are a complex process, and it can take a long time—sometimes years—before bondholders receive something, if anything, in exchange for their defaulted bonds. Defaulted bonds can generally be sold in the secondary market, but that market is relatively illiquid and there can be large bid/ask spreads (in other words, the price that others are willing to pay for the bond—the bid—may be well below what you are asking for it). Also, because bonds don’t trade on an exchange, the process of buying and selling them is less transparent and can be less orderly, leaving you with a real possibility that you may be stuck holding a defaulted bond that is no longer paying interest.

If an issuer is teetering on the verge of bankruptcy, it may work out an arrangement with large bondholders under which it will exchange one of its outstanding short-term bonds for new bonds, usually with longer maturities, higher coupons and perhaps some sort of “secured” status. This may help the issuer avoid a default in the short term because the principal payment date for that bond has been pushed back. Unfortunately, these exchanges often exclude individual investors, who are then left holding bonds that rank lower in the firm’s priority-of-payment scheme and tend to be less liquid.

And when issuers emerge from bankruptcy, bondholders aren’t always given cash. Bondholders may also receive stocks, bonds, warrants or some combination of all those in exchange for their defaulted bonds. Bankruptcies can often cause headaches for the bondholders.

High-yield bond prices can be volatile even if the issuer doesn’t go bankrupt. A credit rating downgrade or a poor earnings report may cause the bond’s price to drop—sometimes significantly. While that might not matter if you hold to maturity (barring default), if you need to sell early, the price could be lower than what you initially paid.

Don’t do it alone

Buying and managing a portfolio of individual bonds can be challenging even with high-quality investments. Holding a portfolio of individual high-yield bonds can be even trickier, as it can be difficult to monitor each of the issuers.

One way to help manage these risks is by investing in high-yield bonds through a professional manager, whether that’s a mutual fund, exchange-traded fund or separately managed account (SMA). We believe diversification is paramount when investing in high-yield bonds. If you’re holding just a handful of individual issues, even one default can have an outsized effect on your overall portfolio. A fund or SMA typically will hold a diverse collection of bonds, to help cushion the negative effects if some of the bonds default.

The bottom line

If you’re tempted by, but unsure about, a particular high-yield bond, speak with a Schwab Fixed Income Specialist. He or she can help you weigh the risks and rewards of such investments, and help assess whether they make sense for your portfolio.

In bond investing, if something looks too good to be true, it usually is. If a bond is offering a yield that’s well above other investments, it almost certainly comes with additional risks. Make sure you understand those risks, and invest only if you have the appropriate risk tolerance.

Collin Martin, CFA, is director of fixed income at the Schwab Center for Financial Research.

Read more here.