Federal Reserve Chair Janet Yellen said the U.S. economy should continue to expand over the next few years, allowing the central bank to keep raising interest rates, while also stressing the Fed is monitoring too-low inflation.

“Considerable uncertainty always attends the economic outlook,” Yellen said Wednesday in remarks prepared for delivery to the U.S House Financial Services Committee. “There is, for example, uncertainty about when -- and how much -- inflation will respond to tightening resource utilization.”

U.S. stocks opened higher while Treasury yields fell with the dollar after her testimony was released.

Yellen is scheduled to begin her remarks at 10 a.m., followed by a question-and-answer session with lawmakers. She repeats the performance Thursday before the Senate Banking Committee, wrapping up her final testimony to Congress as Fed chair, unless she is re-nominated by President Donald Trump. Yellen’s current term expires on Feb. 3.

“We thought that it was pretty balanced and a pretty steady continuation of the themes” that Yellen had laid out after the Fed’s meeting last month, said Michael Feroli, chief U.S. economist at JPMorgan Chase & Co. in New York. “It was pretty straight down the middle.”

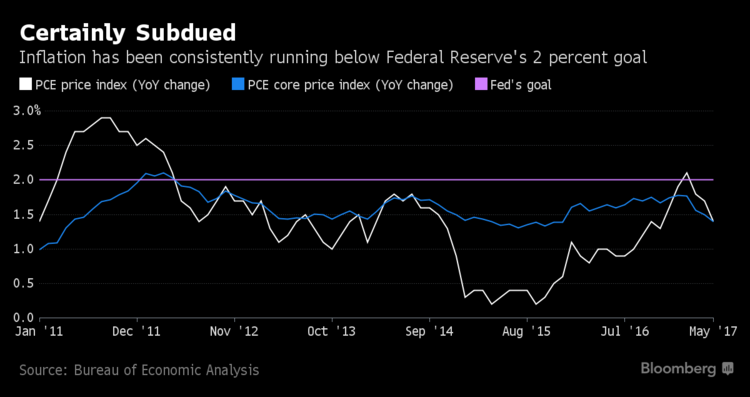

Yellen emphasized in her remarks that the central bank is on alert about prices remaining below the central bank’s 2 percent target. Other members of the Federal Open Market Committee have mentioned similar concerns in recent days.

“The committee will be monitoring inflation developments closely in the months ahead,” she said.

Nevertheless, the Fed chair said, the baseline outlook is for levels of interest rates to continue to support job gains and income growth and therefore consumer spending.

A faster pace of global growth should support U.S. exports, she said, and a recovery in drilling activity should support business investment.

“These developments should increase resource utilization somewhat further, thereby fostering a stronger pace of wage and price increases,” she said.