JPMorgan Chase & Co. inflated the value of complex bonds it sold to individual investors, by 15 percent in one example, according to a study by a financial consulting firm that works with plaintiffs in securities litigation.

The bank overstated how much some of its structured notes were worth by failing to account for fees for the indexes that determined the payouts on the securities, according to the study from Securities Litigation & Consulting Group. The consulting firm analyzed at least $253.7 million of one kind of structured note sold by JPMorgan between 2011 and 2014, and found that some were sold with inflated valuations.

Amanda Smith, a spokeswoman for JPMorgan, declined to comment on the study.

Structured notes have grown increasingly attractive to mom-and-pop investors that are starved for income in a low-interest-rate environment. The bonds often pay higher interest than regular corporate debt and are usually created by combining a bond with a derivative that offers extra market exposure, as well as added risk. Last year banks issued about $43.5 billion of structured debt that was registered with the Securities and Exchange Commission, according to data compiled by Bloomberg, up about 13 percent from 2012 levels.

Regulatory Concern

But regulators fear that individuals can have trouble figuring out fair prices for the securities, and have fined banks for failing to disclose enough information about the bonds. Rule makers have been zeroing in on structured notes tied to complex, self-designed indexes in particular. With that pressure, issuance levels in recent years have been far below their pre-crisis highs.

In April 2012, the SEC sent a letter to banks that sell structured notes, encouraging them to prominently disclose the difference between the public offering price of the note and the issuer’s estimated value for the bonds.

Overstated Value

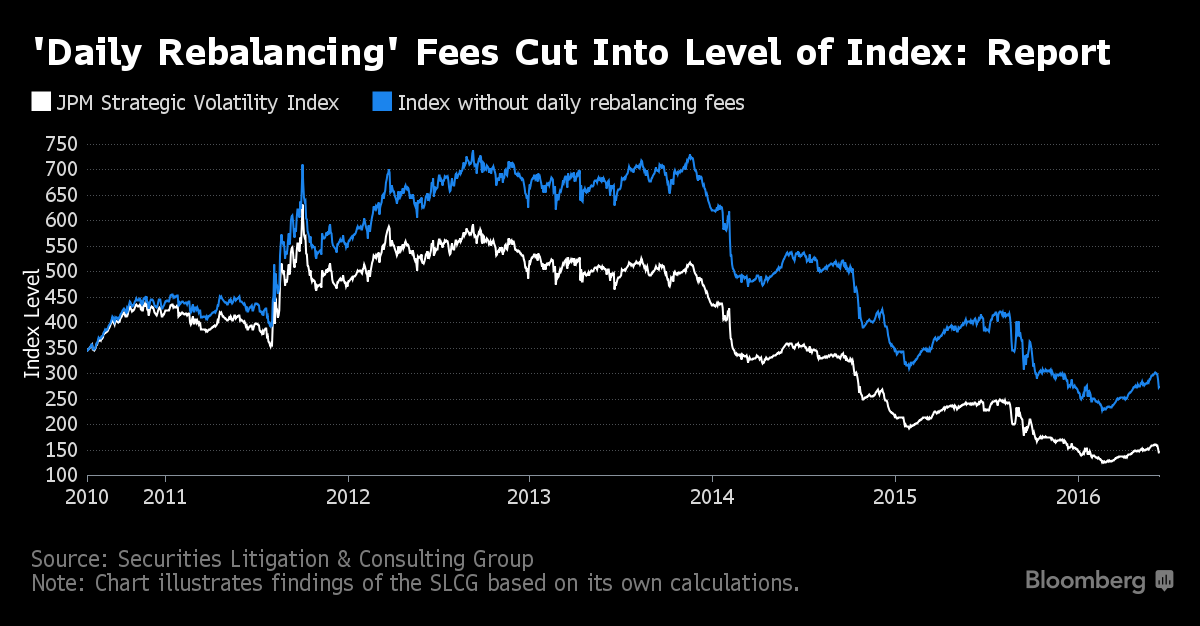

The estimated values are what JPMorgan may have overstated, according to the Securities Litigation & Consulting Group report published to the group’s website on Wednesday. The consulting firm looked at a kind of bond called a “volatility note.” It calculated an estimated value of the 10 largest such securities sold by JPMorgan between 2011 and 2013 as ranging from 67.5 to 85.5 cents on the dollar. In the case of the bond worth 85.5 cents, JPMorgan had disclosed an estimated value of 98.6 cents, or about 15 percent higher. Many of the JPMorgan notes were sold without the bank having disclosed estimated values, according to the report.

Volatility notes are designed to pay a higher return if futures market investors grow more concerned about stock market price fluctuations, which would increase an index known as the CBOE Volatility index, or the “VIX.” Securities linked to volatility strategies "are complex to begin with," said Joe Halpern, chief executive officer at Exceed Investments in New York. When they’re also designed to react to market conditions, they “can go from complex to almost impossible to understand.”