So, last week I gathered up Harry Katica (Director of the Equity Advisory Group) and Nick Lacy (Chief Portfolio Strategist of AMS) and left for a tour of the Northeast corridor. Our mission was to raise the Raymond James “flag” for our new friends at Alex Brown (AB), a firm we are purchasing from Deutsche Bank. Having lived and worked in the Baltimore area, where AB was originally based, I have very fond memories of arguably the best boutique research firm in the country. We arrived in Washington, D.C. mid-day Sunday. Harry and Nick were hungry and went off to eat while I ate lunch with some beltway insiders that I have known for years. One of the first words out of one of their mouths was, “kakistocracy.” “Huh,” I said, “What the #$%& is that?!” She said it is Greek and means, “Government by the worst possible persons.” She then questioned how, in a country with over 311 million people, these are the two best candidates we can find to run for president. Many other things were discussed like scuttlebutt about political rumblings inside the beltway, Brexit, the economy, electoral votes, the fact that Putin had massed three forces 170 miles north of Kiev (an event that was elevated in the news late last week), China’s provocative moves in the China Sea, North Korea, the forthcoming release of last minute “October Surprises” for both presidential candidates, etc. The insights from this meeting were awesome.

Comes Monday morning, we walk from the Hay Adams Hotel (behind the White House) to the nearby AB office to present the Raymond James case to their financial advisors (FAs). Afterwards, I took our crew to a hedge fund in Northern Virginia to meet some portfolio managers (PMs) and discuss various issues as well as stocks. Nick and Harry were great at that meeting. Then it was off to Baltimore to have lunch with more PMs followed by a meeting with Bill Miller, legendary PM of the Legg Mason “Value Trust Fund” and now captain of his Legg Mason Opportunity Trust (LGOAX/$17.62). I didn’t think there was anyone more bullish than I am, but I was wrong, and I am going to buy his fund. Bill is a VERY smart guy and a great stock picker! As a sidebar, we all mentioned our favorite stock ideas. Shortly thereafter, we met with AB’s Baltimore office and took them to dinner with a subsequent drive to Philly, because the next morning we were going to meet with that city’s AB folks before riding a train to NYC.

I love NYC, and to a shocked Harry and Nick, we took the subway to Wall Street for a confab with AB’s downtown-based FAs. After a great meeting, we adjourned to Bobby Van’s for the nightly FOF meeting (Friends of Fermentation). Regrettably, my dear friend Arthur Cashin was not there, but the best MLP portfolio manager in the biz (Eric Kaufman of VE Capital fame) was indeed in attendance and accompanied us to dins at Capital Grill with the Alex Brown folks. The next morning, it was off to Greenwich Connecticut’s AB offices and then another meeting with the mid-town Alex Brown folks before our train ride to Boston. That night was yet another dinner at my favorite, not-North End, restaurant in Boston (http://www.teatroboston.com/) with friends.

During our sojourn, the most frequently asked question was about passive versus active portfolio management. To repeat said question, “Since very few active portfolio managers have been able to beat the index over the past five years, is active management investing dead?” To answer that question, we asked it another way. To wit, “What if the PM didn’t outperform the index but outperformed the Exchange Traded Fund (ETF) that allegedly “mirrors” the index? Is that a win for active management?” The answer is a resounding yes. Consider this, you cannot buy the index. You have costs to implement any strategy. So, while with the S&P 500 (SPX/2084.05) you can come close to matching the index’s returns with an ETF, using most of the other ETFs (small and mid-cap ETFs, sector ETFs, high-yield ETFs, emerging market ETFs, etc.) the tracking error is large. When one drills down using this lens, active managers outperform by a large percentage. As stated, there are costs to implement these various strategies that are not associated with an index. Moreover, active managers not only have similar costs, but many of them have a “cash drag” because they tend to hold at least a modicum of cash, which has zero return. All said, when the market is cheap, and the index is going straight up, it is very tough to outperform, so what you want to own is “cheap beta.” However, when the market is fairly valued, or expensive, you want to employ active management where the PM is not forced to buy everything in the index and is not afraid to hold cash. Indeed, as my dearly departed father used to tell me, “Cash is an asset class, because if you think the investment opportunity sets that are available to you today are as good as any that will present themselves next week, next month, or next quarter, you are naïve. Manifestly, you always need to have some cash to take advantage of new investment opportunities.”

Obviously, between the PMs and the advisors, we got a lot more questions, but another one of the other more ubiquitous was regarding Low Volatility investments, or what I have termed “chicken longs.” To me, Kimberly Clark trading at a P/E multiple of 24 is expensive given that Intel trades at 16x earnings. Speaking to Low-Vol ETFs, our friends at JP Morgan have done a lot of work on the subject and concluded, “This style is now up ~74% relative to the market since the beginning of this cycle in 2009, pushing its valuation to reach a new record high. Additionally, Low Volatility has become even more correlated to Momentum, a vulnerable trade that has become increasingly crowded. This suggests Low Volatility may be in a bubble and subject to negative tail risk. The high valuation multiples for Low Volatility are becoming unjustified based on fundamentals.”

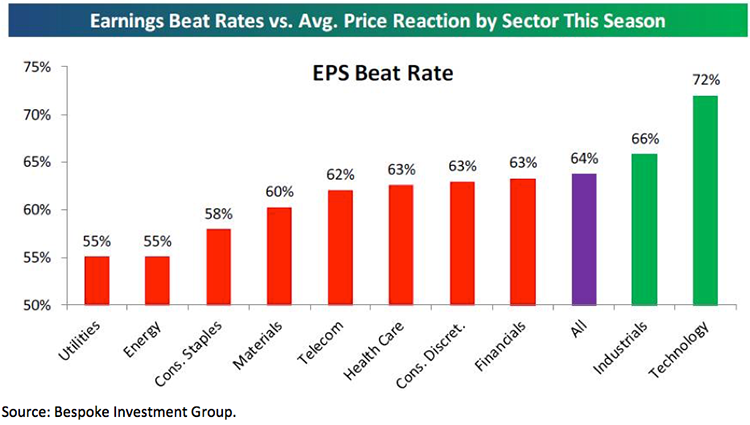

The call for this week: From our Boston-based studios last Thursday morning, I told CNBC’s Becky Quick that my proprietary model is currently somewhat confused. The ideal very short-term pattern would be for a pullback into late this week, which would reenergize the equity markets. However, it does not look like that is what is going to happen. Therefore, if we rally into late week, it would set the market up for a garden variety pullback (3-5%). Of course, any pullback should be viewed within the construct of a secular bull market that has years left to run. Our model suggests the first “timing target” for a more important “polarity flip” comes in mid-/late September, which would leave markets susceptible to a more meaningful retracement. As for stock ideas, companies that have beaten both earnings and revenue estimates and guided forward estimates higher, and which have favorable ratings from our fundamental analysts and screen positively on my algorithms, include: Essex Property (ESS/$229.42/Outperform), Harman (HAR/$84.81/Strong Buy), MarineMax (HZO/$20.42/Strong Buy), and ServiceNow (NOW/$75.77/Strong Buy). Speaking to earnings, as we surmised, they are coming in above the “lowered bar” expectation. With the strong U.S. dollar no longer a headwind, as of last Friday, more than 2,400 companies had reported 2Q16 earnings with 64% of them beating the earnings estimate, while 56% beat the revenue estimate. According to Bespoke, the earnings “beat rate” versus the average price reaction by sector this season shows Technology to be the clear winner (see chart). However, Industrials and Financials are not far behind. And don’t look now, but many of the financial indexes are breaking out to the upside in the charts as the equity markets transition from an interest rate-driven bull market to an earnings-driven bull market.

Jeffrey D. Saut is chief investment strategist at Raymond James.