By Brendan Clark

As investors reflect back on the last 13 years, it becomes obvious that traditional diversification using Modern Portfolio Theory produced lackluster results at best. The theory advocates building a portfolio of many different asset classes that behave differently throughout market cycles to maximize the opportunity for return while offering some risk reduction benefits. The relationship of one asset class's behavior to another's can be measured by correlation. An investor can construct a robust portfolio by incorporating asset classes that have different correlations. In theory, as three or four asset classes fall in value, another two or three will increase in value and vice versa. This tendency of diversified asset classes to move in different directions over time helps to smooth out the returns of the overall portfolio, offering greater potential for positive returns with reduced risk over time.

Unfortunately, the purported benefits of diversification were nowhere to be found during the 2008 financial crisis. Risk assets across the globe, including domestic stocks, foreign developed stocks, foreign emerging market stocks, high yield bonds, real estate and commodities, all fell in value at exactly the same moment. Unfortunately, this catastrophic occurrence, where many risk assets declined in value in unison, was not an aberration. It's remarkably similar to what happened during the tech wreck that kicked off the Lost Decade, just to a lesser degree. Asset classes that have lower correlations during normal market environments tend to converge during periods of market stress. This so called correlation convergence further increases the effects of the crisis and seriously limits the benefits of diversification for investors.

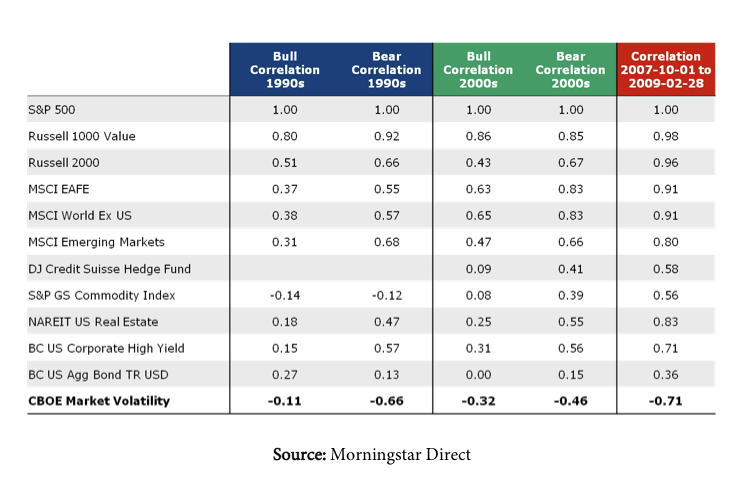

The table below details the correlation between asset

classes over different time periods and in different market environments. A couple of observations can be drawn. First, correlations have continued to

increase over time regardless of the market environment. This has very real implications for investors

trying to diversify a portfolio in order to provide some risk reduction

benefits. Diversification alone is

becoming less and less effective at controlling risk within a portfolio. Secondly, correlations spike higher during

bear markets and periods of market stress. This correlation convergence further weakens the risk reduction benefits

of traditional diversification. Lastly,

if we consider volatility as an asset class, it was the only one that had

consistent negative correlation to equities. Even more important, volatility became more negatively correlated to

equities during bear markets. This negatively

correlated relationship between risk assets and volatility highlights the

ability of a volatility allocation within an overall portfolio to provide risk

reduction benefits that are superior to traditional diversification alone.

History shows that volatility wreaks havoc on investors' psyches (not to mention their portfolios) as proven by Dalbar studies year in and year out. But what if investors could harness the power of volatility to work to their advantage? The stock market declines of 1987, 1999, and 2008 have two things in common:

1. Equity prices went through the floor.

2. Volatility went through the roof.

What if investors could own volatility like they own a stock in their portfolio, helping to offset some of the losses on equities?

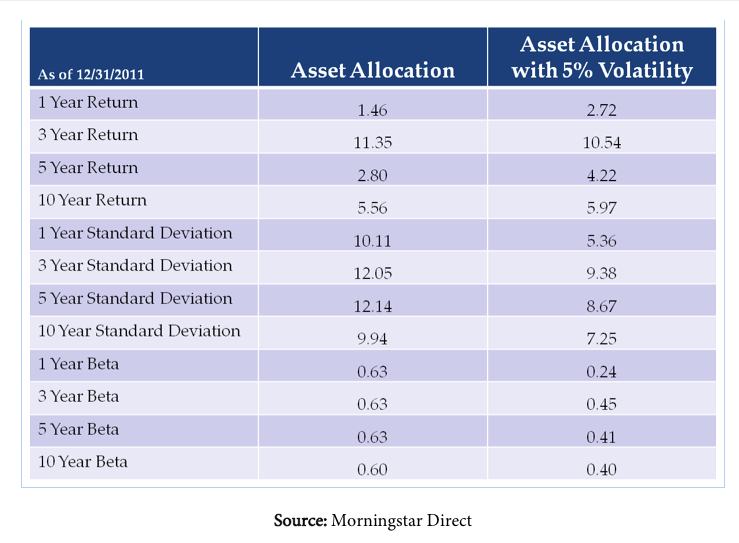

Below is a table that illustrates the benefits of adding a 5% allocation to volatility (the VIX Index) to a diversified portfolio.

The portfolio that included a 5% allocation to volatility experienced less risk in all time periods analyzed and excess return over the 5- and 10-year periods. Controlling risk is critical to wealth creation. It allows an investor to remain committed to their investment plan throughout a market cycle and thus not miss out on the inevitable market rebound. How many investors missed the incredible growth enjoyed by the S&P 500 from the low of March 9, 2009, through today by not having a plan they could stick to?

There are many different ways to incorporate volatility as an asset class within a portfolio, including put options, futures, ETFs and ETNs. Investors have had access to S&P 500 Index put options since 1983. Major institutions have used S&P 500 Index put options to access volatility to hedge portfolios for almost three decades. The original VIX Index, the so-called fear index, was introduced in 1993. Volatility can also be accessed by incorporating futures on the VIX Index. In 2009, Standard & Poor's launched the S&P 500 VIX Short?Term Futures Index and the S&P 500 VIX Mid?Term Futures Index and ETFs and ETNs soon followed suit. Each volatility instrument has unique advantages and disadvantages. Investors would be wise to consult an expert to help them decide which tool would be most appropriate for their needs.

The interest rate environment and its impact on the bond

market will have important implications on the use of bonds for diversification

purposes. Over the last 30 years,

investors have enjoyed above average returns from their bond allocations as

interest rates have continued to fall.

The 10-year Treasury yield peaked in October 1981 at 15.68% and fell to

1.40% in July 2012, which was the lowest level in 114 years. The greatest bond bull market in history was

a tremendous tailwind for diversified portfolios as intermediate government

bonds returned an average of 8.51%. Unfortunately,

these spectacular returns from bonds will not be repeated given where interest

rates are today. If we get into a

sustained rising interest rate environment, bonds will have major

headwinds. The last time we had such an

environment was 1954 to 1982, during which intermediate government bonds

returned an average of 5.22%, but only 0.64% after adjusting for inflation.

Individual investors have committed over $700 Billion to taxable bond funds over the last five years while withdrawing over $1.4 trillion from equity and money market funds. Investors who have been fleeing equities in favor of bonds may have done so at exactly the wrong time and may be headed for trouble. Investors seeking benefits of diversification in terms of increased opportunity for return and less risk need to look beyond bonds.

Allocating to volatility before the financial crisis would certainly have helped mitigate some of the catastrophic losses many investors endured. But what should investors do today? Does it make sense to add an allocation to volatility to an overall portfolio? Given the tremendous anxiety investors face in light of continued global uncertainty, I believe the answer is a resounding yes. The VIX Index has recently reached pre-crisis levels. Allocating to a volatility strategy, therefore, may be even more attractive today than it was a couple years ago. As we look toward the end of 2012 and beyond, equity market volatility will most likely continue and correlations between risk asset classes will remain high. An allocation to volatility as a safety measure looks extremely attractive and will help keep investors safe in the face of uncertainty.

Brendan Clark is the President of Clark Capital Management Group, an independent, family- and employee-owned investment advisory firm with $3 billion in assets under management. Clark Capital is a partner to RIAs, financial advisors and investment consultants across the U.S. and provides separately managed accounts (SMAs), unified managed accounts (UMAs), mutual funds, exchange-traded funds (ETFs) portfolios, collective trusts, and third party asset management services. Clark Capital is headquartered in Philadelphia.