Much has been written about the adoption of a fiduciary standard for financial practices. And the debate continues as firms grapple with what this means for their day-to-day operations.

On November 9, the CFP Board of Standards conducted a Webinar (www.cfp.net) that yielded some interesting perspectives on the subject. The focus was on the financial planning process. However, the points made in the webinar may be applicable to any financial practice.

Clearly, the task of integrating fiduciary standards into a financial practice will take some thought and planning and should involve the development of work-flow processes and/or task sets to ensure that all steps in each fiduciary process are carefully followed and nothing falls through the cracks. But before we delve into the specifics of the fiduciary process, it might be appropriate to revisit when a fiduciary status is mandated.

Basically, anyone who handles anyone else's money, even if the management of that money is outsourced, is considered a fiduciary. This broad definition applies to all financial advisors and others who work with clients and accept checks for deposit into financial accounts, investments, insurance or other financial instruments. However, if you accept the concepts presented in the aforementioned webinar, the label of fiduciary can also be extended to those practitioners who provide financial planning, regardless of whether such services involve the handling of money. Because the label of fiduciary is broad, adherence to fiduciary standards is imperative, given the existing and potential future regulatory requirements.

Fiduciary standards have been developed and promoted by the Center for Fiduciary Studies for years. The Web site Fiduciary 360, or Fi360 (www.FI360.com), promotes a culture of fiduciary responsibility and improves the decision-making processes of investment fiduciaries and other financial service providers. Fi360 also offers two professional designations (AIF and AIFA) along with educational programs and resources for financial practitioners.

The question is, how do firms translate the concepts into their day-to-day operations? With respect to the financial planning process, there are some clear steps that can be built into work-flow task sets. For example, consider the following requirements of a CFP when obtaining information from a client:

1. Identify the relevant information and documents.

2. Communicate reliance on the

completeness and accuracy of the information.

3. If unable to obtain sufficient quantitative information and documentation to form a basis for recommendations, the CFP professional must either:

a. Inform the client of the deficiency and limit the scope of the engagement to those matters for which sufficient information is available (CFP Board of Standards Rule 3.3), or,

b. Terminate the engagement.

Additionally, developing recommendations based on fiduciary standards might include the following:

1. Identify and document alternatives.

2. Evaluate alternatives and ensure they meet the client's goals.

3. Communicate recommendations to the client and describe how they will impact the client's ability to meet goals and priorities.

The final steps for implementation could look like the following:

1. Agree on implementation responsibilities.

2. Select products, documenting product selection basis and criteria.

Each of these steps can be "mapped" to a flowchart and then built into a work-flow process. The visuals developed might also be shared with the client to demonstrate the fiduciary process and the role of the practice in protecting the best interests of the client.

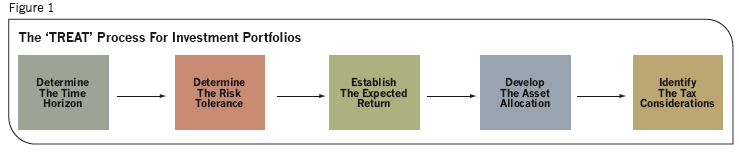

The same technique can be used with investment management under the fiduciary process developed by Fi360. The acronym "TREAT" refers to the five-step fiduciary process for investment portfolio development and selection. TREAT stands for "time horizon, risk tolerance, expected return, asset allocation and tax considerations."

Figure 1 shows how to translate this into a work-flow process using a flowchart.

One of the reasons to illustrate such processes in a flowchart is that it can easily be published and is a powerful learning tool for employees. Some employees learn faster and easier using visuals like these. Whether your firm chooses to use an electronically stored procedures manual or a printed form, using flowcharts with written procedures can increase the efficiency of operations and decrease the time it takes to train employees.

With complicated work flows, it becomes even more important to develop visual aids since it can be difficult to avoid steps being skipped or falling through the cracks without a system to ensure that all steps are followed. Even with such written procedures and work-flow charts, there is no guarantee that steps won't be overlooked unless there is also a system to track each step in a set of work-flow procedures. For this, having a work-flow management system is critical. It may be that your firm already has such a system if you are using client relationship management software that contains this feature. Having the ability to not only automate steps in a fiduciary process but to document the completion of each step and who completes it gives the firm a valuable compliance and employee management resource.

Given the work of the three organizations in the Financial Planning Coalition (the FPA, the CFP Board of Standards and NAPFA), as well as the Committee for the Fiduciary Standard, the SEC and others, to promote and encourage Congress to pass a uniform fiduciary standard, it is incumbent upon financial practitioners to prepare for the eventual passage of a standard. Using documented task and work-flow procedure sets will accomplish this efficiently.

David L. Lawrence, Ph.D. is the Co-Founder and President of Global Practice Network, a technology and consulting firm that provides financial practices, broker-dealers and independent firms with comprehensive, profit-driven efficiency consulting, technology solutions and resources. For details, visit www.globalpracticenetwork.com .