Risk factor #5: The Buffett indicator

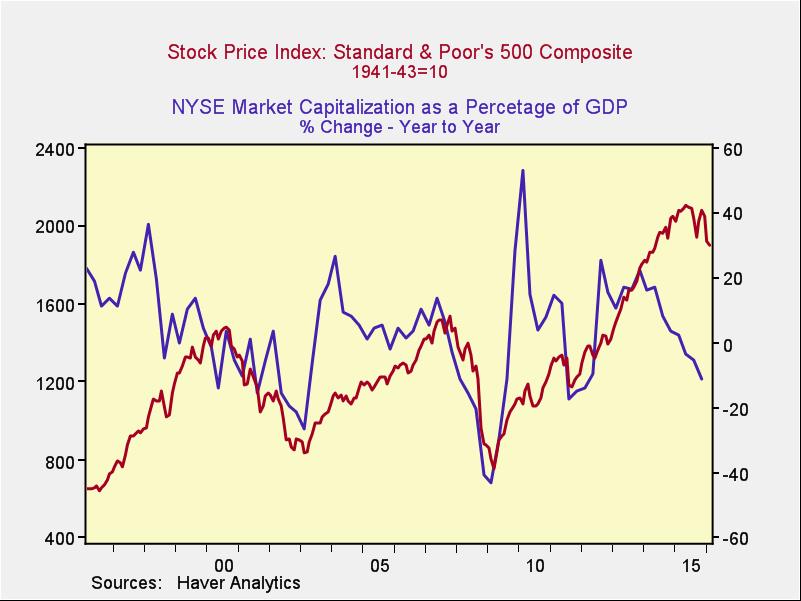

Said to be favored by Warren Buffett, the final indicator is the ratio of the value of all the companies in the market to the national economy as a whole.

On an absolute basis, this indicator is actually somewhat encouraging. Although it remains high, it has pulled back to less extreme levels. On a change-over-time basis, however, downturns in this indicator have typically led market pullbacks—and once again, we see that here.

Amid recovery, keeping an eye on the risks

There’s a big difference, however, between high risk and immediate risk—and it is one that is crucial to investing. Not all of the indicators suggest an immediate problem, and the market recovery may continue, even as the risks remain for the future.

As I said last time, I will continue to think about which factors to highlight here, with an emphasis on signals that may suggest the risk is more immediate and severe. I’d welcome your suggestions!

Brad McMillan is the chief investment officer at Commonwealth Financial Network, the nation’s largest privately held independent broker/dealer-RIA. He is the primary spokesperson for Commonwealth’s investment divisions. This post originally appeared on The Independent Market Observer, a daily blog authored by McMillan.

Despite a substantial recovery in stock prices, risks are clearly still apparent. Technicals are another worrying factor; although improving, the market remains below its long-term (i.e., 400-day) trend line. Per these indicators, risk levels could very well rise.