Toby Dodson waited six months for his bet against a fragile Portuguese bank to pay off.

But before the reckoning, word came down from his hedge fund bosses at Achievement Asset Management in Chicago: get ready to clear out your desk and unwind your trades, we’re shutting down. They’d lost too much on U.S. energy companies and so became one of the 979 firms to announce their closure last year.

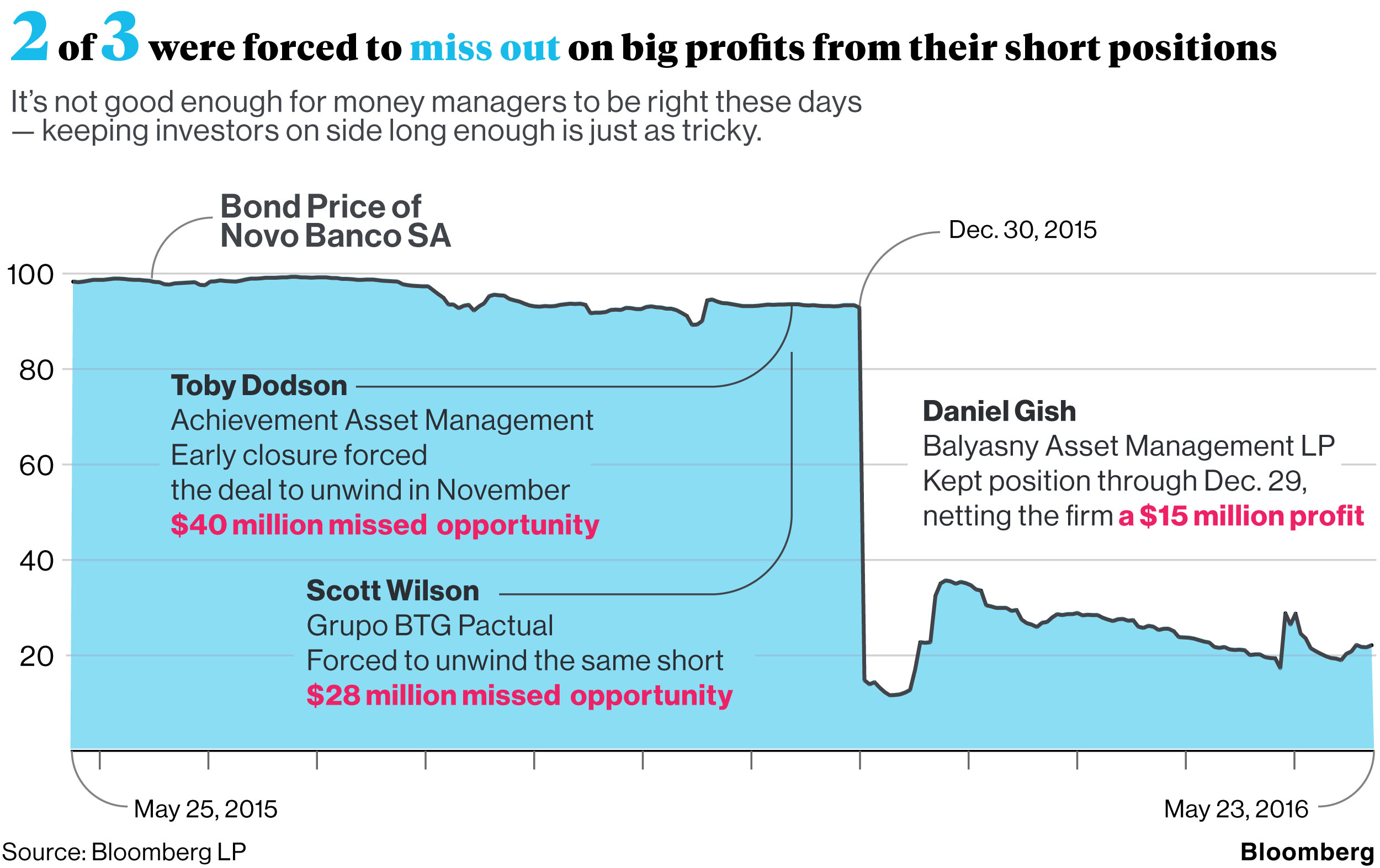

That’s how the 29-year-old Dodson, who specializes in financial companies, and the firm lost out on a $40 million payday, according to people with knowledge of the matter. He learned about his missed windfall from clients who called him on Dec. 30 as the Portuguese notes cratered -- proving he’d bet right.

“My phone had all these missed calls from former colleagues, brokers and sales guys who knew I’d shorted them,” the London-based Dodson said. “The timing was frustrating, but all you can do is smile.” He declined to comment on the size and timing of the trade.

Missing out on a multimillion-dollar win only adds insult to injury for traders caught up in the ongoing hedge fund convulsion. It’s a reminder of how being right is only half of the challenge for those handling other people’s money. Keeping investors onside for long enough to profit from trades that sometimes take months to pay off can be as challenging as being right these days.

Investors put off by disappointing returns and high fees at hedge funds pulled their money out in 2015 at a rate not seen since 2009, according to Hedge Fund Research Inc. Insiders say it’s just getting started.

“There is no doubt that we are in the first innings of a washout,” Dan Loeb wrote last month in a quarterly letter to investors in his New York-based firm Third Point LLC.

Dodson wasn’t alone in missing out on the Portuguese bet. Scott Wilson, 49, a money manager in London for Grupo BTG Pactual’s hedge fund unit, was forced to unwind the same trade.

Like Dodson, who is now raising money for a new fund focusing on distressed debt, Wilson placed bets that would pay out if bonds of Portuguese lender Novo Banco SA fell. The senior securities plunged 80 percent on Dec. 30 after Portugal’s central bank imposed losses on bondholders, a move that blindsided some of the world’s largest money-managers including BlackRock Inc. and Pacific Investment Management Co.

Trade Unwound