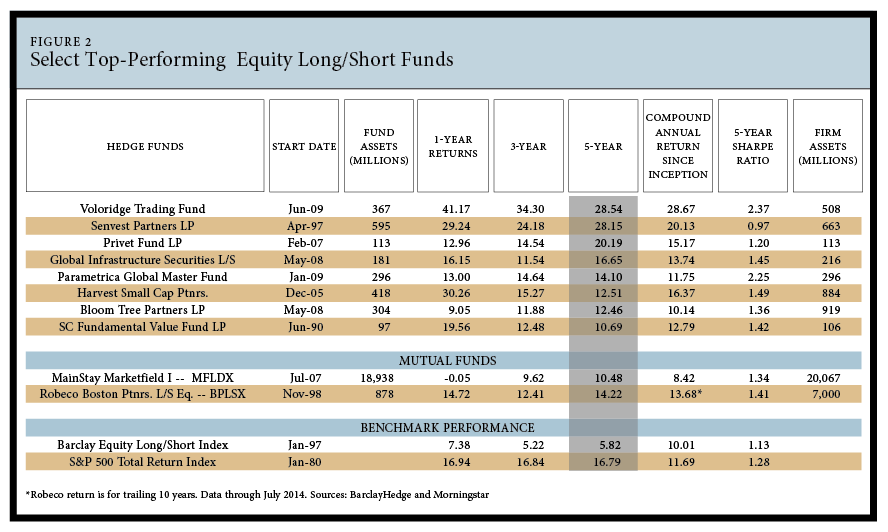

Among the oldest long-short funds still extant is the SC Fundamental Value Fund. Having started in June 1990, Peter Collery’s shop has generated returns of nearly 13% a year—three full percentage points a year better than the S&P 500, with volatility running at less than 7.5% over the past five years.

SC’s list of former associates includes Greenlight Capital’s David Einhorn, Lyrical Asset Management’s Jeff Keswin and SAB Capital’s Scott Bommer.

The fund scours the world for obscure value that the market has missed, not letting foreign language or unusual regulatory environments impede research. In February 2014, more than a third of its long positions were in Asia ex-Japan/China and nearly a quarter was in foreign property companies. Where the majority of investors were pouring into U.S. markets, SC was short one-third domestic shares. “Our shorts are not hedges,” explains co-manager David Hurwitz, “but absolute convictions that a stock is mispriced.”

Among the fund’s more unusual longs is its exposure to regional banks owned by the major French financial Crédit Agricole (CA)—Europe’s second-largest retail bank. Crédit Agricole du Languedoc (CRLA), Crédit Agricole de Normandie-Seine (CCN) and Caisse Regionale de CA Mutuel Alpes Provence (CRAP) all trade independent of CA.

“I would expect the immediate visceral reaction to investing in French banks to be “Are you crazy?” quipped Hurwitz. But given “ludicrously low valuations and an average yield of 6%,” he felt the jurisdictional, regulatory and language challenges of venturing into this underexplored space presented a potential opportunity. After drilling into the structure and financials of these three regionals, SC established positions in fall 2013. A year later, they had rallied about 28%.

Where resource-rich Australia had been booming for years on the back of Chinese demand, SC felt shares of a leading mineral-oriented engineering group, Monadelphous (MND), got way ahead of themselves on soaring revenue and earnings growth since 2001.

Hurwitz saw vulnerability in the firm’s heavy reliance on iron ore and coal industries—key inputs in the production of steel. He felt Chinese steel consumption, which had risen sevenfold between 2000 and 2012, was unsustainable. And the firm’s claim of diversified services wasn’t sufficient to make up for declining steel demand.

With the company having traded at five times book value in late 2012, SC began shorting the shares, establishing an average cost of A$18.37. The stock was trading at A$12.36 in early October.

The Long And Short

November 7, 2014

« Previous Article

| Next Article »

Login in order to post a comment