Negative interest rates are likely to persist as two central banks reiterated their commitment and a third, the Bank of Japan (BOJ), could do the same this week. Sweden’s central bank maintained a -0.5% benchmark short-term interest rate and a -1.25% bank deposit rate but boosted its bond purchase program, and the European Central Bank (ECB) took a market-friendly turn as well by announcing easier than expected qualifying terms for corporate bond purchases.

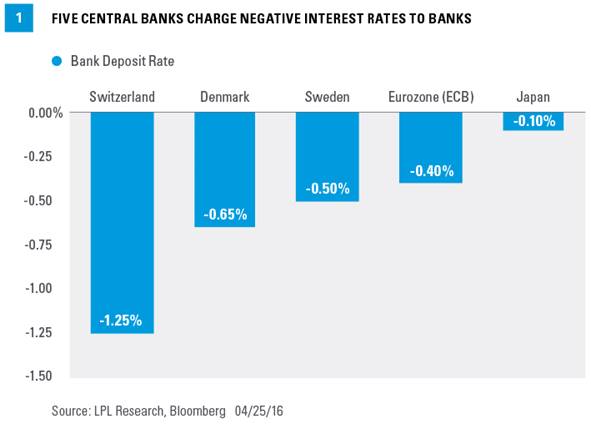

Negative interest rate policies have had profound implications for bond investors thus far, but limited benefits for the economies intended to gain from them. Over the past two-and-a-half years, five countries have initiated the negative rates experiment, with Japan the most recent after cutting rates into negative territory in January 2016 [Figure 1]. By comparison, the Federal Reserve (Fed) pays a +0.5% deposit rate to banks who park excess cash at the Fed.

WHY NEGATIVE RATES?

Increasing bank lending is one of the main goals of charging banks negative interest rates to keep their excess cash parked at a country’s central bank. The negative rate is intended to motivate banks to lend out funds in an effort to boost economic growth. A secondary, but less publicized, motive is to weaken a domestic currency. The ECB cut bank lending rates into negative territory in mid-2014, less than two months after the euro flirted with 1.40 versus the U.S. dollar, at that time a three-year high. A weaker currency can not only boost a country’s exports but may also boost inflation – another goal of central bankers in countries facing deflationary threats.

IS IT WORKING?

Although the jury is still out on the ultimate effectiveness of negative interest rates, early results are questionable. Measured by bank lending to the private sector and inflation, early results are slightly disappointing for the ECB and the BOJ. The ECB’s many policy tools—including bond purchases, targeted lending programs, and negative interest rates—are having a positive impact as Euro Area lending to both individuals and non-financial corporations has improved. Despite the improvement, results are still lackluster overall, with lending to individuals up 2.1% annualized and lending to institutions flat at 0% (i.e., stopped decelerating), both annualized through the end of February 2016. This helps explain why the ECB took bold action in March 2016 by cutting rates further into negative territory and boosting its bond buying program.

Inflation readings also show that negative rates are not having the intended effect. Annualized inflation is still hovering near zero in both Japan and Europe, where it has been since the middle of 2015, suggesting that demand remains weak, a problem that negative rates may not be entirely capable of fixing. Deflation may have been averted but inflation has yet to materialize despite aggressive action from central banks.

When the BOJ ushered in negative interest rates in late January 2016, market reaction was decidedly negative. A loss of confidence in central banks was partly to blame for market volatility early in 2016. Rate cuts further into negative territory could erode investor confidence without some signs current policy is working.

OTHER CONSEQUENCES

Instituting negative interest rates policy has had knock-on effects for investors. Keep in mind that the vast majority of banks (in areas where negative deposit rates exist) do not impose negative interest rates on consumer deposits. In some cases, banks look to recoup negative rates by charging higher fees elsewhere or passing them along to institutional clients. Still, the policies have impacted financial markets in a few ways, including: