When the University of Connecticut sought help managing a slice of its small endowment, TIAA found it was competing with 26 other money managers. So the financial services giant sent its biggest gun: President Roger Ferguson, a former vice chairman of the Federal Reserve, to pitch in person.

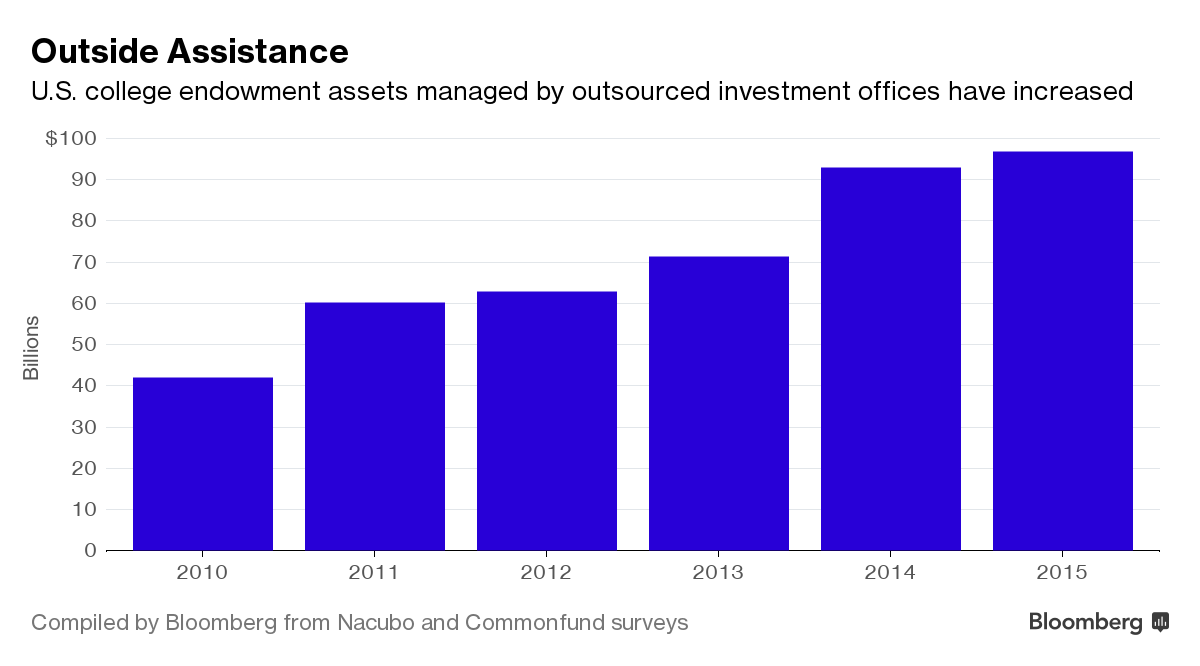

Helping endowments manage their investments has grown into an almost $100 billion business that’s attracted stiff competition from banks, consultants and boutiques. Almost 80 investment firms have sprung up to target foundations, family offices and colleges, up from just a few a decade ago, according to Charles Skorina, an executive recruiter in San Francisco who writes a widely followed newsletter about the endowment business.

Endowments represent just a small corner of the roughly $53 trillion U.S. asset-management business, but they offer a rare area of growth to an industry struggling to compete with index- and computer-driven strategies that are slashing fees. Schools also offer access to wealthy benefactors and trustees who are potential clients. Outsourcers typically take over day-to-day management of the endowments, replacing internal staff as well as outside consultants.

“It’s just such an incredibly crowded space,” said Kevin Quirk, a principal at Casey Quirk by Deloitte, a management consultant to fund companies. “By definition not everyone is going to stay in and win and get the scale.”

Building Business

Kenyon College hired CornerStone Partners of Charlottesville, Virginia, in October to oversee $218 million after the school’s chief investment officer retired. Oregon State University asked 15 firms to bid for its $505 million fund this year, selecting a division of New York-based Perella Weinberg Partners to replace consultant Mercer, a unit of Marsh & McLennan Cos.

The competition has gotten so fierce that some endowments are switching firms. The University of the South this year asked six companies to bid for control of its $336 million endowment, replacing JPMorgan Chase & Co., which got the business in 2010. The school in Sewanee, Tennessee, picked Edgehill Endowment Partners, co-founded by a former investing chief from Carnegie Corp. who trained under Yale University’s David Swensen.

“I think we’re going to be very well served,” said John McCardell, president of the liberal arts school. “Just look at the track record of the principals.”

The targets for outsourcing firms are often endowments controlled by volunteer investment committees, or institutions struggling to manage portfolios increasingly loaded with alternative assets such as hedge funds and private equity.

Outsourcing was initially embraced by smaller institutions, but has expanded as markets have grown more volatile. George Washington University opted to shutter its investment office and part ways with its CIO in 2014, hiring Strategic Investment Group of Arlington, Virginia, to oversee most of its $1.6 billion fund.