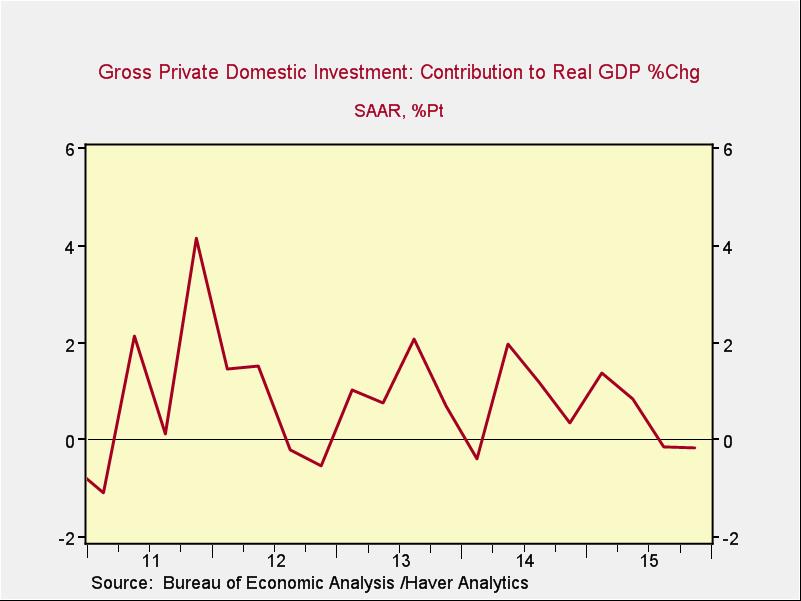

Business and government spending. We can do similar analyses here. For business spending, per the chart below, we can see that growth dropped off over the past several quarters.

That's the good news. Government, on the other hand, has moved from being a drag on growth to a neutral factor, and that seems unlikely to change.

A more promising growth outlook

Overall, although current growth trends are disappointing, they were moving in the right direction until the recent slowdown—and they are likely to continue that movement in the near future.

Here, the reasons are that the drop in the oil price hurt capital investment in the energy sector, and the strong dollar also hurt the manufacturing sector. With the average contribution to GDP growth around 1 percent or so during this recovery, even returning to that level would be meaningful. And, with the dollar trending down and oil up, that looks very likely to happen, as the decline has already stabilized and there are signs in business surveys of a recovery.

Overall, and unlike the demographic analysis, the news based on these components of economic growth is more cheerful. Personal services consumption is likely to add meaningfully more to growth once the slowdown passes, which it seems to be doing. Ditto for business investment.

Brad McMillan is the chief investment officer at Commonwealth Financial Network, the nation’s largest privately held independent broker/dealer-RIA. He is the primary spokesperson for Commonwealth’s investment divisions. This post originally appeared on The Independent Market Observer, a daily blog authored by McMillan.