Other older women end up stuck working far longer than they’d like, financially unable to retire.

“Americans now work more hours per day, days per week, weeks per year, and years per lifetime than almost all rich countries on the planet,” said New School economics professor Teresa Ghilarducci in an e-mail. Working even longer, she said, is a “lazy answer” to the American “retirement income security crisis."

“Older Americans are nearing retirement with increasingly concerning levels of debt,” wrote Annamaria Lusardi of George Washington University and Olivia Mitchell of the University of Pennsylvania’s Wharton School in a forthcoming paper. Older women today, they found, are more indebted and "financially fragile" than older women were in the past.

Borrowers from 50 to 80 saw debt loads rise about 60 percent from 2003 to 2015, even as younger borrowers' debt loads fell somewhat. Two-thirds of people 65 to 74 have debt, and people 65 and older are the fastest-growing group of bankruptcy filers. And women with debt—particularly mortgage debt—are more likely to end up working at age 65, Lusardi and Mitchell found.

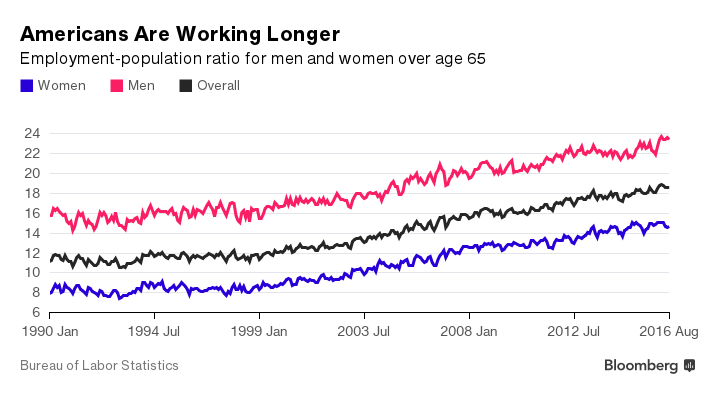

Expect more and more older women to keep working, whether they want to or not. Younger women’s participation in the labor force has actually fallen in recent years, while college graduation rates—the other important factor spurring women to work longer—continue to rise. But after analyzing the most recent data, Goldin and Katz found that neither factor fully explained the rising number of women working past 65.

"Today's younger women will likely retire later than one would have predicted based on their educational attainment and lifecycle participation rates," Goldin and Katz wrote. Particularly among women 67 and younger, they wrote, “something else is keeping them in the labor force at older ages.”

At age 70, Carol Gardner, a former advertising art director, now works “more than full-time” on a business she started 18 years ago, after a divorce left her depressed and in debt. Her business, Zelda Wisdom, started out selling greeting cards featuring Gardner’s bulldog, Zelda, and expanded into other merchandising, as well as an animated film series.

“I think back to my mother and grandmother,” Gardner said in a phone interview from her home in Portland. “When they said they were 70, I thought, ‘My God, their lives are over.’”

Gardner hardly feels the same now—so why retire?

In a perfectly rational world, women might keep working a little longer to maximize their retirement benefits, but that’s not happening—at least not among married straight women, according to new research by Harvard University health policy professor Nicole Maestas. Women are typically younger than their husbands, but they tend to retire at about the same time, often in their “peak earnings years,” Maestas wrote. (Their husbands tend to be already past their peak years.) Those early-retiring women not only miss out on the chance to bank assets and maximize Social Security benefits, they also may be too young to qualify for Medicare.

Why More Women Than Ever Are Putting Off Retirement

September 14, 2016

« Previous Article

| Next Article »

Login in order to post a comment