The municipal bond market has so far taken Puerto Rico’s downgrade in stride, but lingering risks remain due to individual investors’ bias to sell and uncertainty over upcoming Puerto Rico borrowing.

· No forced liquidations. Fears that investors may be forced to sell the bonds upon the loss of investment-grade ratings never materialized, and it is unlikely to occur. Most institutional investors have rules in place that allow them to hold high-yield municipal bonds. Although institutional accounts are unable to purchase additional Puerto Rico bonds, a negative for future demand, a wave of institutional selling is unlikely to take place.

· Already depressed prices. Puerto Rico municipal bonds were already priced to reflect a potential downgrade. Puerto Rican municipal bond yields averaged 1.0–1.5 percent more than the average yield of high-yield municipal bonds, as measured by the Barclays High-Yield Municipal Bond Index. Much of the price adjustment came during a difficult 2013 in preparation for such an event.

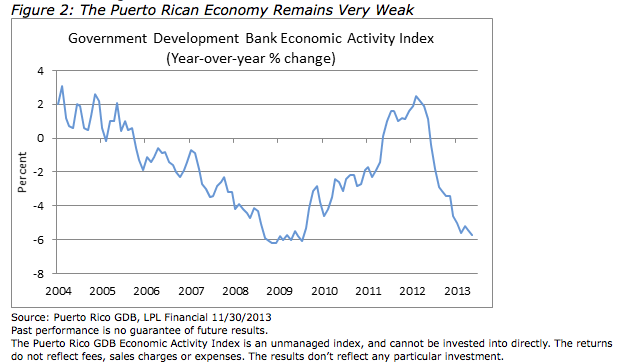

Figure 2: The Puerto Rican Economy Remains Very Weak Puerto Rico is not representative of the broader municipal bond market, as both state and local governments continue to benefit from improving revenues.

Puerto Rico is not representative of the broader municipal bond market, as both state and local governments continue to benefit from improving revenues.

The Caribbean island received cold news last week when both S&P and Moody’s downgraded Puerto Rico to high-yield or “junk” territory. S&P, the last to place Puerto Rico on watch for downgrade, was the first to act Tuesday, February 4, 2014, and was followed by Moody’s three days later. The threat of a downgrade loomed for much of 2013 driving poor performance as Puerto Rico general obligation (GO) bonds clung to the lowest investment-grade rating from both Moody’s and S&P prior to last week’s announcement.

S&P cited rising near-term risks over Puerto Rico’s ability to adequately service all debt obligations while Moody’s additionally mentioned poor economic conditions. Aside from having sufficient cash, or liquidity, to meet its debt obligations, Puerto Rico is suffering from a very weak economy, a woefully underfunded pension plan and a large debt burden -- all of which have led to the recent downgrade. Both ratings agencies acknowledged steps taken by the new government to address its creditworthiness--including pension reform initiatives, reduced government spending and tax changes to boost revenues -- but the negatives outweighed the positives. The municipal bond market has so far taken Puerto Rico’s downgrade in stride as reflected by:

· Municipal outperformance. The broad municipal bond market outperformed the Treasury market over the final three days of last week after S&P’s downgrade was announced. The downgrade also did not hamper strong investor demand for the state of Illinois’ debt sale, which was five times oversubscribed and suggests the market is treating Puerto Rico as an isolated event.

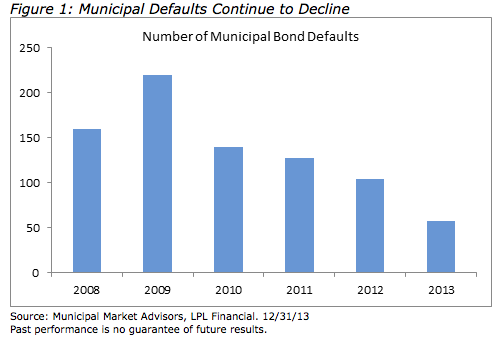

Puerto Rico is not representative of the broader municipal bond market, as both state and local governments continue to benefit from improving revenues. Revenue improvements resulting from the economic expansion have in turn led to better credit quality metrics and are the primary reason troubled municipal issuers are the exception and not the norm. Although high-profile distressed municipal bond issuers like Puerto Rico and Detroit are likely to garner widespread attention, the number of municipal defaults declined for the fourth consecutive year in 2013 (Figure 1).

Figure 1: Municipal Defaults Continue to Decline

Lingering Risks

The downgrade had a negative impact on many individual investors, and this may create lingering risks. From Tuesday afternoon, February 4, 2014, when S&P downgraded Puerto Rico, to Monday, February 10, 2014, roughly 65% of investor trades in Puerto Rico’s most liquid GO bonds were “sells,” according to trading data from the Municipal Securities Rulemaking Board (MSRB). Renewed selling by individual investors, an important demand component, may reverse a nascent trend of three weeks of positive mutual fund inflows following 33 weeks of outflows. Mutual fund flows alone may not move the market but can create a headwind going into a traditionally difficult March to early April seasonal period in the municipal bond market. An escalation of selling may pressure the broader municipal bond market. In the meantime, limited new issuance and taxable bond market strength are helping the municipal bond market.

Next Steps

Puerto Rico is seeking to raise additional cash, in part to help service upcoming debt commitments. Additional liquidity commitments triggered by the downgrades are likely to be met with cash on hand, but some form of borrowing, either through a new debt sale or directly from a bank or other entity, is needed. Puerto Rico is likely to obtain that funding, and if done successfully and at a reasonable cost, ratings pressure may be alleviated. Focus will then return to the economy for signs of improvement, which have yet to materialize (Figure 2). The Puerto Rican Government Development Bank’s Economic Activity Index is very closely correlated with economic growth and indicates no reversal of the current recession.

On a positive note, the Puerto Rican Treasury announced higher-than-expected revenues for December 2013, and in fiscal year 2014, which began July 2013, revenues are $93 million ahead of budget forecasts. Additionally, the government is expected to announce a balanced budget proposal for the coming fiscal year, ahead of earlier projections. The positives are encouraging but outweighed in the near term by the borrowing need. The improving revenues are a step in the right direction toward ultimately stabilizing credit metrics.

Puerto Rico municipal bonds have largely “priced in” a downgrade, but lingering risks suggest that they remain a higher risk investment and suitable only for investors willing to take such risks. Unlike U.S. states and cities, Puerto Rico is unable to file Chapter 9 bankruptcy, and if conditions deteriorate, in a worst-case scenario the commonwealth may be forced to undergo a debt restructuring where investors may receive less than their original principal value in order to reduce the debt burden. Upcoming borrowing, and its success, will determine—along with the economy and incoming revenue—the next direction for Puerto Rican bond prices.

Anthony Valeri has been with LPL Financial since June 1993. As Senior Vice President and Market Strategist, Valeri is a member of the research department’s tactical asset allocation committee and is responsible for developing and articulating fixed income and general market strategy.

Winter In Puerto Rico

February 13, 2014

« Previous Article

| Next Article »

Login in order to post a comment