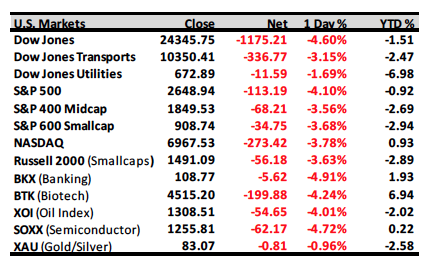

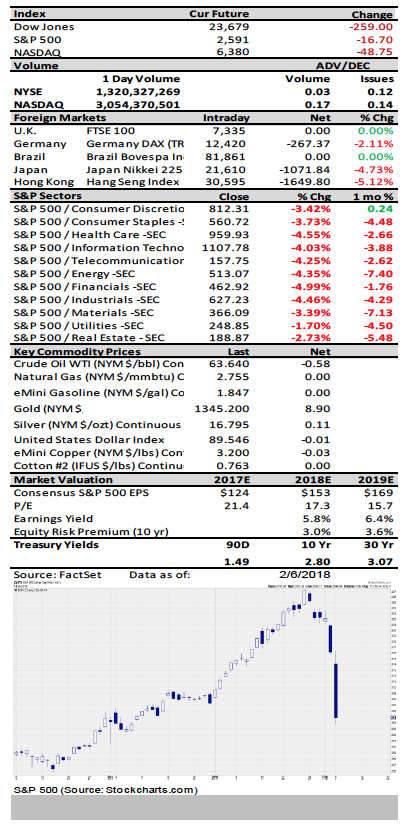

And the headlines read: "Crash Risk Is Soaring: This Is Where They Lost Their Minds," "I expect the S&P 500 to lose approximately two-thirds of its value over the completion of this cycle," "Is the Longest Bull Market Run Nearly Over?" "The Investment With the Most Compelling Case Right Now: Cash." These are unbelievable headlines with the S&P 500 (SPX/2648.94) only ~9 percent off of its intraday high of ~2,873 into yesterday's intraday low! Moreover, we have been telling participants for weeks that early/mid-February was a window of downside vulnerability (to reiterate, our models have a plus or minus three-session timeframe of the exact date). So, the recent selling should have come as no surprise to readers of these missives. As our friend Tony Dwyer, arguably the best thinking strategist on Wall Street, writes:

Corrections only are considered "natural, normal, and healthy" until they actually happen. The next few months that may contain multiple "whooshes and ramps" will be no different. Each will feel like the fundamental backdrop is at risk, only to realize that the tailwinds still exist.

Tony then goes on to explain said tailwinds are still in force and they are solid global growth, accelerating domestic activity, capital spending improvement, incomes that are jumping, and the list goes on. And, then there was this from our pal Leon Tuey:

Currently, investors are gripped by fear, but the market is not yet oversold, but that condition can be reached very quickly. Since the secular trend remains powerfully bullish, investors have been advised to emphasize stock selection and not to be mesmerized by the ups and downs of the S&P. (It doesn't tell investors when to buy or when to sell and what to buy and what to sell.) Therefore, when the market finally gets oversold, many stocks will have taken flight.

‘Fear?’

February 6, 2018

« Previous Article

| Next Article »

Login in order to post a comment