Incorporating private equity into an individual investor’s portfolio can provide benefits. But many investors don’t know where to start. A limited understanding of how private equity works, or a lack of awareness to the different types of funds can create obstacles in adding exposure to the asset class.

Secondary funds, or funds that acquire pre-existing investments of private equity portfolios, are an appealing option. Private equity secondaries may offer investors a particularly attractive entry point, or discount, relative to primary private equity funds because of their unique risk and return profile. In addition, secondaries are generally well diversified and typically provide a faster return of capital, relative to primary private equity funds. For investors that are newer to private equity, these factors can be appealing.

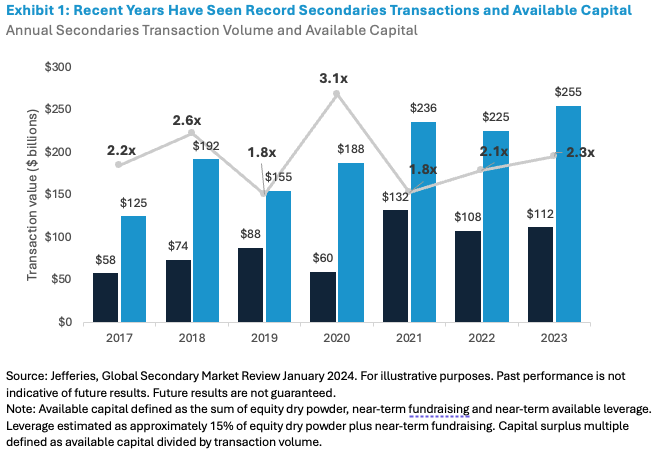

In recent years, the secondaries market has grown and matured and is now considered a core aspect in how private equity markets function. The last three years alone have seen record secondary transaction volumes, with each year eclipsing $100 billion. And all signs point to more activity ahead. Dedicated available capital has doubled over the last six years to over $250 billion in 2023, or 2.3x transaction volume, pointing to sufficient amounts of dry powder. The size and activity in the secondaries market is leading many major asset managers to expand their secondaries business with strategies to grow their presence in the private wealth channel, highlighting a broader appeal of the asset class.

What to keep In mind when considering secondaries

For investors that are new to private markets, secondary funds can be a path to gain access to private equity. Both primary and secondary private equity funds have a role in the alternative investment universe, but they have differences in areas such as diversification, timeline for capital returns and attractive entry points, or discounts.

Diversification

Secondaries are generally more diversified than primary private equity funds (such as growth equity or buyout funds) because they assume pre-existing commitments in multiple funds. As such, secondaries may offer significant diversification across managers, industries, geographies, strategies, and vintage years. This diversified approach has the benefit of offering private equity exposure with less risk compared to an investment in a single primary private equity fund.

Shorter Duration And Faster Return Of Capital (Mitigated J-Curve)

Managers of primary private equity funds can take three to five years to source and complete deals, which means it can take several years before investors start receiving distributions. Secondary funds, on the other hand, invest faster and invest in underlying funds that are generally in their fifth year of life, providing faster capital deployment.

This mitigates the private equity J-curve, in which primary private equity funds typically have negative returns in the first few years — as investors have to pay management fees and other investment costs from the outset — and only generate positive returns as the underlying investments mature. It is at this juncture that funds typically start to generate returns that may materially outweigh the accompanying fees and expenses.

Discounted Access To Private Equity Funds

So-called discounts are also a significant factor and can provide a margin of comfort for investors in secondary funds. The ability for initial investors in primary private equity funds to exit funds or individual investments early has historically come at a price to sellers. Meaning, secondary buyers, or fund managers, can buy these assets at a discount. In essence, investors in secondary funds can receive a boost from the mark-up of discounted purchases, which can act as an enhancement to overall return.

Pricing varies and discounts may not always hold true. But the trendline has been in investors’ favor. Since 2017, sellers have sold assets at an average of 88% of their net asset value (NAV) (Source: Jefferies, “Global Secondary Market Review,” January 2024). Even when markets are robust with healthy deal activity, discounts are common. In 2021, for example, average secondary market pricing was 92% of NAV (Source: Jefferies, “Global Secondary Market Review,” January 2024).

Other Considerations

Investors should also be aware of other considerations. Some secondary funds may focus on acquiring assets at a later stage, which means they may not capture the initial value creation initiatives of investments by the primary private equity fund. While others may focus earlier on in the life-cycle to gain exposure to more growth uplift. However, both strategies typically have exposure to value creation uplift—it just might be captured at a different stage.

When evaluating secondary funds, deal sourcing is important and managers that have access to a broad platform (e.g., primaries, co-investment platforms) can often benefit. As with any private equity investment, manager selection is critical to realize the benefits of these strategies.

For investors that are ready to access private equity, secondary funds can be an appealing pathway. Both primary and secondary funds have a role in the private equity universe and recognizing the unique attributes of both will help in establishing baseline risk/return expectations to better incorporate private equity exposure within a portfolio.

Kunal Shah is head of private asset research and model portfolios at iCapital. Florence Leung is senior vice president on the research and education team at iCapital.