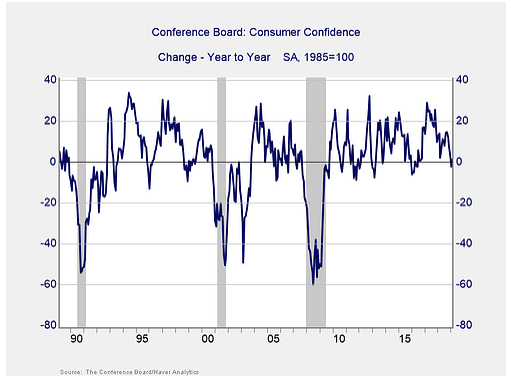

The absolute level of confidence is important, but the annual change is a better indicator of risk. While the level can remain high, when confidence drops significantly (i.e., by 20 points or more) over a year, we have historically seen a recession and a stock market pullback shortly thereafter. We are now just around even on a year-to-year basis, which means another pullback like we saw at the end of last year could take us into the danger zone.

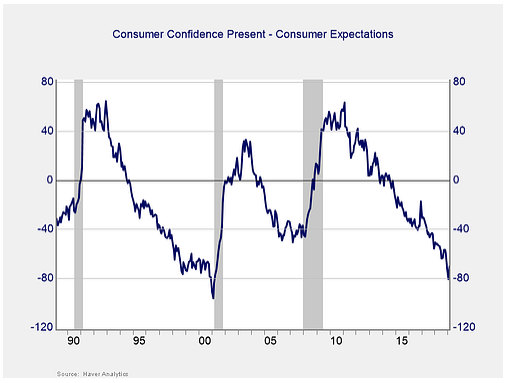

The probability of that decline is also higher than it might seem. One way to measure that is to look at the gap between how confident people are in the present and how confident they are about the future. When that gap gets very negative, it is a sign of risk (as we see in the chart above). We are now definitely in that risk zone, as future expectations are significantly worse than present confidence. People feel good, but they don’t expect that sentiment to continue—and that can be a catalyst for sudden drops in confidence.

Focus On The Similarities

When we look at the past 10 years, then, let’s focus not so much on the differences between then and now. Instead, let’s focus on the similarities between now and the conditions that led to 10 years ago. Conditions are still good, and we should be aware of that. But we should also remember that those conditions can lead to much worse ones—like we saw 10 years ago.

Brad McMillan is the chief investment officer at Commonwealth Financial Network.

10 Years After The Market Hit Bottom, Where Are We Now?

March 7, 2019

« Previous Article

| Next Article »

Login in order to post a comment