Remember the movie Logan’s Run, a cheap sci-fi film from the 1970s? It’s not as memorable as Star Wars, save for one horrific, indelible image—a world where the young people rule and kill anyone over 30 by blowing them up in a giant space arcade. A horrific metaphor for inter-generational conflict.

Indelible because one generation always does seem to be blowing up its predecessors, at least figuratively. The ways baby boomers learned to negotiate the world is quite different from the ways the Gen Xers did, and the latter follow different folkways than millennials.

In a country that registered the first famous patents for telephones, people under 30 now often don’t even bother to answer them. They prefer to speak epigrammatically to one another on Twitter. Personal style is key.

That’s important for advisors, because the disruption of technology isn’t simply manifest in the “robo-advisors” who might do the work of asset allocation for them. It cuts to the very heart of the way young people might do business in this field and the lifestyles they want to pursue. Why pay for overhead in the form of an assistant when an app will set up your meetings for you or do your scanning? Why do a blanket marketing seminar when a web page—with you as the star attraction, not your corporation—lets clients know who you are and that your money problems, maybe even your mistakes, are theirs?

You also discover, talking to younger advisors, that many of them came into the world pure. Children of the holistic planning age, many don’t know what it’s like to cut their teeth in brokerages, insurance companies or CPA firms. Nor do they feel as beholden to old compliance regimes. Their audience hasn’t made its money yet. They are reaching for the emerging affluent (people like themselves). They know this audience will become theirs one way or another, and in many ways they have gone out on their own flouting the compliance orthodoxy of the past, stripping themselves of licenses that keep them from talking directly to their information-hungry audiences.

For the second year, Financial Advisor has found 10 new young advisors, and though their themes are similar, the robo onslaught has raised new issues. The question of what constitutes a firm’s value has changed as millennial advisors sell themselves, bringing technology along as friend, not foe. This is one way of trying to help less moneyed, savvy people in their own cohort navigate the strange world of finance and budgeting—a world that looks strange and hostile to many of the young.

Rianka Dorsainvil

Rianka Dorsainvil

Founder and President | YGC | Lanham, MD

Rianka Dorsainvil took an interest in personal finance while watching her aging grandmother, a nurse at a nursing home, become ill and not be able to retire. “I was naïve. I thought when you get old you retire, there’s a check that comes in the mail every month and everything is well,” Dorsainvil says.

She took a finance class at Virginia Tech and saw the world with new eyes: how people who should have been investing were buying insurance. How unsavory credit card company reps would pop up on her campus offering free meals with every new account (2009’s Credit CARD Act stopped such practices).

“I said to myself, my generation is not going to be the generation of my Nana.” The first generation college graduate in her family, she started at a Bethesda, Md., fee-only firm working with high-net-worth clients, outearning her mother by age 27, but most of her peers couldn’t afford her services.

She envisioned her own firm serving what she calls ‘Henrys’: high earners, not rich yet. “Millennials, Gen Xers are at a very impressionable stage where talking to someone like myself or another CFP ... it can change the financial trajectory of their life.” She walked away from a nice salary, and founded Your Greatest Contribution at the end of 2015.

Her peers need to be put in the right hands, she says. She recently came across a 30-year-old paying $600 a month for life insurance. “It was an ‘investment strategy’ somebody told her about. That’s a pretty expensive investment strategy.”

Dorsainvil thinks culture might play a role. “People of color and minorities, there [are not a lot of CFPs]. But there are a lot of minority insurance agents,” she says. (Limra says in its 2015 “Insurance Barometer” study that 72% of African-American adults say they own life insurance, while only 56% of white American adults do). “If you’ve been drinking the Kool-Aid, that’s what you’re going to tell your community. Now I’m here to tell the community, if you are looking for an investment strategy, invest in the market.”

J. Brent Beene

J. Brent Beene

Managing Partner | RegentAtlantic Capital | Morristown, NJ

Brent Beene, now a partner at RegentAtlantic, hails from a very small town in the Texas Panhandle and he had it all mapped out when he was in college: dentistry. He took financial classes just to figure out how to run a dentist practice. He started to fall for financial planning just as he realized—people don’t like going to the dentist. It was also in college that his father declared bankruptcy after making some troubled investments. Beene’s great-grandfather had been a pioneer in West Texas and owned valuable land, but that—

“It all just disintegrated,” Beene said.

Going for his MBA at Texas Tech, he discovered financial planning as a specialty. Beene is one of a first generation of planners, in a way—the generation that came up not knowing what it was like to sell things at brokerages or insurance companies. He relocated to Little Silver, N.J., to work at a firm called Wealth Builders and holistic planning was all he ever really had to know.

He says he got his first aha! moment while working with a retired couple from Brooklyn—an older couple, a former Verizon employee and her husband, a retired cop. A series of smart investments in real estate in Brooklyn, the Hamptons and Pennsylvania had left them worth $5 million or $6 million. But they had got that way by never spending a penny. They were so parsimonious they wanted to take a loan to pay a tax liability for shifting assets rather than touch income.

At the same time, he met two brothers, grandchildren of a property and casualty insurance baron who were making millions a year in their early 40s, but still having to borrow from their 401(k)s because they were spending so much money. Two sets of clients. Two polar opposites. “They both need my help.”

Beene’s quick rise put him in a senior advisor position by age 31 in 2008 at the firm, and he became a partner in 2011. He’s now a thought leader, too, working on white papers on topics such as New Jersey’s onerous tax regime on businesses.

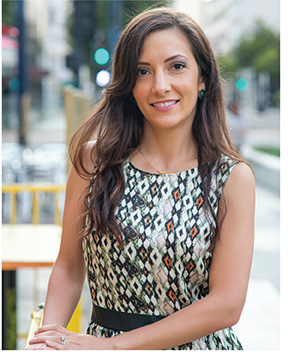

Brittney Castro

Brittney Castro

Founder and CEO | Financially Wise Women | Los Angeles

Southern California native Brittney Castro, now in her 10th year of advising individuals after leaving college, describes her parents as the millionaires next door—on one police officer’s salary, they budgeted, managed their money, ended up with real estate properties while putting three kids through college. “I don’t know how they did it,” she says. “It was really the power of living within your means and saving. Those principles shaped how I am with money today.”

She started her career at Ameriprise and was happy for a while, she says, looking to be a franchisee, but she says the company culture changed after the financial crisis; it made franchises harder and started to reward production more. It was too stressful for Castro. “I [was] successful in terms of production and money, but I didn’t feel like I was living successfully.”

Castro left in 2010 and went to LPL for a while and started working with women, “niching herself.” “That’s when I started studying online marketing and using blogs and e-mails to market instead of going the traditional networking route.” She created “Financially Wise Women” while still at LPL and used her blog to talk to women directly about money in a casual way, to focus on “the individual as a brand more than the company.”

The frugality she learned from her parents shaped her next steps: She lived on savings and took out a personal loan and even robbed her retirement account to get a job with freedom and flexibility (“It’s hard; I’m a financial planner. Most of the time we’re telling our clients don’t do these things. But I was young and I believed in myself … and looking back I’m grateful.”) Her ideal client was an entrepreneurial female in her 30s and 40s. And she says that’s exactly the kind of client who has come through the door. She has done plans for some 120 clients in three years, half of whom have stayed with her, and she’s now moving to a monthly retainer model: $2,500 for a single plan, plus $150 a month on retainer.

Michael Kitces

Michael Kitces

Partner, Director of Wealth Management | Pinnacle Advisory Group | Columbia, MD

Hard to believe that Michael Kitces, something of a guru on subjects as wide-ranging as Roth 401(k)s, practice management and tax issues, didn’t know what he wanted to do after college in 2000. He’d done psychology, pre-med and theater, choosing none. After school, he fell into the slipstream of insurance selling almost by happenstance when an agent corralled him during a family meeting. Kitces was a lousy salesman, he says of himself. He didn’t even know where you found clients.

Contrast that with the man who works conference rooms almost like a professor, playing to packed rooms on subjects as heady as human capital and the nuances of Roth 401(k)s. He also runs countless small businesses such as his blog and newsletter, was the co-founder NexGen and is so ubiquitous that he shares his sleep counter online just to prove he’s getting some.

He has also been lucky enough at various companies to define his own job as a kind of thinker, student and autodidact (after finding firms that were a better fit than insurers, he started to get his soup of credentials, including the CFP and a master’s degree, and he quickly outgrew his jobs). He arrived at Pinnacle in 2002, right before its huge growth, as director of financial planning, overseeing himself, writing 80 to 120 plans a year. Even after he’d broken six figures there, he was still living with roommates and splitting rent three ways. That allowed him to twice risk leaving his regular job to go and develop the newsletters and social media presence for which he’s best known. He runs the blog “Nerd’s Eye View” and commands $6,000 to $10,000 speaking fees.

That freedom to question and ponder the loftiest of questions (he recently wrote an article for Financial Advisor about a person’s job being considered part of his or her asset allocation) means he is now bringing clients into Pinnacle, where he’s been a partner since 2012. At last, he says, he’s developing business. Only now the clients come to him.

Eric Roberge

Eric Roberge

Founder | Beyond Your Hammock | Boston, MA

Boston-area advisor Eric Roberge at one time wanted the tony finance job, the prestige name and the money—and he got them, with the names JP Morgan and State Street Bank splashed on his resume. But twice in his career he left the safety of those good jobs to seek out something that would affect people more.

He left for the independent planner channel in 2007, not knowing the distinctions between planners, and found himself at a small firm hitting up teachers in middle school cafeterias during lunchtime to sell them 403(b) plans. “I would sit at a table and nobody would sit next to me.”

He also had to move back in with his parents at age 27 for two years. He fell in with a firm affiliated with an independent broker-dealer. There he got his first experience with comprehensive planning for clients with up to $3 million. But he wanted to work with younger people, and was told everywhere it wouldn’t work because the business model was set up for the rich.

He left again and launched his own firm while waiting tables at a seafood restaurant for 10 months in 2013, being a planner Monday through Wednesday. “That was interesting. What am I doing right now? Am I talking to you about your investments or how your steak is cooked?”

But that helped him launch a subscription based-business. After all, that’s the way people in his world (and he) were living their lives. For them, financial management is less about asset allocation and more about the monthly management of cash flow, and his subscription model played into that, he says. The articles he penned for financial sites helped bring people in.

His profile, referrals, clients and revenue grew apace—suddenly others wanted to know what he was doing. A big win for him came when he published an article for Money magazine, questioning the use of 401(k) plans, that drove 1,000 people to his website, he says. He had some 40 clients in 2015, and now has about $3 million in assets under management.

Leah Warren

Leah Warren

Senior Client Advisor | Ballentine Partners | Waltham, MA

Before Leah Warren became a senior client advisor at Ballentine Partners, helping high-net-worth clients work on their financial picture, she was helping couples of far more modest means develop talking points about their money values at a small start-up shop in Boston. She had always thought psychology would be her field at Simmons College (her mom was a therapist), but she fell in love with economics after taking classes to understand the financial crisis better (it was happening while she was still a junior). “I was watching with fascination as everything was tumbling down and trying to figure it out.”

While still in college, she was interning at a one-person shop called Lantern Financial helping couples get past their money troubles by getting down to their core values. The program she developed “was called ‘Harmoney,’ spelled with an ‘E’ because we thought we were really cute.” It was a curriculum to help couples who were getting married or who were recently married talk about what money is for and how to evaluate difficult trade-offs when you have different desires. First as an intern, then as vice president, she would often find herself facing spouses who couldn’t agree on, say, saving for a house or a vacation. She would help them locate what the underlying value was. The answer was usually about love for the children.

She took that discipline to a much higher level at Ballentine, where she says the principles haven’t changed, just the number of zeroes. One of the activities she uses with clients is a deck of cards, each with a picture. The clients pick three after being asked the question, “What’s important to you?” The cards might feature a kite, a cross, an older woman on them. “What comes out of this discussion is a shared theme.” Still under 30, Warren has been working with teams whose clients average $55 million in assets, and she recently spent three months in Palm Beach, Fla., helping Ballentine integrate a new office there.

Joe Pitzl

Joe Pitzl

Partner | Pitzl Financial | Arden Hills, MN

At his old firm, Joe Pitzl once sat listening to a much older client talk about his 20 years of success with the firm, which had grown alongside him. Pitzl realized he was never going to have stories like that unless he started working with people his own age. What’s worse, he realized that he had 30 years to go on his career, and those older clients wouldn’t be around that long.

His older brother John, a CPA, pushed Joe to join forces with him, and at first, Joe was skeptical. Their personalities were somewhat different (John was more charismatic, Joe was more mild-mannered) and Joe wasn’t sure he was ready to take on his own business yet. But two years ago, he says, the time seemed to be right. So he launched Pitzl Financial, in Minneapolis, severing ties with a former partner, and partnered with his brothers’ CPA firm.

Pitzl wants to cultivate the emerging affluent, as he calls them, and says the personal relationships he has with these clients is the good stuff, more than the numbers—and that it’s the “messy” things that actually make room for a good planner to emerge, with a value robo-advisors don’t have. The hard math, for instance, means telling clients to squirrel more money away and let interest compound. But he says he’s found many younger emerging affluent clients squirrel away too much, in qualified vehicles, and then leave themselves cash-strapped when life actually comes calling. Maybe it’s a house they wanted to buy, or maybe it’s something that becomes of paramount importance like an expensive in vitro fertilization.

“In large firms they are extremely good at what they do, but work can become rigid and process-driven and there is not a whole lot of room to adapt and create,” he says.

Joshua Brown

Joshua Brown

CEO | Ritholtz Wealth Management | New York, NY

Josh Brown, now a ubiquitous presence on financial TV, was not interested in finance in college. He wanted to be an animator at Disney, but, he says, “had very little technical skill.” Looking for purpose, he found himself among a lot of ambitious young peers on Long Island going the brokerage route. “In the late 1990s, there was so much money being made and so much excitement nationally around the stock market. It had really become America’s pastime.”

He worked, he says now, at mediocre firms without intellectual stimulation. He became bitter, watching “some of the worst investing you could possibly imagine. Just every mistake you could make. The same people making the same mistakes over and over.” But because the market was starting to rise again by the mid-2000s, a lot of those sins were covered over by analysts and traders.

There was a lot of stuff nobody had taught him. “Having a business model that’s not conflicted by commissions; not listening to sell-side analysts; not participating heavily in investment banking deals—those were all the things that we were taught to do as brokers,” Brown says.

Eventually, he lost his will to sell, started going home with paychecks marked “zero.” “And I had a baby at home.” His awakening came during the financial crisis in 2007 and 2008, and he decided he was wasting his career.

In 2010, he met Barry Ritholtz at another firm and then in 2013, the two went and launched Ritholtz Advisors, where Brown is now a CEO and partner. He now lectures a younger generation in blogs replete with references to rap music and movies. “I don’t know if teens are reading me,” he says. But the motivation is to talk to younger people and help them avoid the experience he had. “If I had gotten better guidance from my parents or from more senior people that understood the business, I would not have started out at small-time brokerage firms on Long Island.”

Mary Beth Storjohann

Mary Beth Storjohann

Founder and CEO | Workable Wealth | San Diego, CA

When people see friends on Facebook with their cars, fancy houses and trips to Bermuda, it affects the way they spend their money. Mary Beth Storjohann calls this “fear of missing out.” Or “Fomo,” and it encourages bad behavior.

Storjohann, part of the MySpace generation, says her family struggled financially. “We were Italian so we had loud arguments … I should say loud conversations … about money.” She brought her anxieties about money into the workforce. She was working her way through college and got a job as a receptionist at a financial planning firm. By the time she got out of college, she already had much of her work experience to get her CFP credential. “I was one of the youngest ones at the firm to have the CFP license,” she says.

But being a young planner didn’t make her any more confident. Older colleagues were dismissive. Clients called her “kiddo.” One older advisor told her, “You can’t sit for your CFP until I can sit for mine,” she says.

She was working with people her grandparents’ age and wanted a better cultural fit. She spent short stints at Smith Barney and Morgan Stanley doing client service and financial planning training, but those didn’t last long. “As long as you can sell shoes at Nordstrom they will hire you for the financial training program.” She landed at a small firm that allowed her to wear many hats—read stock reports, do client service and do marketing. She started a blog for 20-somethings under an alias. “That was my toe in the water toward educating my generation. … I was really never allowed to work with my target clients through those firms.”

Her entrepreneurial instinct led her to start her own firm in 2013. She talked with peers like Alan Moore and Michael Kitces and went into a mentorship program and then made the jump to independence. She’s now author of the book Work Your Wealth: 9 Steps To Making Smarter Choices With Your Money.

Jeff Rose

Jeff Rose

CEO | Alliance Wealth Management | Carbondale, IL

It’s not many people who, when they’re just starting to get their financial planning practice off the ground, get deployed to Iraq and find themselves being shot at.

But that’s what happened to Jeff Rose. He’d joined the Army National Guard in 1997 as a younger man. Hailing from West Frankfort, Ill., Rose assumed he’d be doing service stateside. Meanwhile, he started as a junior broker for A.G. Edwards in 2002, and started closing the clients he was supposed to merely be attracting.

His mentor set him free, but within two years of going on his own in 2003, Rose’s life changed as the National Guard was deployed to Baghdad in 2005. “I didn’t ever really think it would be a possibility,” Rose says now. He calls himself and his military police unit “glorified chauffeurs,” to the interim president of Iraq, but it was no parade. There were snipers and IEDs. “Over there to get shot at is like saying you were driving to work and you hit a red light.”

After 17 months, he came home to his clients and started over. Though he had always worked with Edwards until then, he left after its infamous change in ownership, joining two other Young Turks to form Alliance Investment Planning Group under the cover of LPL. By 2008, the writing and blogging bug had hit him. He realized he had things to say directly to his audience he couldn’t say at a B-D.

“In 2008, I started a blog called GoodFinancialCents.com, not knowing what a blog was and no clue what I was doing.” The feedback was intense, however, and he says, “I could only imagine the results I could get if I didn’t have the restraints of Finra and compliance and all that stuff.” Rose got his first deal for a book, which would become Soldier of Finance in 2013. On his site, he talks in an informal and candid tone about mistakes people (including he himself) have made with their money.