History doesn’t repeat, but it rhymes, or so the saying goes. In retrospect, we see many similarities between 2018 and 1994.

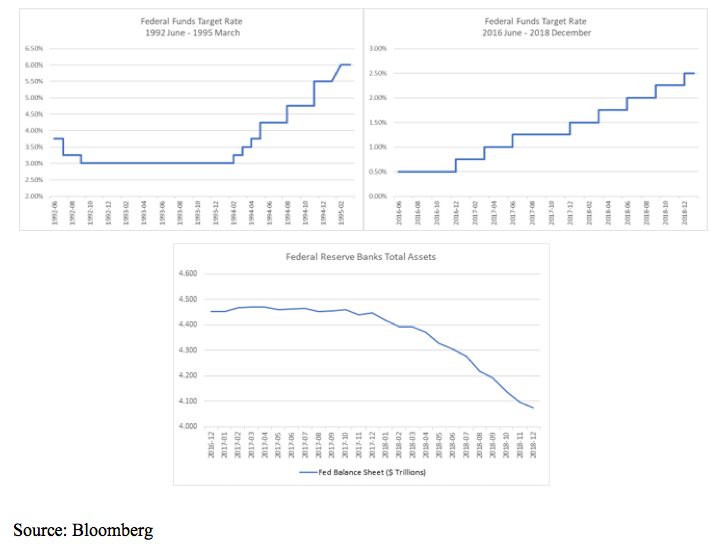

To start, after holding the Federal Funds rate at 3.00 percent since late 1992, in early 1994 the Federal Reserve began a series of interest rate increases. Over the course of the year, the Federal Reserve increased the Federal Funds rate by 2.25 percent. In 2018, the Federal Reserve increased the Federal Funds rate by 1.00 percent, delivering four 25bp rate increases, in excess of the two to three 25bp rate increases expected by most market participants at the start of the year. In addition, the Federal Reserve also reduced its balance sheet by $400 billion, a reduction of roughly 9 percent of the assets held by the Federal Reserve.

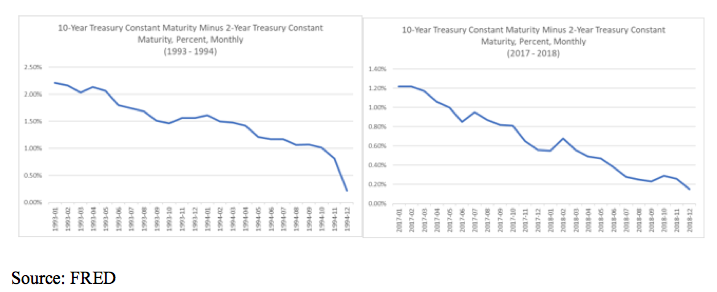

As a result of these Fed policies, the spread differential between longer dated Treasuries and shorter dated Treasuries contracted over the course of both periods, continuing a trend that was already in place.

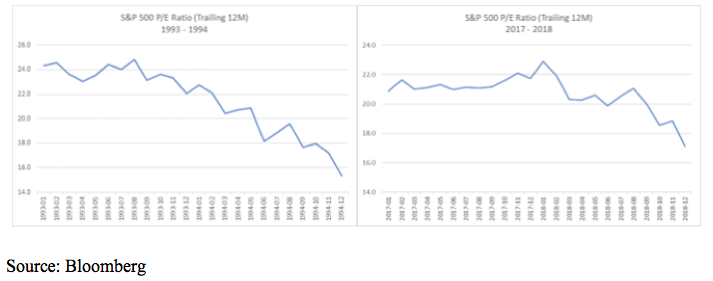

Equity valuations improved (got cheaper) in both periods as prices struggled while earnings grew.

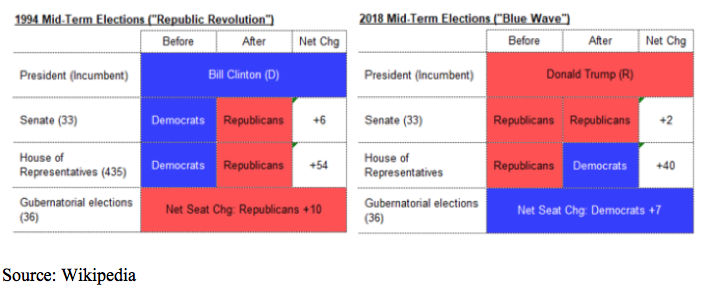

Politically, the United States had mid-term elections during both periods. Prior to each election, both chambers of Congress and the presidency were held by the same party. After each election, at least one chamber of Congress flipped parties resulting in a divided government for the next two years.

Lastly, both years ended with ISM manufacturing that, while still strong in absolute terms, was a sharp decline from the readings seen in the prior months.