The major secular investment theme during the past eight years was global deflation. However, the post-bubble secular period of deflation and slow nominal growth now seems to be ending, and re-inflation could be a prime investment theme for 2017. We hope to take advantage of that important shift because consensus portfolios generally remain positioned for stagnation and deflation rather than for stronger nominal growth.

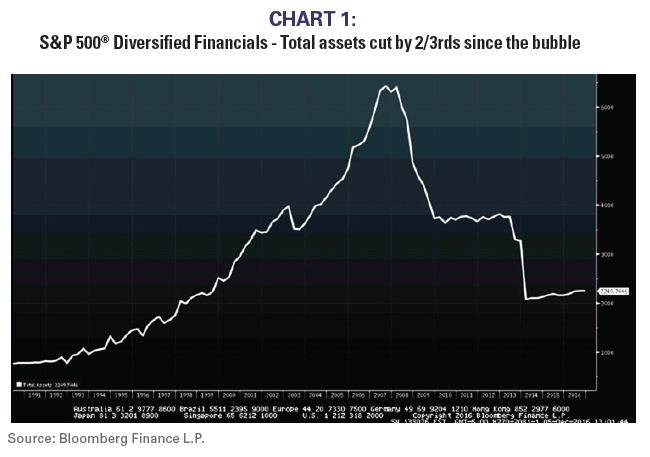

The deflating global credit bubble left the world with massive productive overcapacity, bloated financial sector balance sheets (See Chart 1), and little incentive for capital investment. Central banks were faced with a textbook “liquidity trap”, and credit creation remained moribund regardless of how low central banks set interest rates or how wildly their balance sheets expanded. Most investors wouldn’t take risk because they were too fearful that 2008’s bear market would repeat, despite that the economic environment was quite good for financial asset appreciation.

However, this past summer’s hackneyed theme of “lower for longer”, meaning that interest rates would stay lower for longer than investors might expect, might prove to be the swan song for the deflation investment theme. Secular global stagnation and deflation probably ended last February, and our portfolios have been positioned for improving nominal growth for much of 2016. Our positioning, which still seems quite out-of-consensus judging by other “year ahead” reports, will likely become consensus as 2017 progresses.

“Lower for longer?”

Investors are typically the most bullish about an asset class in the very last stages of a bull market. To use a baseball analogy, investors become most bullish with 2 strikes on the batter with 2 outs in the bottom of the 9th inning. Rather than leaving the game early to beat the traffic from the stadium parking lot, investors stay firmly in their seats sure that there will be extra innings.

Investors were most bullish about Technology stocks in March 2000 and the most bullish on housing in the fall of 2007. The “New Economy” and “housing never depreciates” were the widely accepted economic themes with 2 outs and 2 strikes in the bottom of the 9th.

This past summer, it was “lower for longer” with respect to interest rates, and bond bulls declared that the global economy would remain under deflationary pressures. Few investors made the “lower for longer” claims five or six years ago because investors feared central bank policies would produce rampant inflation (Remember the TV commercials that had central bank buildings with mouths that vomited printed money?). The “lower for longer” theme became popular last summer when the economic backdrop finally began to meaningfully change.

Investors’ rabid fervor for bonds and income during 2016 might ultimately prove to be the bond market’s equivalent of March 2000’s over-enthusiasm for technology stocks or 2007’s for housing stocks.