Financial services leaders and financial advisors are enthusiastic about the coming year and optimistic about growth, yet the majority does not feel confident about addressing their top objectives, according to the annual Beacon industry trends report from global consulting firm North Highland.

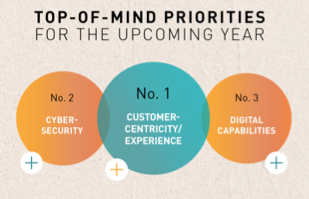

The top cited priorities for 2019 include: 1) client-centricity/experience, 2) cyber security, and 3) digital capabilities. But, only a minority of respondents feels very prepared to address these categories: 16 percent, 42 percent and 14 percent, respectively. Why the low confidence?

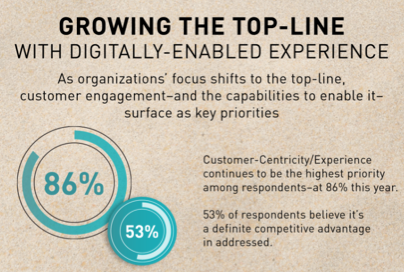

For many firms, the muscle that’s used for revenue generation has atrophied after the past several years of focus on cost take-out and regulatory implementation. Now, companies are reimagining growth opportunities through improved client experiences powered by digital capabilities and secured data insights. For financial advisors, this means digital tools to more quickly gather and aggregate client information and capabilities to model real-time scenarios.

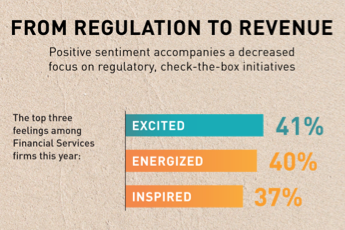

Leaders relayed positive sentiment: 41 percent feel excited, 40 percent energized and 37 percent inspired. This is mostly attributed to decreased focus on check-the-box regulatory initiatives. Although the proposed SEC Best Interest regulation is still unfolding, most firms have put similar standards and operations in place to meet requirements of the DOL Fiduciary Rule. Firms that did so are in a stronger position to embrace growth.

Top Priorities To Drive Growth

1. Client-Centricity and Experience—For wealth management firms and financial advisors, a profitable and sustainable client relationship is vital to success. While 86 percent of respondents rank this a priority, only 16 percent feel very prepared to address the opportunity. Why the gap?

• First, most firms have not turned themselves inside out. To be client-centric, you must know what your clients and prospects need, want and expect through research/data insights. Assets under management and demographic information are no longer sufficient predictors for a good fit in a practice. Firms and advisors need to understand if client experiences are truly client centric (personalized and flexible) or if they are firm centric (standardized and static). Have you asked your clients recently what they want in a relationship?