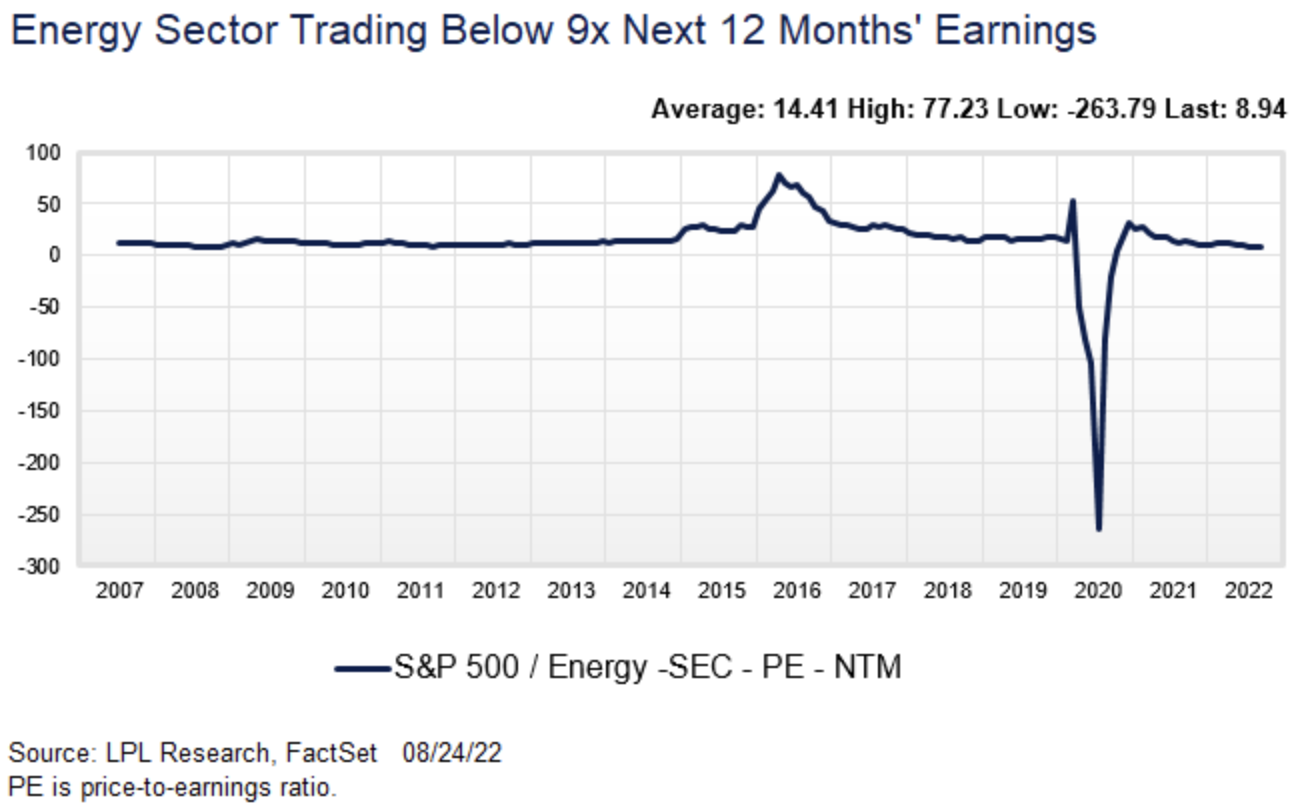

4. Valuations still reflect pessimism. It’s difficult to assess value in the energy space because no one knows where oil and gas prices are going. But if we make the assumption that prices will be stable or higher in the months ahead—a reasonable assumption we think—then energy sector valuations look quite compelling. Forward estimates imply a price-to-earnings ratio below 9, as shown in the chart below, compared to the S&P 500 at 17.5. Cash flow valuations look just as compelling, with free cash flow yields over 10%, more than double S&P 500 levels (free cash flow yield is how much cash is generated after capital expenditures relative to share price). On a price-to-book value basis, the sector’s valuation is not as compelling at 2.4 times, but that is roughly in line with the long-term average and hardly expensive.

5. Follow Warren. Warren Buffett and company (Berkshire Hathaway) have been big buyers in the energy sector recently. In fact, on August 19, Mr. Buffett received approval to purchase up to 50% of Occidental Petroleum (ticker: OXY). Berkshire owns over 20% of the company as of the latest SEC filings and has been aggressively buying. We’re not saying buy OXY, but rather that if Mr. Buffett likes the energy sector that much, we should pay attention.

So there are our five reasons to consider adding energy exposure. We believe the odds favor the sector going higher in the coming months. The energy markets are tight and getting tighter, while valuations look attractive and profits are on the upswing. Finally, being on the same side of a trade as Warren Buffett probably isn’t a bad thing!

Jeffrey Buchbinder, CFA, is chief equity strategist at LPL Financial.