Active Fexibility Versus Passive Simplicity

As the market for low volatility equity strategies has emerged, many of the largest index providers have constructed low volatility benchmarks. These benchmarks have increasingly been used to manage passive strategies, including exchange traded funds (ETFs) and smart-beta portfolios. The case for these approaches is to provide a cheap, transparent way to implement a low volatility portfolio.

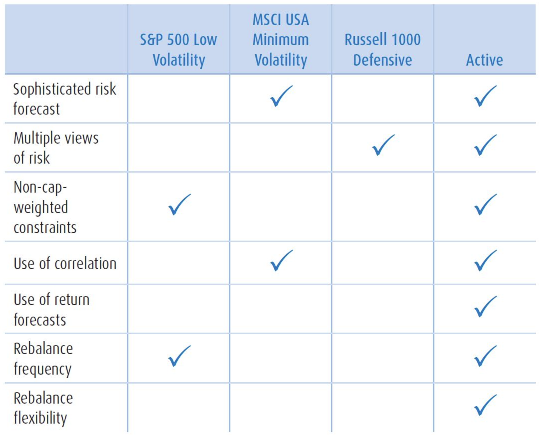

There are three major providers of low volatility indexes, and we have included a table evaluating each of them along the dimensions discussed in the paper. The takeaway is that active management can provide far greater benefits than simple passive approaches.

Conclusion

Strategies featuring more robust risk forecasts and unconstrained portfolio construction methods should provide lower realized risk and thus better downside protection. Furthermore, strategies using reliable return forecasts potentially provide higher realized returns and improved upside participation. Finally, a skillful manager should be able to adapt to emerging risks in the market, and balance the risk/return trade-off as opportunities in the market arise. Investors should evaluate all of these characteristics when determining which low volatility strategy to use. Asset Management Insights September 2015.

As investor attention increasingly turns toward outcome-based solutions and smart-beta products, we expect low volatility equity strategies to continue growing in popularity. However, when choosing a low volatility provider, it’s important to remember all solutions are not created equal.Ernesto Ramos, Ph.D., is Head of Equities at BMO Asset Management U.S. He leads the team responsible for portfolio management and research for all equity strategies.

Jason C. Hans, CFA, is responsible for equity portfolio management and research at BMO Asset Management U.S.

Jay Kaufman, CFA, is primarily responsible for the research and development of quantitative equity investment models at BMO Asset Management U.S.

Jay Kaufman, CFA, is primarily responsible for the research and development of quantitative equity investment models at BMO Asset Management U.S.

David A. Corris, CFA, is responsible for equity portfolio management and research at BMO Asset Management U.S.

David A. Corris, CFA, is responsible for equity portfolio management and research at BMO Asset Management U.S.