“The world thinks it’s difficult to combine meaningful current income with growth of capital, but we don’t agree and have proven otherwise,” declares David King, lead portfolio manager of the Columbia Flexible Capital Income Fund, which holds securities that offer the potential for income and price appreciation. His matter-of-fact tone exudes confidence without braggadocio, and the performance numbers back up his claim.

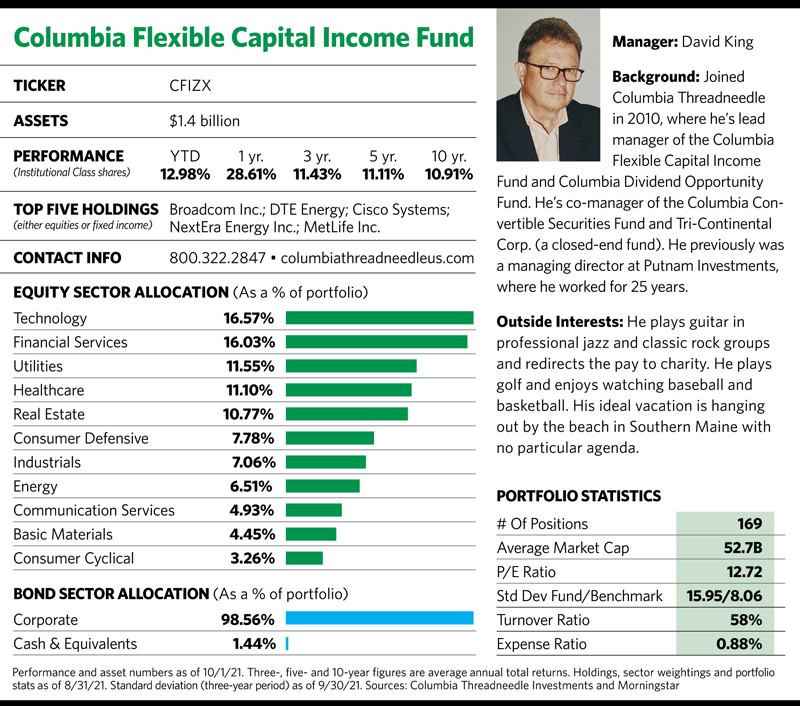

The fund has landed in the top quartile in Morningstar’s “Allocation—30% to 50% Equity” category in all of the measurable periods from year-to-date (as of October 1) through the past 10 years. The portfolio recently included roughly 170 holdings grouped into three main asset classes. Equities represented the largest category at about 45% of the portfolio, followed by bonds and convertible securities at 28% and 27%, respectively.

While the fund is included in an asset allocation-type category, King dismisses the notion that his fund is guided by asset-allocation concerns. Instead, he states that portfolio flexibility via securities selection is his game.

“The end idea of any investment is to get to a solution, and the mechanics are just the route to that,” King says. “We thought we could construct a portfolio that would have meaningful current yield with growth of capital. The consensus view has been that’s not possible in today’s low interest rate environment, or that it’s just very difficult. It’s made difficult because nearly everyone else who tries to do this does so through a top-down, asset-allocation lens.

“Our proposal is that you build it through securities,” he continues. “That’s what has enabled us to be the top-performing fund in total return in our Morningstar category in the past 10 years. And it’s one of the highest-yielding funds at the same time.”

The Columbia fund’s 10-year annualized return through October 1 was nearly 11%, and its trailing 12-month yield was 4.26%, according to Morningstar. King credits the fund’s success to the securities selection acumen of its three-member management team, which also includes Yan Jin and Grace Lee, along with what he describes as the strong collaborative culture at Columbia Threadneedle Investments, a Boston-based money manager with roughly $600 billion in assets under management.

“It’s easy for me to say everyone should go bottom up when they want to have income and growth, and another thing to do it because there are thousands of potential securities,” King explains. “That would be difficult except for all of the people [in Columbia’s investment research department] who will help us out who follow dividend-paying equities or bonds or areas such as REITs or other areas we might choose to find income in.”

Sometimes, he and his team know a particular company well enough that, for example, they need to look only at that company’s bonds, because the stock doesn’t pay a dividend. At other times, an analyst on Columbia’s research team might suggest a new bond that would be a good fit for the fund. Or maybe an equity analyst recommends an equity, but King’s team won’t buy that equity because it doesn’t pay a dividend. Instead, the company might have a convertible security or bond the firm can buy, so the team will confer with a credit analyst who covers the company.

“The unifying premise is that all of the securities we buy have a dividend or a coupon and they’re all denominated in U.S. dollars,” King says. “In our world of stock-paying dividends, converts, preferreds, REITs, MLPs, bank loans and bonds, we think these securities are more similar than different when you analyze them from the bottom up.

“It’s done bottom up as if there isn’t a meaningful difference between the stock of Verizon or the next junk bond deal being done,” he adds. “We think that philosophy is the extreme minority view.”