After so many years of rising stock prices, it’s only normal for investors to be apprehensive about the future of their stock portfolios. Virtually every equity benchmark is at or around a record high in this, the 11th year of the longest ever bull market, and valuations have become measurably inflated. At the same time, yields on fixed income securities have declined to levels less attractive than a standard savings account. So, where do investors turn when they see headwinds in the stock market and unattractive choices every traditional direction? We suggest turning to the options market.

An Attractive Option In Today’s Environment

To date, 2019 has been an exceptional year for U.S. stocks and as of December 5th, all major stock indexes are at or near historic highs. The Dow Jones Industrial Average is up 21.46% year to date, the S&P 500 26.73%, and the Nasdaq Composite 30.53%. Unsurprisingly, equity valuations have become inflated, with the P/E multiple on the S&P 500 well above its long-term average.

Meanwhile, bond returns have fallen to truly unappealing levels — with the latest rate cut by the Fed, yield on the 10-year Treasury is less than 2%. To us, this combination of a long-in-the-tooth bull market and low yielding fixed income enhances one of the more traditional option overlay strategies in the marketplace: writing call options on profitable equity holdings.

From a risk-adjusted return perspective, we believe that selling away some of the additional upside potential of equities to generate worthwhile cash flow presents a historically attractive opportunity.

A Resilient Strategy

Call premiums, like bond yields, are subject to Fed interest rate policy. However, option premiums typically do not fall in proportion to interest rate movements due to other pricing factors that have a greater impact on valuation, including volatility. In today's market, the Fed has been lowering interest rates and we have seen fixed income yields impacted significantly while cash flow generated from option premiums has hardly changed. In other words, cash flow potential from option premiums is resilient, even in the face of falling interest rates.

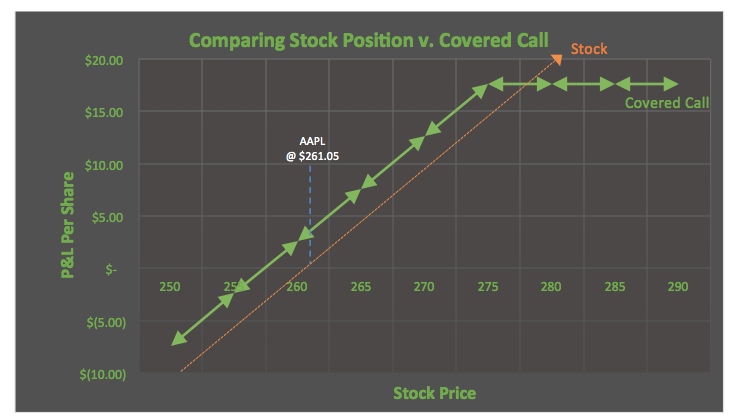

To illustrate the point, the chart below compares the profit and loss potential of simply holding Apple stock versus holding the stock and writing a call against the shares. The example uses real prices, and assumes the investor sold the January 2020 call with a strike of $275 (56 days to expiration) for $3.85.

In this example, if the price of Apple stock goes down — whether by five dollars or fifty — the covered call writer would be better off by the amount of premium that was received ($3.85). The same is true if Apple’s stock trades flat during the life of the option…the call expires worthless and the writer keeps the premium. Keep in mind, if the stock moves down in price, the covered call writer would still be exposed to losses — the primary risk of the strategy is the stock price going down significantly.