One of my least favorite market cliches is “healthy correction.” Why exactly is it ever good for your health to lose money? And how do we know when a market is “correct”? That said, if there is any such thing as a healthy correction, we might just have seen one in U.S. large-caps this month.

The rebound since the Covid scare reached its worst in March has been one of the most unbalanced and narrow rallies ever seen. The market cap-weighted version of the S&P 500 massively outperformed the equal-weighted version — or in other words, the average stock did far worse than the overall index. That was because gains were concentrated in a few big companies. That trend has been at least somewhat corrected in the last two weeks:

Note that the trend of outperformance by the cap-weighted index was briefly but dramatically interrupted in June. That was when the coronavirus appeared to be coming under control, just before it became clear that a second outbreak in the Sun Belt was forming. The phenomenon of investors pumping everything into a few big names thought to benefit from the pandemic, led by the tech players, has been central to creating such a narrow market.

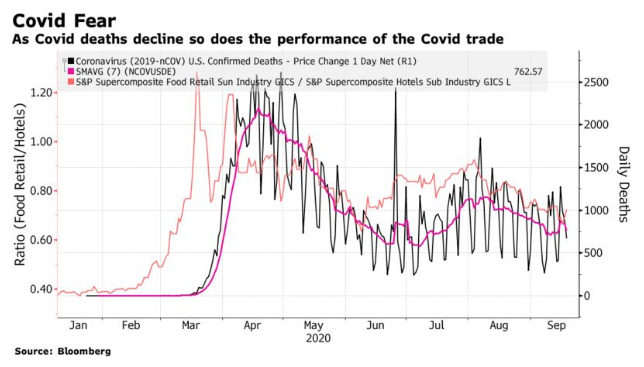

We can see this more clearly from a “pure” version of the Covid-fear trade, which shows how food retailers (thought to benefit) perform relative to hotels, resorts and cruise lines (plainly very much harmed). The following chart shows how this trade has performed, compared to the number of new Covid-19 deaths each day. Covid-fear is obviously reducing at present, which has meant that hotel stocks have regained ground on food retailers. The current death statistics don’t suggest the pandemic is over, but do indicate that it is less dangerous than once thought, so this makes sense:

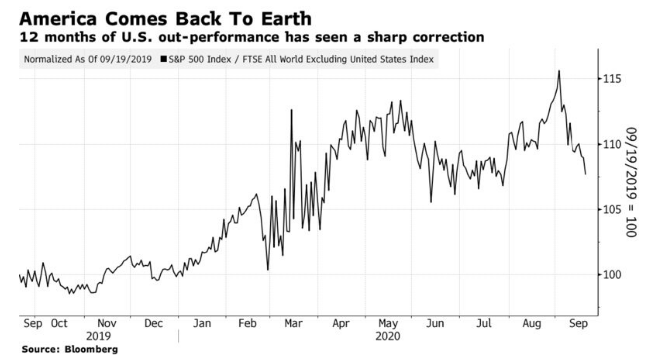

This isn’t just about the market narrowing. A number of other trends, all linked with the dominance of the FANG stocks, had already been brought to a point where they looked ready to collapse on themselves. And indeed, they are correcting. The U.S., as measured by the S&P 500, had massively outperformed the rest of the globe, as tracked by FTSE’s index for the world excluding the U.S., for the year so far. Corrections for the FANGs have brought a relative decline for the U.S.:

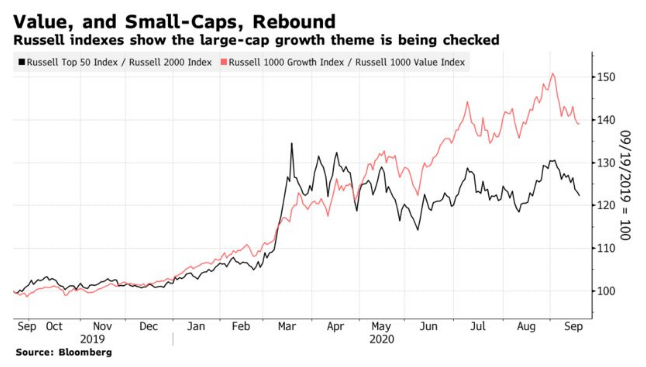

In a more muted way, the Russell indexes show that within the U.S. the strong outperformance by growth over value, and by mega-caps versus small-caps, has also been pegged back somewhat in September: