Over the last 50 years, a diversified portfolio averaged 9.59%. Importantly the diversification return averaged 1.12% annually! This is a huge bump in today’s low expectations environment. Recall, the more diversification you have, the higher your average diversification return.

We’ve already set our expectations for U.S. stocks and bonds at 3.55% and 1.92%. Let’s look at the other pieces of the diversified portfolio.

Start with international bonds. A large international bond fund, ticker BWX, has a 30-day sec yield of 0.67%. A large emerging market bond fund, ticker EMLC, has a 30-day SEC yield of 5.09%. For international bonds in total, we’ll make a rough assumption of 70% in developed and 30% in emerging markets. We should expect a return of .70%*0.67 + .30*5.09 = 2.00% on our international bonds.

While this is similar to our U.S. bond expectations, there is a diversification element provided by holding international currencies. If the U.S. dollar depreciates, these bonds might do well. Of course, the reverse holds true if the dollar appreciates.

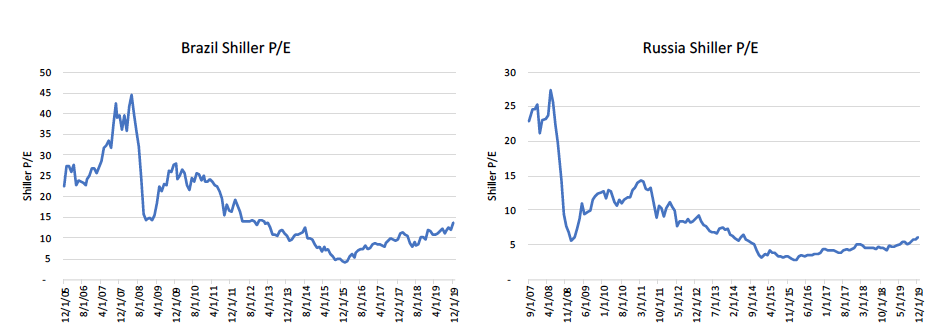

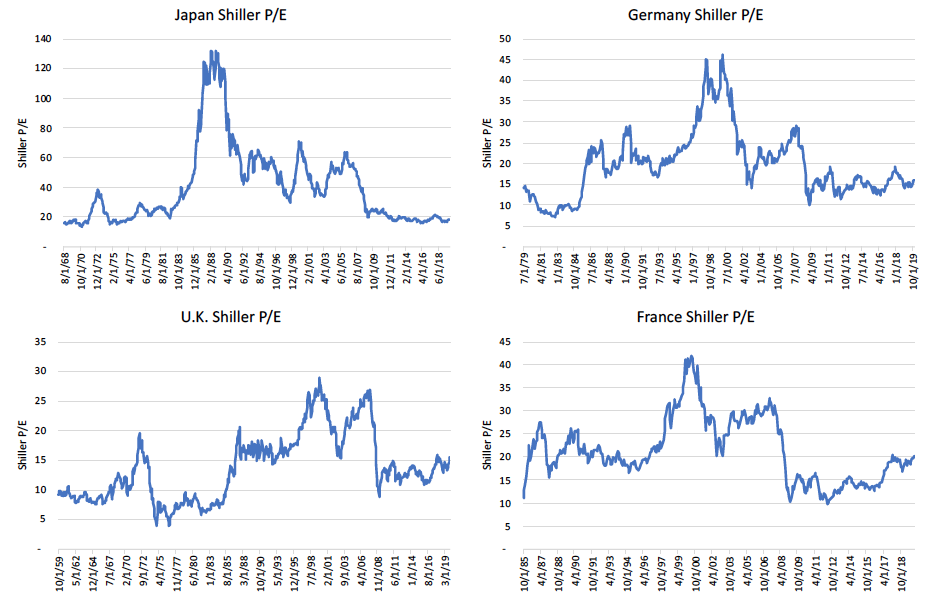

How about international stocks? Look at valuations for the four largest developed countries: Japan, Germany, the U.K. and France.

Each of the largest developed international countries have valuations within one standard deviation of their median, implying a normal range of returns going forward. Over the last 50 years, developed international equities have averaged 9.33% annually, and with normal valuations this is our current expectation.

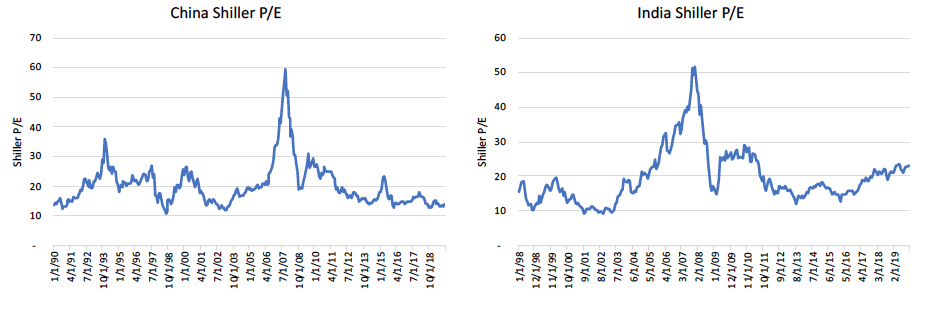

How about emerging markets? Look at valuations for the BRIC countries, the four largest emerging market countries.