Not long ago, emerging market debt was viewed as the most speculative corner of the bond market. The Asian currency crisis in 1997 and Russia's massive debt default the following year crushed bonds issued by emerging markets in Asia, Europe and Latin America. In 1998, emerging markets bond funds fell nearly 23%, on average. During the 2008 credit crisis, they fell about 18%.

More recently, however, the bad boys of the bond world have morphed into up-and-coming role models as investors gravitate to the attractive yields and improving risk profiles of emerging market bonds.

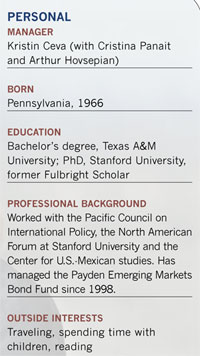

"Today, many emerging markets have more sustainable debt dynamics than developed markets," says Kristin Ceva, the manager of Payden & Rygel's Payden Emerging Markets Bond Fund. "The divergence in macroeconomic development between emerging markets and developed markets is unprecedented."

As established markets struggle with huge debt levels and slow economic growth, many emerging market countries are meanwhile less leveraged and enjoy solid economic growth. In emerging markets, the average debt to GDP ratio-a measure of government debt as a percentage of gross domestic product-stands at around 40%. For developed countries with slower growth and more leverage, that figure is about 100%.

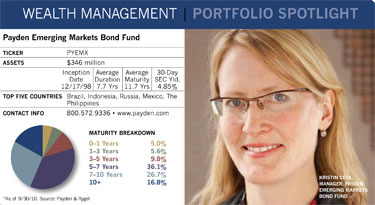

Emerging market bonds also have higher yields than most other types of fixed-income securities, which is a major reason investors have been flocking to the group since last year. By the end of August 2010, retail and institutional inflows into emerging market bond investments for the year had totaled nearly $50 billion, and they are expected to reach $70 billion by the end of the year, according to J.P. Morgan Chase. That's more than double the inflows of $33 billion for all of 2009.

Investors see bonds as a tamer way than equities to tap emerging market growth, Ceva says, adding that a growing number of investors who like the emerging markets story are complementing equity allocations with debt. Since 2000, calendar year returns for the fund have ranged from a low of -10.28 in 2008 to a high of 28.9% in 2009. By contrast, returns for the moodier iShares MSCI Emerging Markets Index ETF (EEM), which follows emerging market equities, have bounced from -49% in 2008 to 68% in 2009.

"Over the last 15 years, emerging market debt has had better performance and lower volatility than emerging market equities," she says. "Financial advisors and pension funds tell me they have a long-term strategic allocation to emerging market debt of 10% to 20% of a fixed-income portfolio."

The influx of money has pushed up bond prices and driven down yields. In recent years, the yield spread between emerging market debt and comparable U.S. Treasurys has ranged from about 200 basis points in 2007 to 800 basis points during the credit crisis in 2008. This year, the yield advantage for emerging market bonds has settled into the 290-to-330 basis point range.