She believes the yields on these bonds remain more attractive than they are on many other types of bonds. "Those spreads are about the same as they were in 2005," says Ceva. "But you have to remember that the credit quality of emerging market bonds has improved about two notches since then. It's a totally different asset class than it once was."

The improved credit quality comes after years of effort by some emerging market countries to shore up their balance sheets and reduce dependence on foreign creditors. As developed nations ramped up borrowing to prop up failing economies in 2008, these growing countries were able to keep their debt in check thanks to strong exports, buoyant commodity prices and economic growth.

Today, over half of the sovereign universe is rated at investment grade, where only 5% was in 1993. The average quality of the JP Morgan EMBI Global Diversified Index is Baa/BB+, which falls just shy of investment grade. And while the fortunes of companies tend to be cyclical, "the structural transformations in many emerging market political and economic systems are unlikely to reverse in the near term," says Ceva. She expects defaults on sovereign bonds to be less than 1% in 2010, and expects credit upgrades to exceed downgrades.

In Ceva's view, the biggest threat to total return over the next year would be rising interest rates, since emerging market bonds typically have longer maturities than many other types of securities. Rising rates could also heighten investor aversion to risk, which could reignite emerging market phobia and drive investors away from both stocks and bonds in those markets.

But she doesn't think that's likely to happen. "In a low-interest-rate environment, which appears likely for some time to come, investors will be drawn to a fixed-income alternative that offers high credit quality and attractive yield," she says.

Quality Varies

Since the economic health of these countries and their credit quality are uneven, with bond ratings that run the gamut from admirable to abysmal, country selection is critical in this space. The bonds issued by nations such as China, Chile and Poland sport ratings of 'A' or higher, for instance. But other bonds, such as those issued by Greece, Ecuador and Iceland, have ratings below investment grade and are backed by countries mired in debt. With ratings in the 'BBB' area, the lowest Standard & Poor's investment grade, many emerging market country bonds are relative newcomers to the world of higher-quality debt.

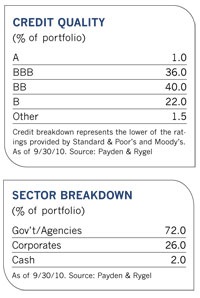

To help control risk, the Payden fund invests in securities from at least 15 countries, with each country accounting for no more than 20% of assets. The fund's latest fact sheet shows 69% of assets in government bonds, with 26% in corporates and the rest in cash equivalents. There are no structured products or credit derivatives among the fund's holdings.

In deciding country allocations, the first step in the investment process, Ceva looks for nations with consistent and appropriate economic policy, with strong financial and banking systems, with the potential for economic growth and with reasonable debt burdens. She also analyzes a country's political and social institutions and its government's ability to enact structural reforms. To get firsthand knowledge, she often travels to speak with different countries' government and banking officials.

The countries with the highest ratings don't always get the nod. China, the one perhaps most identified with emerging markets, has a solid 'A+' rating with S&P. Yet Ceva's fund has no investments there because the strong foreign demand for the bonds has compressed yields to the point where they are no longer attractive.