One of the most popular and reliable touchstones of investment strategy is value. Buying stocks with lots of current good things—book value, earnings, dividends—per dollar spent does better in the long run than buying stocks with hoped-for future good things. This principle seems to apply to other assets as well.

But this is a long-term claim measured over large portfolios tracked over many decades. Value goes through extended periods of underperformance, often when markets are frothy and investors are pouring even more money into the most overvalued assets. The 2010s were not kind to value, especially from 2017 to 2020, but the 2020s are making up for the losses rapidly.

A popular explanation for the trends is that value is an interest rate bet. The story goes that value stocks deliver cash flows in the immediate future, while growth stocks promise cash flows farther in the future. (I use “growth” to indicate the opposite of value, which is common usage. But to be more precise, non-value stocks are expensive, with high market prices relative to book value or other fundamentals. The reason they are expensive is usually because investors expect above-average growth, but there are sometimes other reasons.) At high rates, the present value of future cash flows is diminished relative to current cash flows, so value stocks are attractive relative to growth. But when rates are low, value is less attractive. The underperformance of value occurred at a time of low rates, and value revived when rates started to climb.

Hedge fund manager Cliff Asness of AQR Capital Management LLC (who I spent a decade working for) recently demolished this popular explanation on both theoretical and empirical grounds. But he did agree that value has been trading this way for a while, and that likely means it will continue to trade this way for a while. So, what’s an investor to do?

If you think value requires increasing rates to do well, then it doesn’t seem like a good strategy at the moment. The Federal Reserve is raising short-term rates with the intention of fighting inflation. If it works, long-term rates should go down on reduced inflation expectations. If it doesn’t work, we could end up in a recession, with even lower long-term rates. In either case, the Fed will eventually cut rates. The only scenario for continually increasing long-term rates is a disastrous repeat of the 1970s, with the Fed doing just enough to slow the economy without reducing inflation. Even in that case, value could likely outperform growth as it did in the 1970s, but no stock portfolio is likely to do well.

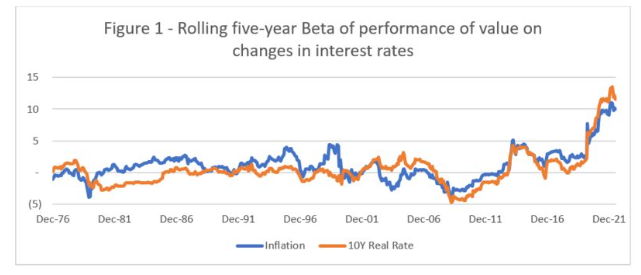

Asness based his empirical case on the correlation between changes in the 10-year U.S. Treasury note’s yield and the performance of a portfolio long value stocks and short growth stocks. A positive correlation supports the idea that value requires rising rates. Asness shows that the correlation wanders up and down over time, seldom far from zero, and more often negative (falling rates help value) than positive. Only relatively recently have we seen a sustained significant positive correlation.

Figure 1 repeats the analysis with three changes. (These are my calculations based on data from AQR.) I decomposed the 10-year Treasury yield into an inflation component and a real rate (the nominal yield minus forecast inflation). Because inflation in gold-standard days was qualitatively different than fiat-money inflation, I only used data since 1971, while Asness goes back to 1926. Third, I show beta rather than correlation.

The two statistics are similar, but correlation is more useful to show how reliable an association is—statistical significance—which was Asness’s concern. Beta indicates the size of the effect—practical significance—which is what I want to discuss. The current betas around 10, for example, mean a 50-basis-point increase in either inflation or 10-year Treasury yields is associated with value outperforming growth by 5%, an amount that is certainly of investment interest.

Prior to the 2008 financial crisis, the 10-year Treasury real yield seemed to have little effect on the value factor. That further undercuts the popular story of why rates matter for value, since that story should depend on the real rate. There does seem to be a mostly positive correlation with value, ranging from a beta of zero to almost five. Perhaps value stocks are more able to recapture inflation than growth stocks.