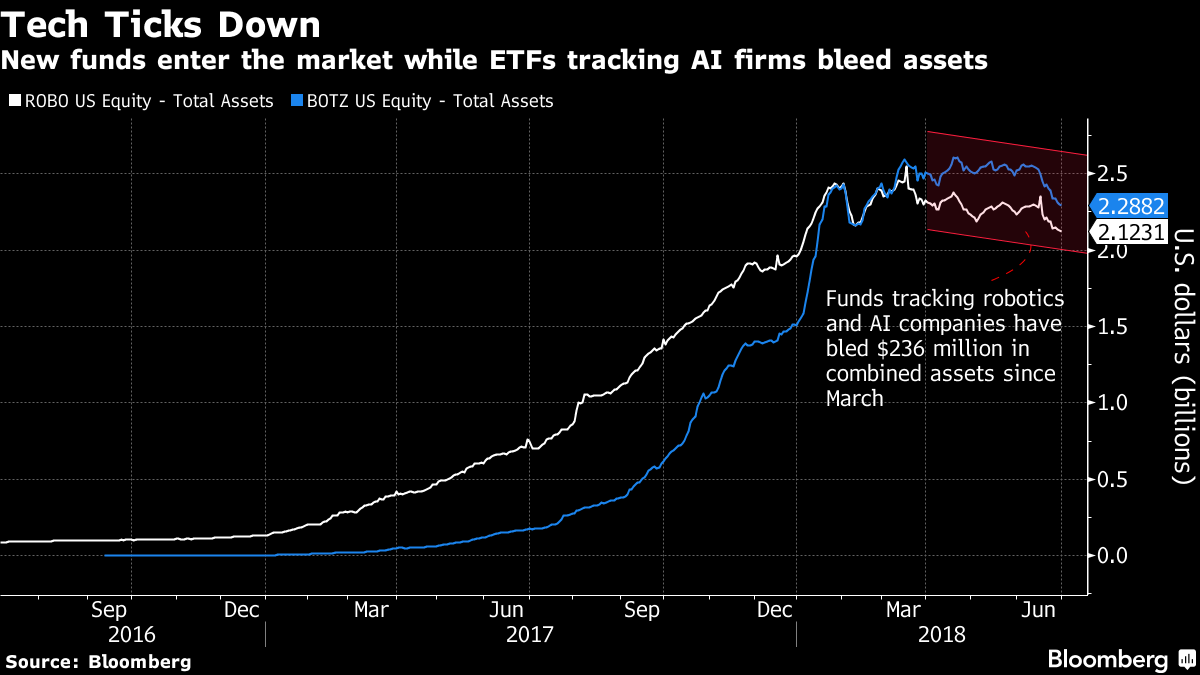

Large funds tracking robotics and artificial intelligence stocks have bled cash in recent months, but that isn’t stopping other issuers from joining the fray.

BlackRock Inc. last week announced the launch of its iShares Robotics and Artificial Intelligence ETF, or IRBO, joining a crowded field that’s seen massive outflows in recent periods. The Global X Robotics & Artificial Intelligence ETF, or BOTZ, lost a record $115 million in assets the past two months. The ROBO Global Robotics & Automation Index ETF, or ROBO, has bled $121 million since the beginning of April.

“BlackRock is sort of like the big budget studio who you could argue comes in a little late or after the trend has been in place for a while,” said Eric Balchunas, senior ETF analyst for Bloomberg Intelligence. “The good news is that with this army of sales people out there, they now have a robotics option available and because it’s cheaper, it’s probably going to draw some investors.”

IRBO will charge $4.70 for every $1,000 invested in the fund, while Global X’s BOTZ fee is $6.80 and Exchange Traded Concepts’s is $9.50 for ROBO.

Meanwhile, another smaller fund is taking advantage of this futuristic-technology investment trend to re-brand itself after failing to gain traction. The WEAR ETF from Exchange Traded Concepts will now become the Tactile Analytics AR/VR Virtual Technology ETF, or ARVR, according to a filing with the Securities and Exchange Commission.

Instead of tracking wearable technology, the fund will hold companies focused on augmented and virtual reality. It is unclear yet if the ETF will contain artificial intelligence or robotics stocks.

WEAR has seen less than $1 million in asset growth since its launch in December 2016, so perhaps the change will do it some good.

That’s because the ALPS Disruptive Technologies ETF, or DTEC, a $29 million fund tracking "disruptive technology" companies like those specializing in augmented reality, has seen inflows every month since it debuted in late-December 2017.

AI Funds Are Sexy, But They’re Bleeding Assets

July 3, 2018

« Previous Article

| Next Article »

Login in order to post a comment