A pretty common area where wealth managers fail is when it comes time to blunt the taxes on the sales of clients’ companies. Astute wealth managers can talk about the different approaches to eliminating or lowering capital gains or estate taxes. For instance, they could use deferred sales trusts to take the bite out of capital gains taxes, as well as tax-wise charitable giving and offshore pension plans. Instead, a great many wealth managers will hand the client off to a lawyer and hope to come back into the picture when the company is sold and the investment management piece becomes more important.

The research suggests most wealth managers know the terms and the names of strategies, but fall short when it comes to having experience with the approaches, let alone being able to discern where they best fit and how to explain them to clients. It’s not that wealth managers need to be expert in all things. But they do need to see where the value can be added by turning to a cohesive team of internal and external experts and then skillfully implement the best solutions.

Build Powerful Business Relationships

The most essential thing you must have is an ability to build powerful business relationships—with the people and professionals you’ve chosen. You pick them because they can help you better serve your clients (and thus help you grow your income).

You can build great relationships with certain clients, with other professionals who can refer clients to you, or with anyone else who can help you. There are different ways to build powerful relationships, but one of the most effective is by helping other people achieve their dreams and wishes or better cope with their problems.

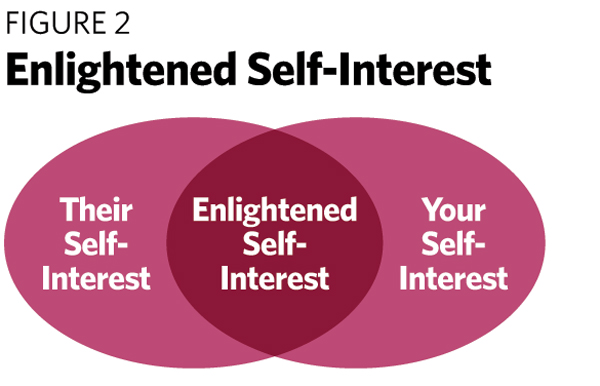

Consider an accountant with wealthy business owner clients you’d like to have referred to you. It’s in your interest to ascertain what’s in the accountant’s interest. You can find that out by asking insightful questions and being empathetic. That way you can find areas of overlap. (This is known as enlightened self-interest. See Figure 2.)

For example, many clients are very interested in lowering their income taxes. Not many accountants are knowledgeable about the various qualified retirement plans available to business owners. As a wealth manager you can show them how certain qualified retirement plans can lower a business owner’s income taxes—how the clients will be able to get back most of the monies they put into their plans, plus the tax-deferred growth. By working with accountants, you can find the appropriate clients for such strategies. The accountant then delivers the expertise, for which he or she is compensated.

What’s Holding You Back?

When you think about the obstacles, do any of them seem insurmountable? Are any of them beyond your abilities? Most wealth managers will say no, yet there are relatively few of them consistently earning $1 million or more, year in and year out.

What’s holding them back? Generally, wealth managers are not inclined to deviate from their current way of operating. It makes them uncomfortable not leading with a discussion about who they are and their investment strategy. They might be saying to themselves that this approach has worked before (to varying degrees), so why change it? Other wealth managers simply might not know how to circumvent the obstacles. But they can get through with help from coaching, mentoring or educational programs.

The only thing really holding back wealth managers from becoming amazingly successful, or at least much more successful, is themselves. If you are not as proficient as you like at building powerful business relationships, for example, there are resources available to help you become adept.

Russ Alan Prince is president of R.A. Prince & Associates.