Wild Cards To Be Considered

There are some other wild cards to plan for as well, including income-related monthly adjustment amounts (or IRMAA) on Part B and Part D premiums. “All Medicare enrollees start off by paying a standard amount, while higher income earners pay more for the same coverage,” says Kuster.

The calculation, he notes, is based on adjusted gross income plus certain foreign-earned income and tax-exempt interest (also known as modified adjusted gross income, or MAGI) from two years prior. For example, an individual’s 2024 Medicare costs are based on 2022’s MAGI.

Advisors must also consider how inflation will affect people’s healthcare costs.

For instance, the Centers for Medicare & Medicaid Services projects an average annual Medicare spending increase of 6.7% between 2023 and 2030. And Fidelity’s Retiree Health Care Cost Estimate tool currently predicts a 4.9% healthcare inflation rate in retirement. “When planning for longer periods of time, it’s anticipated that a more conservative inflation number can be used in the assumption,” Kuster says.

What’s more, the Centers for Medicare & Medicaid Services project an average annual Medicare spending per beneficiary increase of 4.5% between 2023 and 2030, and it is assumed that Medigap plans may experience similar increases over this time.

When thinking about the long-term projections of Medigap premium costs, Kuster says it’s important to note that supplements essentially pay the portions of Medicare-approved medical claims that weren’t covered by Medicare Part A or B. “The coverage is based on the prices Medicare negotiates and reflects a very similar utilization that Medicare experiences,” he says. “Therefore, we should expect Medigap premiums to increase within a reasonable range of Medicare’s increasing costs per beneficiary.”

Advisors must also account for the fact that Medicare and Medigap do not provide any dental coverages; though many Medicare Advantage plans have added some dental coverage, those plans typically have caps on how much they pay. “This leaves those with large dental procedures still needing to plan for sizable out-of-pocket costs,” Kuster says.

Planning For Long-Term Costs

The biggest wild card when it comes to healthcare expenses—expensive healthcare shocks and long-term care—can also be planned for.

According to Banerjee’s research, very few retirees experience a catastrophic healthcare shock. “The likelihood of experiencing healthcare shocks increases with age, particularly after age 80, but very few retirees saw a permanent increase in healthcare costs after having a large healthcare expense,” he writes.

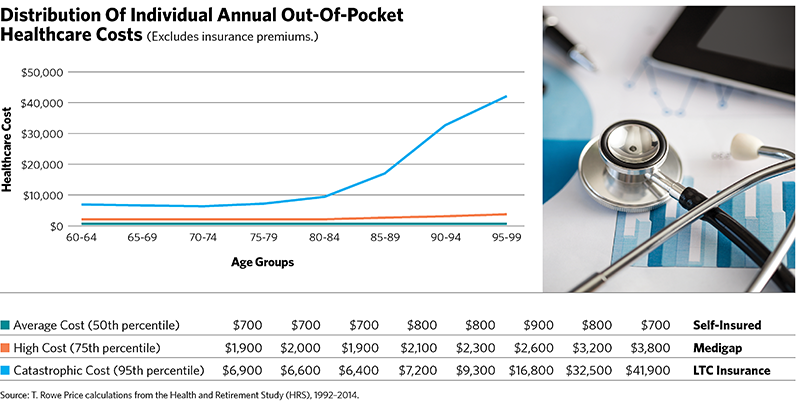

How might financial advisors plan for these costs then? According to Banerjee’s work, an individual in excellent health might budget for the median expenses (see the figure on page 61), while someone with a chronic medical condition might use the 75th percentile as their guideline and those in poor health might use the 95th percentile.

And how might a client pay for those long-term-care costs and healthcare shocks? Banerjee suggests the following: “One might think about self-funding the average costs, using Medigap policies to safeguard against high costs and purchasing long-term-care insurance to protect themselves from catastrophic cost scenarios.”

Kuster also thinks of long-term care as a separate risk. “It is important to address the risk of long-term-care expenses and the potential for an increase in ongoing healthcare-related expenses when evaluating each unique financial plan,” he says. “For many retirees, there is not one ‘right’ solution that removes all the risk.”

Robert Powell, CFP, RMA, is an award-winning financial journalist whose work appears regularly on MarketWatch.com, USAToday.com and TheStreet.com. He is also the editor and publisher of Retirement Daily on TheStreet and co-founder of finStream.tv.