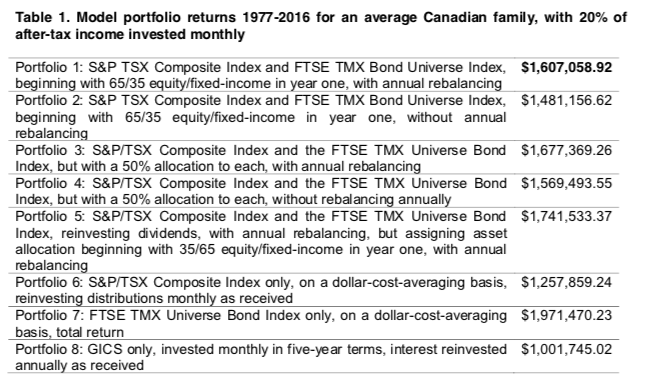

On the other hand, the all-bond portfolio hit $1,971,470.23, while the all-equity portfolio reached only $1,257,859.24. (See table 1.)

The study also looked at how long the portfolio could fund retirement for the couple, based on various scenarios. The annual income of the hypothetical couple was $83,900 during the last year they were in the workforce, and the study assumed they would need only 70% of that income, or $58,730, indexed to 2% inflation, after retirement. With a 5% annual investment return, all of the portfolios had balances of more than $1 million when the couple reached age 100.

However, if the couple were to begin yearly withdrawals at the amount they earned in their last year before retirement -- $83,900 – the portfolio based on MPT/EMH was depleted by age 93 and some were depleted far earlier. The only portfolio with a balance when they reach 100 under that scenario was the all-bond one, which had started at nearly $2 million and had $844,559.59 left.

The study also looked at how the various portfolios would be depleted if there were no annual investment return. Not surprisingly, they were depleted even sooner.

Fischer’s study is entitled “Modern Portfolio Theory and the Efficient Market Hypothesis: How Well did they Serve Canada’s Baby-Boom Generation?”