Key Takeaways:

• Time is running out for Congress to raise the debt ceiling. Treasury Secretary Janet Yellen has warned lawmakers that the government may not be able to service its debt by June 1.

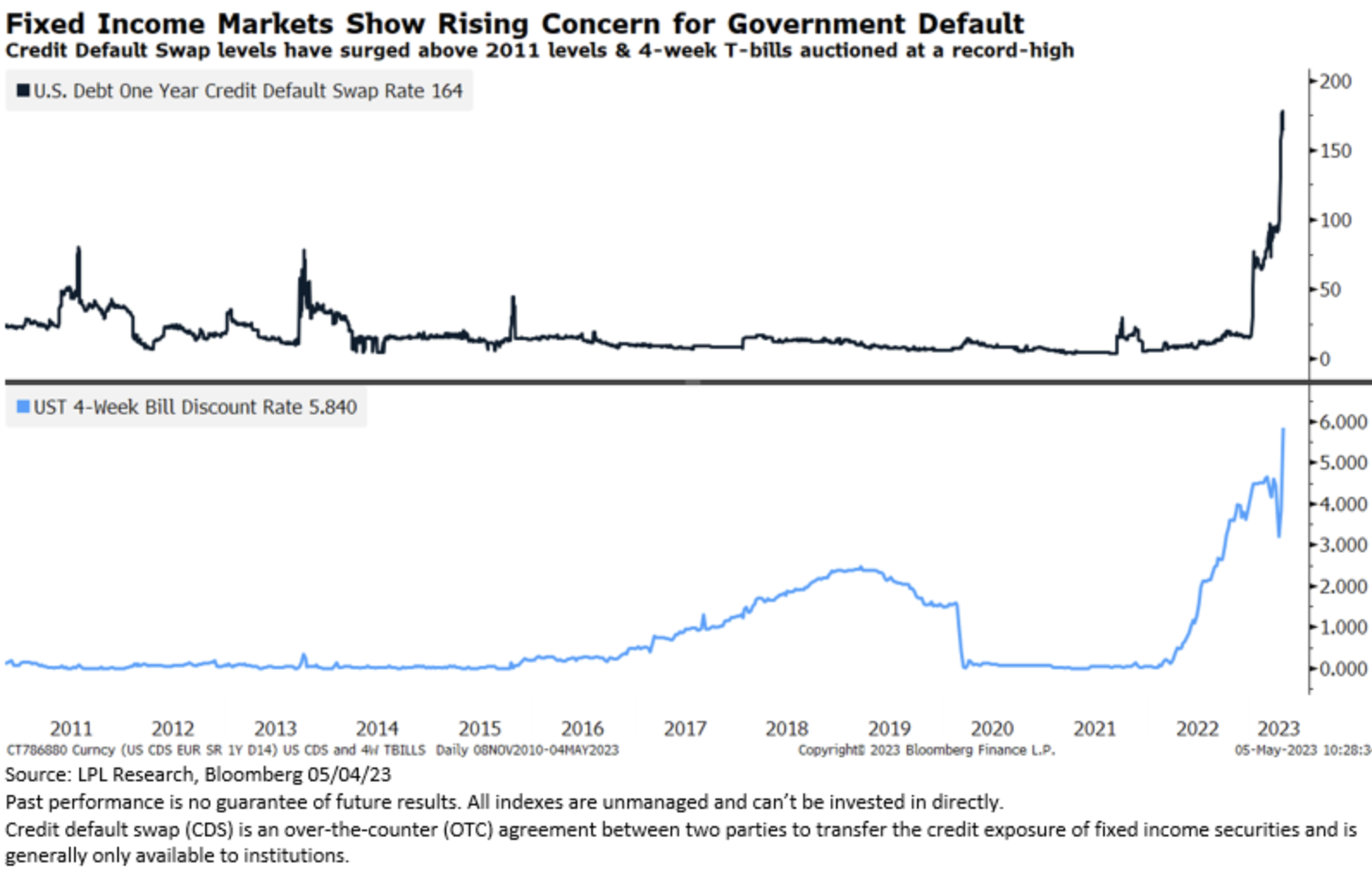

• The fixed income market continues to show signs of concern over a potential technical default. Credit default swap (CDS) rates for U.S. government debt have roughly doubled over the last month, while four-week Treasury bills auctioned at their highest discount on record this week.

• While we view a default as a very low probability event, headline risk over the next few weeks could weigh on risk sentiment.

• What does this mean for stocks? In the event of a prolonged debt ceiling battle similar to 2011, watch for large caps to outperform small caps, growth to outperform value and defensive sectors to outperform more cyclical sectors.

Backdrop

As if rate hikes, rising recession risk and another bank rescue were not enough to deal with, the market is now gearing up for a battle inside the Beltway as Democrats and Republicans spar over solutions to avoid a default on the nation’s debt. According to Treasury Secretary Janet Yellen, time is running out for Congress to raise the debt ceiling as she warned lawmakers earlier this week that, while the actual date is unclear, the government may not be able to service its debt as early as June 1, the so-called X-date.

A failure by the government to reach a deal by the X-date could trigger a technical default with potentially catastrophic economic consequences. Chair Powell commented on the severity of the situation during this week’s Federal Open Market Committee press conference: “It’s essential that the debt ceiling be raised in a timely way so that the U.S. government can pay all of its bills when they’re due. A failure to do that would be unprecedented. We’d be in uncharted territory, and the consequences to the US economy would be highly uncertain and could be quite averse.”

While we view a default as a very low probability event, headline risk over the next few weeks will likely weigh on risk sentiment.

The fixed income market continues to show signs of concern over a potential technical default, resulting in a delayed payment for bond holders. Credit default swap (CDS) rates for U.S. government debt have roughly doubled over the last month as investors demand a higher premium for the potential default risk. For context, CDS rates reached only 0.80% during the 2011 debt ceiling crisis, about half of where rates are today. Furthermore, four-week Treasury bills auctioned at their highest discount on record this week, yielding 5.84%.

The message from the fixed income market is concerning, although the risk lies more in the government’s willingness versus its ability to service its debt. According to LPL Fixed Income Strategist Lawrence Gillum, “U.S. bond market investors have taken for granted the government’s ability and willingness to pay its debt. While its ability to repay its obligations is not in question, the debt ceiling debate complicates the country’s willingness to pay its debts.” Read more from his April blog titled The Treasury Market is Starting to Show Signs of Worry Over Debt Ceiling.

Flashback To 2011

While we view a default as a very low probability event, headline risk over the next few weeks could weigh on risk sentiment. Unfortunately, the market has also seen this film before, with the most recent edition playing out in 2011. As a quick backdrop, a debt ceiling spring showdown in Washington resulted in the government hitting its debt limit on May 16, 2011. However, the Treasury pulled off some accounting maneuvers to narrowly avert a crisis and fund the government until August 2, exactly how long it took Congress to get a deal done. The damage during this period included a sizable sell-off across equity markets, lower yields underpinned by a flight to safety, and a credit downgrade of U.S. debt to AA+ from AAA by Standard & Poor’s.

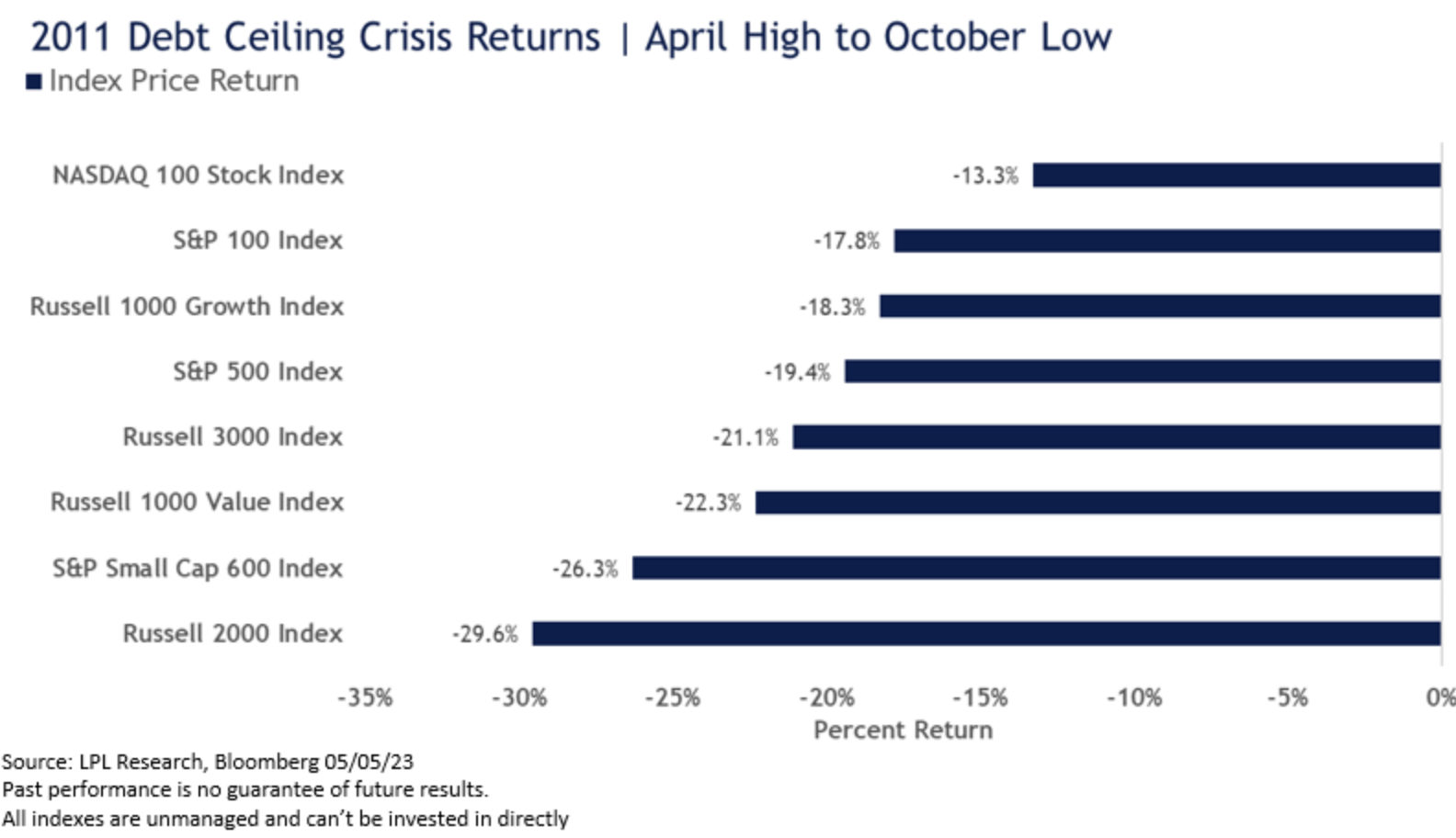

While there are many economic differences between now and then, the 2011 analog at least provides a potential roadmap for stocks if the debt ceiling drama continues. The chart below shows how several major indices performed during this period, encapsulated by the market’s April high to the October low.

At the market cap level, small cap stocks clearly underperformed during this period, evidenced by sizable drawdowns on the Russell 2000 and S&P Small Cap 600 Index. Large caps and growth outperformed but still posted double-digit declines.

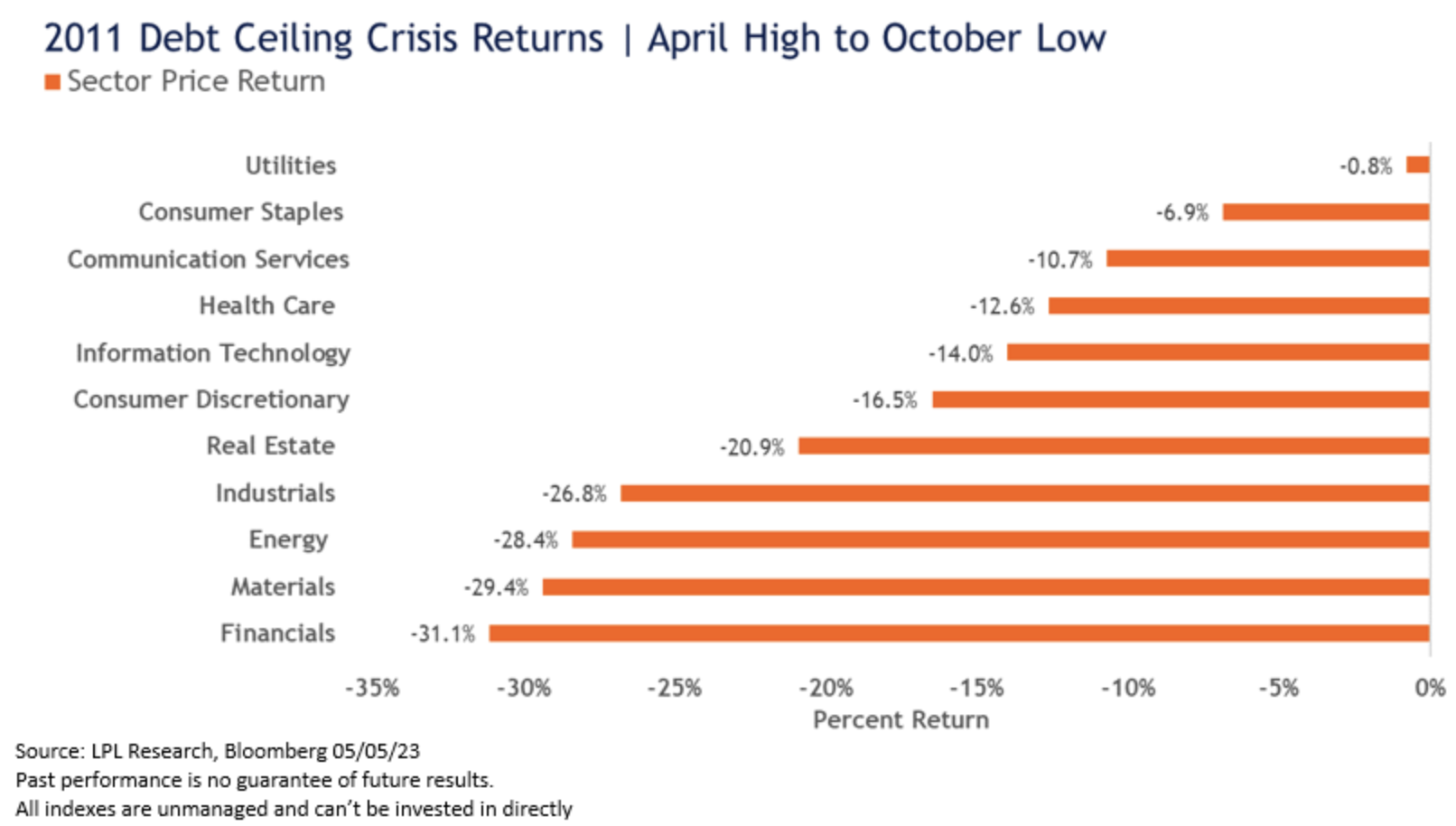

The following chart breaks down the S&P sector performance during the 2011 debt ceiling crisis.

Defensive leadership was a major theme during this period as utilities and consumer staples topped the sector leaderboard with minimal relative losses compared to peers. The more offensive cyclical sectors widely underperformed, led by financials. Under a prolonged kick-the-can down the road scenario similar to 2011, we suspect defensive sectors could be in a similar position this year.

Summary

We believe the odds of the government defaulting on its debt obligations remain low. However, without a debt ceiling deal, the probabilities of a technical default are not zero and headline risk will remain elevated until a resolution is passed. The fixed income market continues to price in increased credit risk in U.S. Treasuries as the X-date approaches. In the event of a prolonged debt ceiling battle similar to 2011, watch for large caps to outperform small caps, growth to outperform value, and defensive sectors to outperform more cyclical sectors.

Adam Turnquist is chief technical strategist for LPL Financial.