Market watchers have been intensely focused on the Federal Reserve (Fed) this year. Recently, they’ve mostly opined on when the first rate cut might be coming and, generally, making the assumption that a rate cut would be good for stocks. It could be good, but our analysis peels back the onion to help make an important point. Once the cut comes, typically the Fed has gone too far and recession is near (or already started). Further, markets tend to get jittery ahead of the cut, suggesting investors right now might be better off rooting for “higher for longer.”

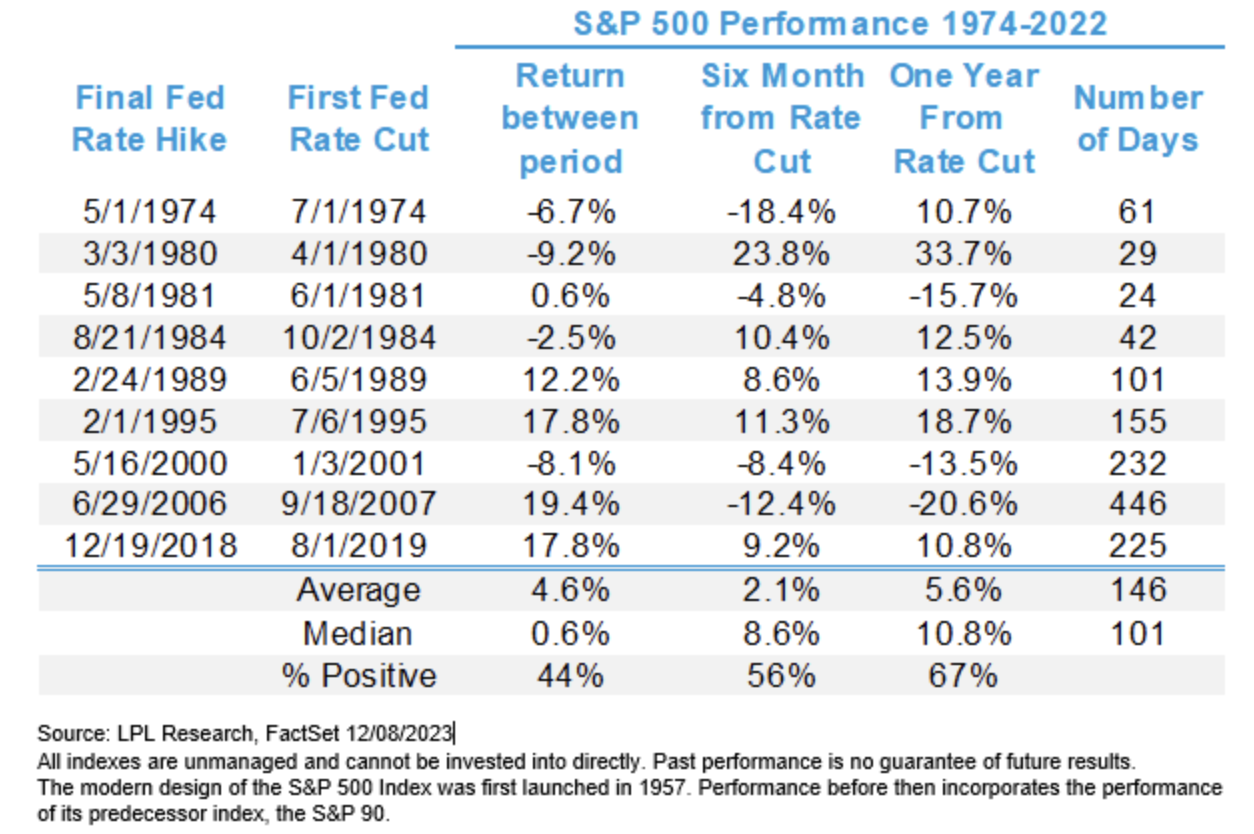

An examination of Fed rate cycles since the 1970s (table below) reveals that investors don’t have much to look forward to when looking at how stocks do during the first six months following the first Fed rate cut. Keep in mind that the sample size is relatively small, with only 9 rate cycles studied. It is also worth noting that the time from the first rate hike to the first rate cut has more than doubled since 1985 as business cycles have generally lengthened.

While average gains don’t look great (2% over the subsequent six months and 5-6% over the next 12), they aren’t bad either. The dispersion is where this gets more interesting. During challenging economic environments such as the early 1980s, early 2000s, and pre-Great Financial Crisis, stocks suffered mightily after the Fed easing cycle began. Simply put, performance varies quite a bit across these periods.

We see the same thing when analyzing the period between the final rate hike and the first rate cut, with mixed returns; in addition, negative returns outnumber positives.

The Fed will cut rates because it worries monetary policy is too restrictive for a weakening economy. The central bank’s goal remains a soft landing, and their spotty track record in achieving that goal does not mean a hard landing is necessarily in the cards. Some things have already broken, by the way, including Silicon Valley Bank and First Republic Bank. And many think the U.S. economy already experienced a recession with the two straight GDP declines in the first half of 2022 (it was a technical recession, not an official one).

Today, consumer and corporate balance sheets are in great shape, with many corporate executives having already prepared for recession. And don’t forget the cause of the presumed recession, high inflation, has sharply reversed. Bottom line, if a recession comes in 2024, it will likely be too mild to disrupt the market meaningfully.

So now 135 days into the rate pause—assuming no addition hikes are forthcoming—be careful what you wish for. Higher for longer and a “muddle-through” economy without cuts might be best for stocks in 2024.

Jeffrey Buchbinder, CFA, is chief equity strategist at LPL Financial.