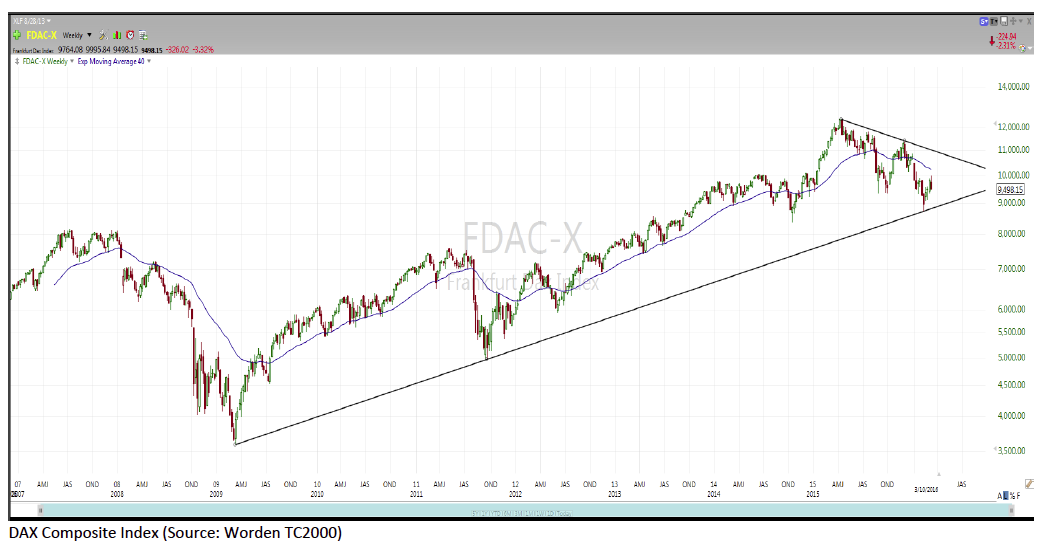

And U.S. markets weren't immune to the volatility, either, as the S&P 500 essentially ended the day right where it began despite falling over 1.75% from its early morning peak, putting in a rather indecisive-looking candlestick on its chart in the process. Stocks are still sputtering right where we expected, and the impact of this kitchen-sink stimulus only adds more uncertainty to the situation. However, it rarely pays to fight the Fed (or ECB in this case), so with more easy money flowing into European markets, it could offer up opportunities in something like Germany's DAX Composite Index, which is still not too far above a crucially-important long-term trendline and could very well be a beneficiary of increased capital inflows. And as of this morning, it appears global markets like the stimulus a bit more after sleeping on it, with the DAX up almost 3% and DJIA futures up 150 points!

Andrew Adams, CMT joined Raymond James in 2008 and serves as the research associate to chief investment strategist Jeff Saut and chief economist Scott J. Brown, Ph.D. He focuses on macro investment strategy, with an emphasis on technical and quantitative analysis of the global markets.

Bespoke Investment Group

March 11, 2016

« Previous Article

| Next Article »

Login in order to post a comment