BBB Or BB Companies Often Have Better Upgrade Prospects

Equity investors frequently take the opposite tack with BBB or BB companies. They often push them to reduce leverage, often by selling assets, raising new equity or simply by growing earnings.

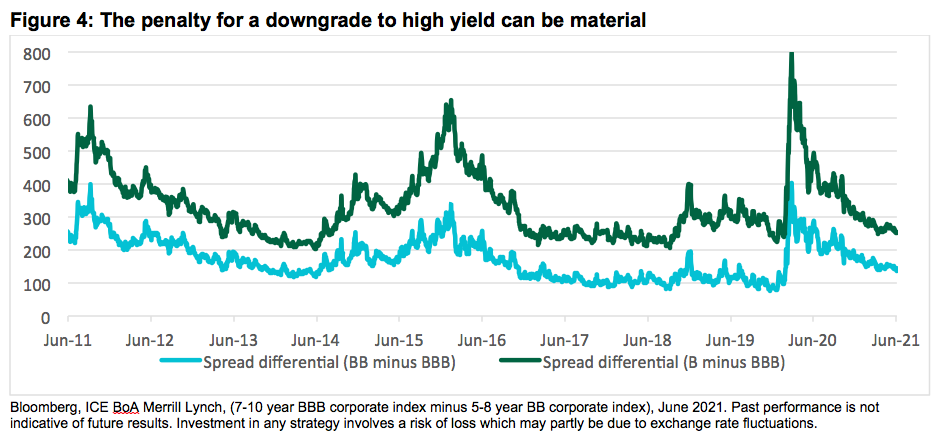

This is because the cost of a downgrade from investment grade to high yield can be prohibitive. There is still a notable cliff between BBB and BB corporate bond spreads at ~145bp, with BBB and B at ~255bp (Figure 4).

The penalty reflects the fact that the high yield market is smaller and less liquid. A downgrade to high yield means forced selling from funds that track the Aggregate index and less favorable capital requirements for insurance investors.

We are seeing deleveraging trends in lower rated issuers as a result. For example, AT&T (BBB) agreed to spin off its media operations and General Electric (BBB) sold its air leasing business and introduced plans to buy back debt given equity investor concerns about its giant debt load.

Kraft Heinz (BB) sold assets such as Planters and Corn Nuts to Hormel for $3.4bn to reduce debt, to plaudits from equity investors such as Warren Buffett and Michael Burry of ‘Big Short’ fame.

These deleveraging trends have also resulted in growing US equity issuance (which doubled to a record $300bn in 2020) as companies moved to manage cash shortfalls and contain balance sheet leverage.

Issuers Gravitating To BBB Is Potentially The ‘New Normal’

We are seeing the fastest economic cycle in history play out, and the accompanying credit cycle has been equally rapid. Corporates have gone from raising defensive cash holdings to thinking about making the most of the recovery.

That leaves issuers at a fork in the ratings cycle. Higher-rated companies will potentially work more for equity holders while lower-rated firms will work more for bondholders.

We increasingly expect both will gravitate toward mid-to-high BBB ratings—a sweet spot for funding costs and balance sheet strength.

Playing A And BBB/BB Debt As The Economy Recovers

Seek improving credits, from mid-to-low BBBs and rising stars. We favor mid- to low-rated BBB credits as the sweet spot for credit allocations. For investors that require a higher average quality, we suggest blending Treasuries with BBB credit to arrive at a weighted average of A.

We still see some selective value in A-rated debt, but focused in areas still impacted by the pandemic, where best-in-class players potentially offer defensive attributes or where higher ratings are desirable given the nature of business models, such as banks, insurance companies, utilities, municipalities and hospitals.

We also see value in improving credit stories—such as "rising star" candidates or issuers that have recently completed M&A activity and are now on a deleveraging path.

Sector and security selection is crucial, however. There will always be exceptions to the rule. For example, AA rated Exxon recently decided to hold oil production at a two-decade low as part of a plan to address activist investor pressure around debt, dividends and sustainability. Elsewhere, Synnex, a BB IT supply chain vendor, announced plans to issue $4bn for an acquisition.

As such, bottom-up credit analysis that considers the potential attractiveness of M&A or buybacks to management teams, as well as the company’s attractiveness as a takeover target is essential.

In general, industrial corporates gravitating toward BBB is potentially the "new normal." Credit investors need to position accordingly.

James DiChiaro is senior portfolio manager at Insight Investment.