When T. Rowe Price purchased the $173 million fund from a large property/casualty insurer in 1992, McCrickard, then a 34-year-old analyst who had been with T. Rowe Price for six years, kept many of its features, such as broad diversification, a combination of value and growth stocks and a long-term holding period. "The basic strategy didn't change much under our management, and we have managed the portfolio with the same process since the first day," he says.

McCrickard and his staff of six analysts look for a proven business model, an attractive valuation relative to future earnings or cash flow, cost controls and a catalyst for change such as new management. To avoid "froth," he will sell a stock when a company's problems appear to have lasting implications, valuations become too expensive, its market capitalization leads it into mid-cap territory or its premise has played out and he finds better ideas.

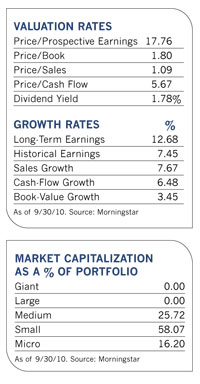

Unlike many of its peers, which often morph into closet mid-cap offerings as they get bigger to avoid wreaking havoc with their out-sized trades, this one remains true to its small-cap roots. As of September 30, its median market capitalization was $1.5 billion.

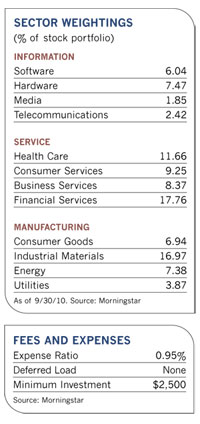

The fund spreads its assets over a large swath of over 300 names, with each one typically accounting for no more than 1% of assets. It's also dispersed among a variety of sectors, with industrial and business service companies leading the way at 19.7% of assets.

Having a lot of irons in the fire has not led to the asset bloat that plagues some funds, says Standard & Poor's mutual fund analyst Todd Rosenbluth. "The fund has a very low turnover, and the fact that it isn't churning in and out of names means the analysts really get to know them," he observes. "It consistently scores well based on performance, risk and cost factors, and its strategy and investment philosophy has remained intact since McCrickard took over in the early 1990s."

Although the expansive list of holdings makes it difficult for the best picks to drive returns, it also helps prevent blowouts that can plague more concentrated funds in down markets. In 2008, for example, its shares declined 33.3%, compared to a drop of 36.6% for its Morningstar small blend peer and 37% for the Standard & Poor's 500 index. But it can also set the pace in a bull market, as it did in 2009, when it beat its average Morningstar peer by nearly seven percentage points.

The fund also did well in 2010, despite some laggards in the financial and utilities sectors, and was up nearly 18% during the first ten months of the year. Strong showings included stocks such as Mariner Energy, an offshore oil exploration and production firm that surged after a takeover bid from Apache that eventually led to a merger in November. Another contributor to performance, Baldor Electric, benefited from strong demand for its energy-efficient industrial motors, as well as aggressive cost-cutting measures that will magnify the tailwind from an economic recovery.

Investments in a number of consumer discretionary stocks have also paid off. Automotive parts maker TRW saw a bounce after earnings came in well above analyst expectations, and the firm is prospering despite fears about its European auto business. AnnTaylor Stores, recently a top ten holding, continues to post strong comparable sales at its women's specialty stores.

Expectations In Check

McCrickard says the midterm elections have done little to provide direction for the investors and the economy and is keeping his expectations in check for the coming year. While he believes demand from emerging and international markets will continue to help U.S. companies that do business overseas, weakness in the housing market will cast a shadow over the economy.