It may seem a little self-serving when the manager of a large-company stock fund says large company stocks will likely perform better than small caps in 2011. But the observation carries a bit more weight when someone who runs one of the largest small company funds in the country makes the same observation.

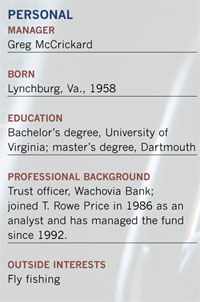

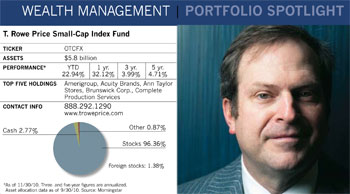

"I don't think small company stocks are going to see a correction, but I believe large companies will lead the market this year," says Greg McCrickard, who has managed the $5.8 billion T. Rowe Price Small-Cap Stock Fund since 1992. "At this point, I'd say no more than a neutral weighting in small caps is warranted, and more conservative investors might even think about an underweight position."

Concerns about small company stock valuations lie at the heart of the 52-year-old manager's sentiments. After a strong surge following the market rebound in 2009, those stocks are trading at high valuations relative to their historical averages and growth prospects. Large company stocks, which have not recovered as sharply since the beginning of the rebound, look more attractively valued by comparison.

Still, investors who want to maintain an allocation to small caps can squeeze some juice out of companies that are positioned to increase earnings as the economic recovery takes shape.

An upturn in commercial construction, for example, would benefit fund holding Acuity Brands. A leading provider of lighting fixtures and related products and services for industrial and outdoor use, the company has a strong niche in education, government and health care facilities as well as an emerging business in LED lighting and other energy-efficient lighting products.

Brunswick Corporation, which manufactures outboard engines, fitness equipment and boats, looks set to remain profitable and increase earnings as cost-cutting measures kick in and the market for its products improves. Convinced that the company was serious about cutting costs, McCrickard began building on the fund's position after the stock fell sharply in 2008.

Old Fund, New Tricks

Small company stocks have rotated in and out of favor many times since Small-Cap's predecessor, the Over-The-Counter Securities Fund, was launched over 54 year ago. The oldest small company mutual fund in the country traces its roots back to 1956 when Ralph Coleman, who wrote and published a newsletter on over-the-counter stocks, launched the first mutual fund to invest in what was then unfamiliar territory to most investors.

The original fund grew to about $50 million under Coleman's management and after his death it changed hands several times, including a stint with Boston-based Wellington Management in the 1980s. According to a New York Times article, then-manager Binkley Shorts dubbed it the "Under the Counter" securities fund because of the large number of small company holdings that most investors had never heard of.