We offer more information on central bank actions in the Street View video, Central Banks Are All In.

Revised Forecasts

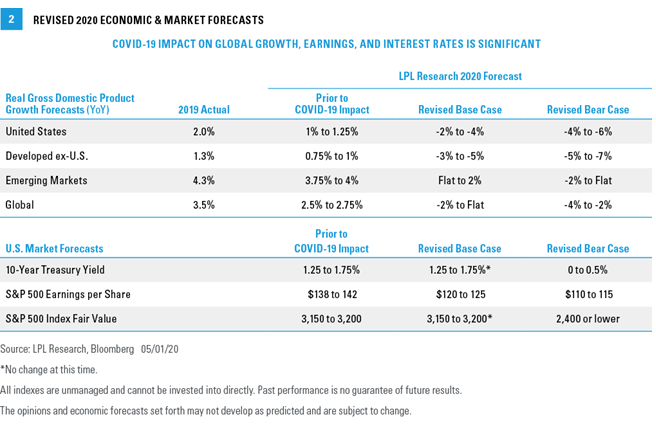

While forecasting in this environment remains very difficult, we now know more than we did in mid-March. In light of the severity of the COVID-19 lockdowns, recent economic data, and evidence of a more gradual recovery received in the past six weeks since we last adjusted our forecasts, we are sharply reducing our 2020 estimates for GDP growth and earnings. We have widened our ranges and provided bear-case forecasts to reflect the significant uncertainty [Figure 2].

We have significantly lowered our US, international, and global GDP growth forecasts for 2020, and we are now forecasting a full-year contraction in the United States and developed international region. Our prior forecasts assumed a shallower economic contraction from the lockdowns and a quicker and stronger rebound than we now expect. It is important to note that the midpoints of our forecast GDP ranges are all at or above Bloomberg’s consensus forecasts and reflect our belief that the second-half economic recovery, while gradual and delayed compared with our prior expectations, may be a bit stronger than economists currently anticipate.

We also lowered our 2020 earnings forecasts given what we’ve learned from corporate America during earnings season. Consensus estimates have been reduced by 25% since March 1 and may have to come down further. While we continue to expect a strong second-half rebound, a later start to the recovery and a bigger hit to the economy than we had anticipated translates into our reduced earnings forecast, which reflects a decline slightly larger than the typical decline in recessions of about 20%.

Our S&P 500 fair-value target and interest-rate forecasts are under review but remain unchanged for now.

Near-Term Caution

We continue to follow our Road to Recovery Playbook to help guide us through this challenging market environment. While we are encouraged by the stabilization of new COVID-19 cases and the massive stimulus put in place, stock market valuations are no longer as attractive. Our technical analysis work suggests we may be due for a pullback after the strongest bear market rally since World War II. We do not expect a full retest of the March 23 lows (2,237 on the S&P 500), which is 20% below the market’s close on May 1, but a correction of 10–15% would not surprise us, based on the average pullback of 10% following a bear market rally. For tactical investors, we believe patience is prudent.

For long-term investors, we continue to believe stocks are more attractive than bonds at current valuations and, for now, we maintain our overweight equities recommendation and a corresponding underweight to fixed income assets.

Importantly, we have not changed our year-end 2020 S&P 500 fair-value target range of 3,150–3,200, roughly 11% from the May 1 market close at the low end of the range. We believe the stock market is appropriately looking ahead to normalized earnings, perhaps beginning in mid-2021. Though the timing of achieving some semblance of normal earnings is uncertain, and our fair-value target may not be reached by year-end, we believe a price-to-earnings multiple (PE) of 19 on $165 per share in S&P 500 earnings, which gets us to around 3,150, is a reasonable fair-value target once normalized earnings come into view.

Jeffrey Buchbinder, CFA, is an equity strategist at LPL Financial.