The last week of April was a big news week. A very weak first quarter GDP highlighted a busy economic calendar. Investors digested a flurry of earnings reports, including some of the biggest names, such as Apple, Amazon, Facebook, and Microsoft. Gilead Sciences released promising test results for a COVID-19 treatment, a positive step in potentially limiting the human and economic impact of the virus as some states began to reopen their economies. Finally, we heard from three major global central banks.

In The News

Stocks bounced early the week of April 27, but limped to the finish. The S&P 500 Index ended the week about flat—but it wasn’t because of a lack of news. Investors digested the initial estimate of first quarter gross domestic product (GDP), another top-tier economic report in the Institute for Supply Management (ISM) manufacturing Purchasing Managers’ Index (PMI), meetings from all major central banks, and the busiest week of earnings season.

Gross Domestic Product

During first quarter 2020, GDP contracted by 4.8% on an annualized basis, the biggest quarterly contraction since 2009, even though most of the lockdowns from COVID-19 didn’t kick in until mid-March. The contraction provided added confirmation that the economy almost certainly entered a recession in March. Consumer spending contracted a record 7.5% in March, while the business investment component of GDP fell 8.5%. The data is backward-looking, and Bloomberg consensus expectations for the second quarter are calling for a contraction of more than 25% on an annualized basis. The good news is GDP could bounce potentially more than 20% in the third and early fourth quarters as the economy opens back up. We remain focused on the timing and pace of the economy re-opening, but the depth of the contraction and staged recovery will likely translate into a sizable contraction in GDP in 2020.

Institute For Supply Management

The May 1 report from the Institute for Supply Management PMI for manufacturing—the so-called official PMI—provided more evidence of the depth of the manufacturing downturn. The headline index fell 7.6 points to 41.5, better than Bloomberg’s consensus forecast of 36, but a level consistent with prior recessions. That headline number, however, was inflated by the supplier deliveries component. Normally, lengthening supplier delivery times reflect strong demand, which prevents suppliers from keeping up. However, in this environment, it reflects global supply chain disruptions from lockdowns related to COVID-19.

The new orders and employment components of the report, which both fell more than 15 points to around 27, are better indicators of where manufacturing activity in the United States is right now. The new orders number just missed the December 2008 level of 25.9, while the employment component set a new record low, putting the slump into proper perspective. Given the close relationship between manufacturing activity and corporate profits, earnings in the second quarter likely will take a significant hit before recovering in the second half of the year.

Central Bank Roundup

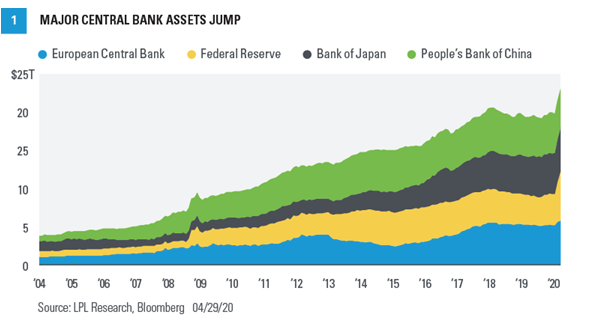

Central banks have responded quickly and effectively to COVID-19. The Federal Reserve (Fed), the European Central Bank (ECB), and the Bank of Japan (BOJ) all met separately the week of April 27 and collectively reasserted their resolve to do whatever is necessary to support the global economy. Rates are being held about as low as they can go, significant new programs to enhance market liquidity and support lending are in place, and asset purchases have accelerated [Figure 1]. In fact, with April data not yet completed, central bank assets have risen more than $3 trillion the past two months, the biggest two-month jump on record. We do not think it’s a coincidence that the S&P 500 bottomed the day after the Fed rolled out a wide range of emergency programs.

Federal Reserve. Prior to its policy announcement April 29, the Fed had expanded its program supporting municipalities by lowering the minimum size of the city or county to qualify. The Fed left its target rate unchanged at 0–0.25% and signaled that it is unlikely to remove its extraordinary policy support anytime soon. We believe the Fed may hold its policy rate near zero into 2022. Asset purchases are currently open-ended and have expanded to include corporate bonds, even including those packaged into investment-grade and high-yield bond exchange-traded funds. Interestingly, the Fed put the onus on Congress to use fiscal policy to help support the economy, something that was once unusual and is now commonplace.

European Central Bank. At its April 30 meeting, the ECB announced new refinancing operations and that it would ease conditions on long-term loans to banks, encouraging banks to increase lending. While some were disappointed the ECB did not add to its asset purchase program, President Christine Lagarde stressed that the program would continue at least until the end of the year and for as long as necessary, while leaving the door open to increase asset purchases quickly if needed. The ECB followed the Fed’s lead and stressed continued fiscal policy is needed.

Bank of Japan. The BOJ met April 27 and announced that it would lift its cap on buying government bonds, making purchases open-ended, and triple the size of its corporate-bond commercial-debt purchases.